- United States

- /

- Food

- /

- NasdaqGS:PPC

How Pilgrim's Pride's Nine-Month Earnings Growth Could Shape the PPC Investment Outlook

Reviewed by Sasha Jovanovic

- Pilgrim's Pride Corporation announced its third quarter and nine-month earnings results, reporting quarterly sales of US$4,759.34 million and nine-month sales of US$13.98 billion, with net income for the nine-month period reaching US$994.37 million.

- While third quarter net income slightly decreased year over year, the company delivered higher sales and profits for the nine months, reflecting ongoing strength in its operations and demand for its products.

- Following these results, we'll assess how improved nine-month earnings growth informs Pilgrim's Pride's investment narrative and future outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Pilgrim's Pride Investment Narrative Recap

To be a shareholder in Pilgrim's Pride, you need to believe that value-driven demand for chicken and diversified branded offerings will support sustainable earnings, even amidst industry volatility. The recent earnings update points to resilient nine-month growth despite a modest dip in quarterly profit, and does not materially alter the key short-term catalyst: consumer demand for affordable protein. The primary risk, heightened sensitivity to commodity input costs, remains largely unchanged by this report.

Among recent announcements, the special dividend of US$500 million earlier this year underscores Pilgrim's Pride's confidence in its liquidity and ongoing cash generation, supporting the company's capital return narrative. While positive, this action also signals management’s priorities for shareholder returns at a time when underlying risks tied to cost pressures and global supply chain conditions continue to influence the outlook.

However, investors should also be aware that, despite growing sales, risks related to input price volatility could challenge profit margins...

Read the full narrative on Pilgrim's Pride (it's free!)

Pilgrim's Pride is projected to reach $19.0 billion in revenue and $874.8 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 1.5% and reflects a decrease in earnings of $325 million from the current $1.2 billion.

Uncover how Pilgrim's Pride's forecasts yield a $44.86 fair value, a 21% upside to its current price.

Exploring Other Perspectives

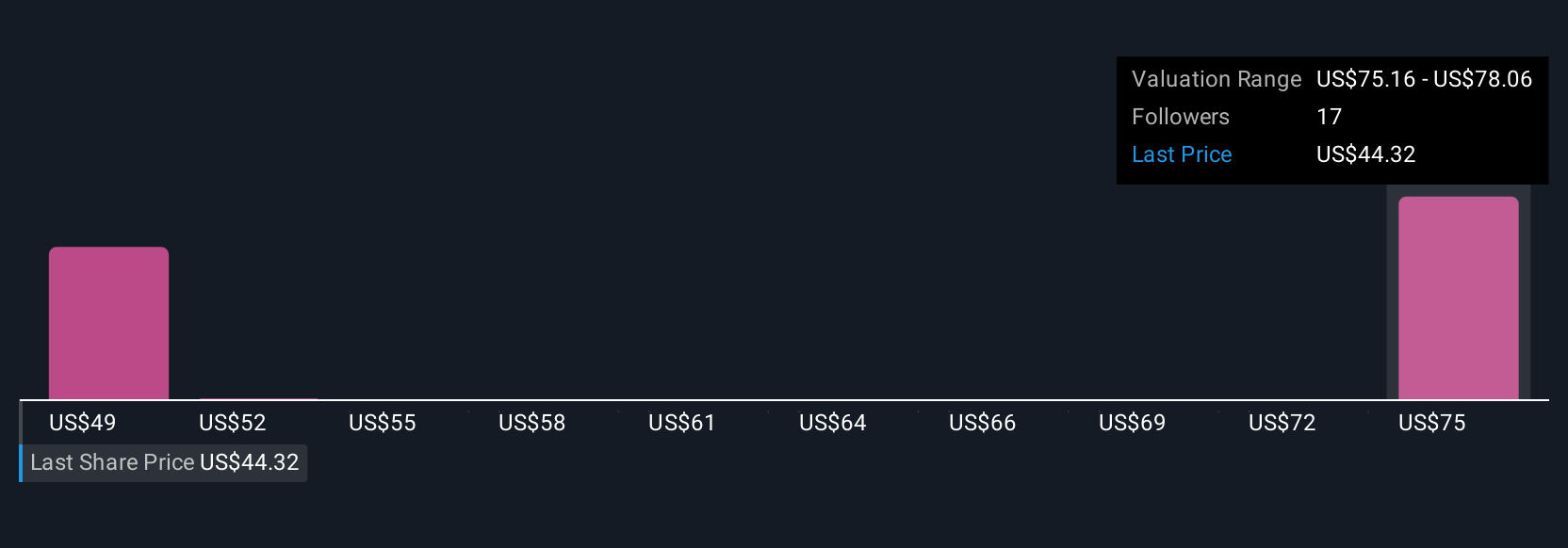

Simply Wall St Community users set Pilgrim's Pride fair value estimates from US$44.86 to US$77.09 across 4 opinions. With cost volatility a central risk cited in analyst consensus, it is useful to compare these diverse viewpoints.

Explore 4 other fair value estimates on Pilgrim's Pride - why the stock might be worth over 2x more than the current price!

Build Your Own Pilgrim's Pride Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pilgrim's Pride research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pilgrim's Pride research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pilgrim's Pride's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PPC

Pilgrim's Pride

Produces, processes, markets, and distributes fresh, frozen, and value-added chicken and pork products to retailers, distributors, and foodservice operators in the United States, Europe, and Mexico.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives