- United States

- /

- Food

- /

- NasdaqGS:STKL

Will SunOpta's (STKL) Upbeat Revenue Outlook Sustain Its Growth Story in Plant-Based Foods?

Reviewed by Sasha Jovanovic

- SunOpta Inc. recently reported improved third quarter results, turning a profit, and raised its revenue guidance for 2025 to US$812 million–US$816 million, while also providing a 2026 revenue outlook of US$865 million–US$880 million.

- This upward revision in guidance, combined with year-over-year sales growth and positive earnings, highlights strengthened operations and management’s confidence in future performance despite a third quarter impairment charge.

- We’ll assess how SunOpta’s increased revenue projections reinforce its long-term growth narrative in the context of rising demand for plant-based products.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

SunOpta Investment Narrative Recap

To be a SunOpta shareholder, you need to believe in the sustained demand for plant-based and healthier food choices, as well as SunOpta’s ability to execute expansion at scale. The latest raised 2025–2026 revenue outlook and positive earnings are positive for the short-term growth story, but do not fundamentally reduce the company’s risk from shifting consumer preferences in core categories or capital intensity of expansion; the impact on these key risks and catalysts is not material at this stage.

The most relevant recent announcement is SunOpta’s updated 2026 revenue guidance to US$865 million–US$880 million, which supports management’s optimism about continued top-line growth. This outlook is meaningful in the context of the company’s ongoing manufacturing expansions and investments designed to capture growth in plant-based beverages and fruit snacks, areas driving current momentum and supporting future earnings potential.

Yet, even with higher sales projections, investors should also consider how customer concentration and private label exposure could intensify if...

Read the full narrative on SunOpta (it's free!)

SunOpta's narrative projects $1.0 billion in revenue and $141.9 million in earnings by 2028. This requires 9.4% yearly revenue growth and a $144 million increase in earnings from the current level of -$2.1 million.

Uncover how SunOpta's forecasts yield a $8.80 fair value, a 122% upside to its current price.

Exploring Other Perspectives

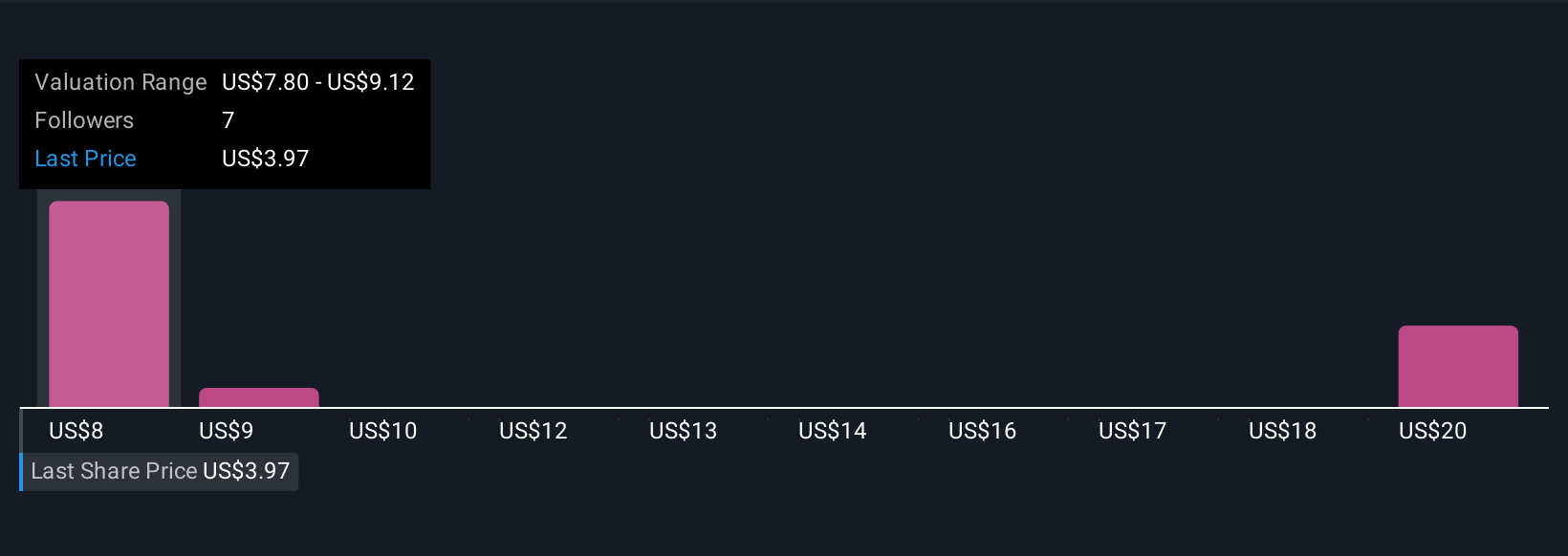

Four members of the Simply Wall St Community assessed SunOpta’s fair value using independent growth forecasts, yielding estimates from US$7.80 to US$20.95 per share. While healthy demand for plant-based offerings is helping fuel guidance increases, wide opinion gaps reinforce why it’s important to compare a diverse set of market expectations and insights before making decisions.

Explore 4 other fair value estimates on SunOpta - why the stock might be worth just $7.80!

Build Your Own SunOpta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SunOpta research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free SunOpta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SunOpta's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STKL

SunOpta

Engages in the manufacture and sale of plant and fruit-based food and beverage products in the United States, Canada, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives