- United States

- /

- Food

- /

- NasdaqGS:STKL

SunOpta (STKL): Valuation Perspectives After Upside Sales Surprise and Margin Pressures

Reviewed by Simply Wall St

SunOpta (STKL) just reported its latest quarterly results, showing revenue growth that topped expectations and lifting its full-year sales guidance. Investors, however, are debating what comes next as margins moved lower.

See our latest analysis for SunOpta.

After SunOpta surprised with stronger quarterly sales and a raised outlook, the share price has been on a wild ride, tumbling nearly 24% over the past week and down 45.5% in total shareholder return over the last year. While management’s focus on new capacity and profitability improvement could set up a recovery, recent operational setbacks appear to have cooled market momentum in the short term.

If you’re on the lookout for what’s next in the market, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With SunOpta shares trading well below analyst price targets and fresh sales growth ahead, is the market overlooking a bargain, or is it fairly pricing in all the operational hurdles still to come?

Most Popular Narrative: 54.9% Undervalued

SunOpta’s most popular narrative places its fair value far above the recent close of $3.97, implying the market is missing significant upside. This has sparked debate over whether the current headwinds can truly offset such a big gap.

Expanding manufacturing capacity investments, such as the new manufacturing line for fruit snacks already oversubscribed by existing customers, ensures SunOpta can meet robust customer demand. This positions the company for volume-led revenue increases and improved gross margins through efficiency gains (supports revenues and margin expansion).

Want to know why SunOpta’s fair value is so much higher than today’s price? There is a bold set of financial projections hidden inside this narrative, including aggressive revenue climbs and a sharp turnaround in margins. Discover what’s fueling such a confident valuation. One big assumption could surprise you.

Result: Fair Value of $8.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if category growth slows or if competitive pressures intensify, SunOpta’s expected revenue and margin gains could prove challenging to deliver.

Find out about the key risks to this SunOpta narrative.

Another View: Market Ratios Tell a Different Story

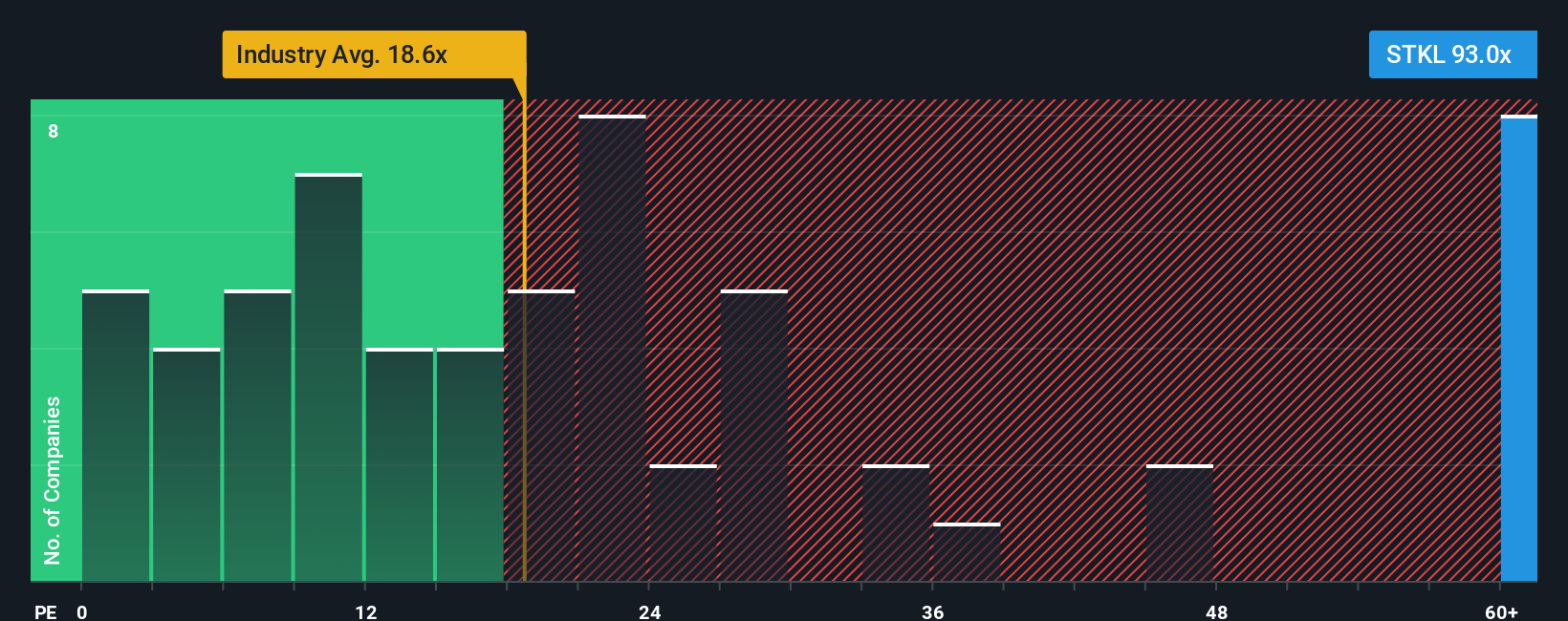

When we look at SunOpta’s valuation through the lens of price-to-earnings, things get complicated. The current ratio, at 93x, is much higher than both the US Food industry average of 18.6x and peer average of 43.2x. Even the fair ratio, which is what the market could eventually gravitate toward, sits higher at 142.7x. Does this rich valuation suggest elevated risk for investors, or could changing fundamentals close the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SunOpta Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own take on SunOpta’s outlook in just a few minutes, then Do it your way

A great starting point for your SunOpta research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Investing Opportunities?

Position yourself ahead of the next market move with Simply Wall Street’s free screener tools. Don’t wait and risk missing standouts in fast-changing sectors.

- Unearth high-yield opportunities and start earning from these 16 dividend stocks with yields > 3%, which offers robust returns with solid fundamentals.

- Catalyze your portfolio by tapping into the potential of these 25 AI penny stocks as artificial intelligence reshapes entire industries.

- Capitalize on overlooked value by uncovering these 874 undervalued stocks based on cash flows, which may be poised for re-rating as the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STKL

SunOpta

Engages in the manufacture and sale of plant and fruit-based food and beverage products in the United States, Canada, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives