- United States

- /

- Beverage

- /

- NasdaqGS:MNST

Monster Beverage (MNST): Exploring Valuation After a 28% Year-to-Date Rally

Reviewed by Simply Wall St

See our latest analysis for Monster Beverage.

Monster Beverage's positive momentum stands out, with a 90-day share price return of nearly 11%, while its total shareholder return reached 28% over the past year. This steady climb suggests investors are growing more optimistic about both its growth prospects and market position.

If Monster’s sustained run has you thinking about what’s next, consider broadening your path and discover fast growing stocks with high insider ownership

The question now is whether Monster Beverage's impressive gains still leave room for upside, or if all the good news is already reflected in the share price. Is this momentum a true buying opportunity, or has the market already accounted for future growth?

Most Popular Narrative: 1.7% Undervalued

Monster Beverage’s narrative-driven fair value now sits just above the recent closing price, hinting that the stock may offer a bit more upside than the market currently expects.

Ongoing product innovation, including new functional energy drinks, affordable brand rollouts, and premium SKU introductions, enhances Monster's ability to capture share in both developed and developing markets. This supports sustained revenue and market share growth.

Want to know the secret behind that high sticker price? Analysts are betting on a bold mix of double-digit category growth, premiumization strategies, and a future profit multiple that only sector leaders can command. Wondering which financial forecasts turn these ambitions into a target price above today’s levels? Read the entire breakdown to uncover the numbers guiding the narrative.

Result: Fair Value of $68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure from international expansion, as well as heightened regulatory and cost risks, could challenge Monster Beverage’s bullish outlook in the period ahead.

Find out about the key risks to this Monster Beverage narrative.

Another View: Price Ratios Raise Caution

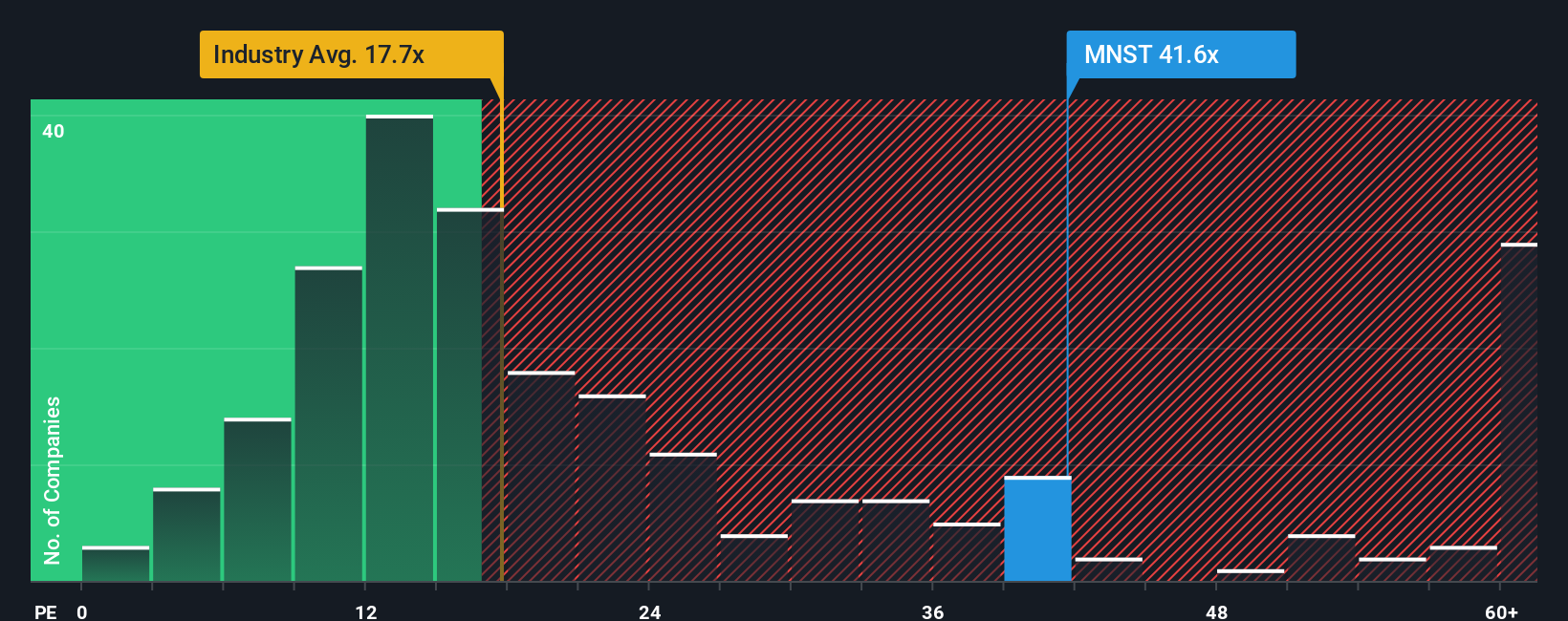

While the narrative-driven fair value suggests Monster Beverage could be undervalued, our market price ratio check tells a different story. The company's price-to-earnings ratio stands at 41.5x, which is well above the industry average of 17.8x, the peer average of 22x, and our fair ratio estimate of 23x. This signals investors are already pricing in a high degree of optimism. Could this steep premium limit future returns, or is strong growth still enough to justify it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Monster Beverage Narrative

If you see the story differently, or want to dive into the numbers yourself, you can build a personalized take in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Monster Beverage.

Looking for more investment ideas?

You’re not limited to one stock. Uncover opportunities smart investors are already watching and put your portfolio ahead of the crowd with these top picks.

- Tap into future market disruptors by researching these 26 AI penny stocks, which are poised to benefit from the explosive growth of artificial intelligence.

- Boost your long-term returns with passive income by evaluating these 23 dividend stocks with yields > 3%, featuring reliable yields above 3%.

- Strengthen your portfolio’s innovation edge by reviewing these 28 quantum computing stocks for advancements in quantum computing technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNST

Monster Beverage

Through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives