- United States

- /

- Beverage

- /

- NasdaqGS:PEP

Did PepsiCo’s (PEP) Expanded Climate Platform Redefine Its Sustainable Supply Chain Strategy?

Reviewed by Sasha Jovanovic

- PepsiCo, together with Bioversity International and CIAT, recently rolled out a major update to its Climate Resilience Platform, expanding support for more crops and geographies and onboarding new partners like Olam Agri and Bonsucro.

- This development not only enhances actionable climate risk insights for agricultural stakeholders but signals a broader industry shift towards open-access collaboration in building resilient, regenerative supply chains.

- We'll explore how PepsiCo's expanded climate resilience initiatives, particularly the integration of new partners and crops, impact its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

PepsiCo Investment Narrative Recap

To be comfortable as a PepsiCo shareholder, you need confidence in the company's ability to drive steady earnings growth through international expansion, productivity gains, and its push towards healthier products, even as its core beverages and snacks face moderating category growth. The expanded Climate Resilience Platform strengthens PepsiCo’s commitment to sustainable supply chain management, but does not materially shift the most pressing near-term catalyst (earnings and margin recovery) or the current risks around input cost inflation and soft profit trends.

Among recent news, PepsiCo’s planned dividend increase stands out. This signals management’s focus on rewarding shareholders amid recent profit headwinds and declining net margins, directly tying into near-term catalysts around investor returns. The combination of growing sustainability initiatives and continued capital returns will need to balance against...

Read the full narrative on PepsiCo (it's free!)

PepsiCo's narrative projects $101.5 billion in revenue and $11.8 billion in earnings by 2028. This requires 3.4% yearly revenue growth and a $4.2 billion earnings increase from the current $7.6 billion.

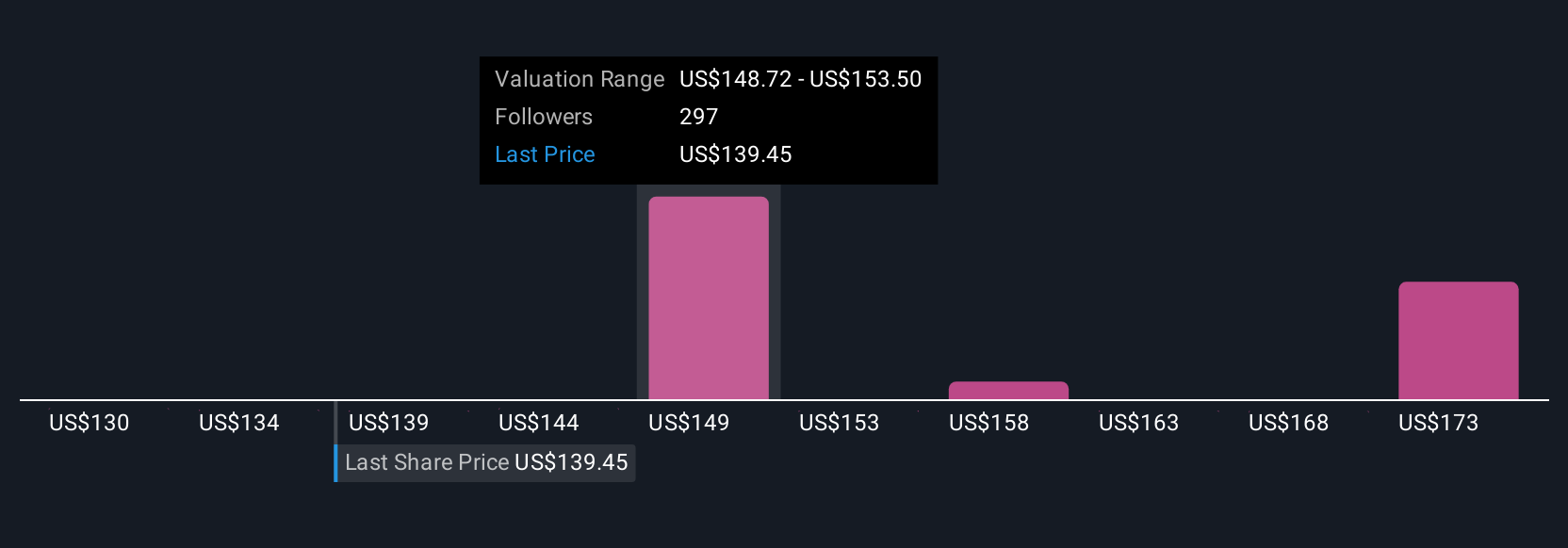

Uncover how PepsiCo's forecasts yield a $152.57 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Within the Simply Wall St Community, 41 investor fair value estimates for PepsiCo currently range from US$116.47 to US$222.91. While many see long-term opportunities, the profit headwinds and slow earnings recovery highlighted above have led to different outlooks that may influence your view on future company performance.

Explore 41 other fair value estimates on PepsiCo - why the stock might be worth as much as 56% more than the current price!

Build Your Own PepsiCo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PepsiCo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PepsiCo's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives