- United States

- /

- Food

- /

- NasdaqGS:MDLZ

Mondelez International (MDLZ): Valuation Perspectives Following Earnings Growth, Profit Drop, and Completed Share Buyback

Reviewed by Simply Wall St

Mondelez International (MDLZ) is in focus following its third-quarter earnings release. The report highlighted higher sales but lower net income compared to last year. Investors are also watching updated growth targets and a completed share buyback.

See our latest analysis for Mondelez International.

After a challenging quarter with solid sales but weaker profits, Mondelez International’s share price has slumped: its 30-day share price return is down 10.2%, and the 1-year total shareholder return now sits at -11.9%. While this momentum is fading for now, new revenue targets and a recently completed share buyback could set the stage for future shifts in sentiment.

If this has you rethinking where opportunity could strike next, now’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock currently trading at a sizable discount to analyst targets and new revenue guidance in play, the question now is whether Mondelez is undervalued or if the market has already accounted for its next wave of growth.

Most Popular Narrative: 19.3% Undervalued

With Mondelez International closing at $56.19 and the most popular narrative setting fair value nearly 20% higher, the gap in expectations is striking and raises the stakes for the company's next moves.

The company is implementing a strategic growth agenda that includes reinvesting in brands, expanding distribution, and strengthening market presence. These initiatives are expected to positively impact revenue growth and market share. Mondelez’s focus on innovative brand activations and product collaborations, such as the Oreo and Post Malone partnership and Cadbury Dairy Milk with Lotus Bakeries, aim to enhance consumer engagement and drive revenue growth.

Curious what financial leaps and assumptions power this bold value target? The narrative relies on upgrades to core earnings, revenue expansion, and a rising profitability bar. Eager to see which high-stakes projections make or break the case? The answers may surprise you.

Result: Fair Value of $69.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high cocoa costs or additional declines in consumer demand could undermine the valuation case if these trends continue longer than expected.

Find out about the key risks to this Mondelez International narrative.

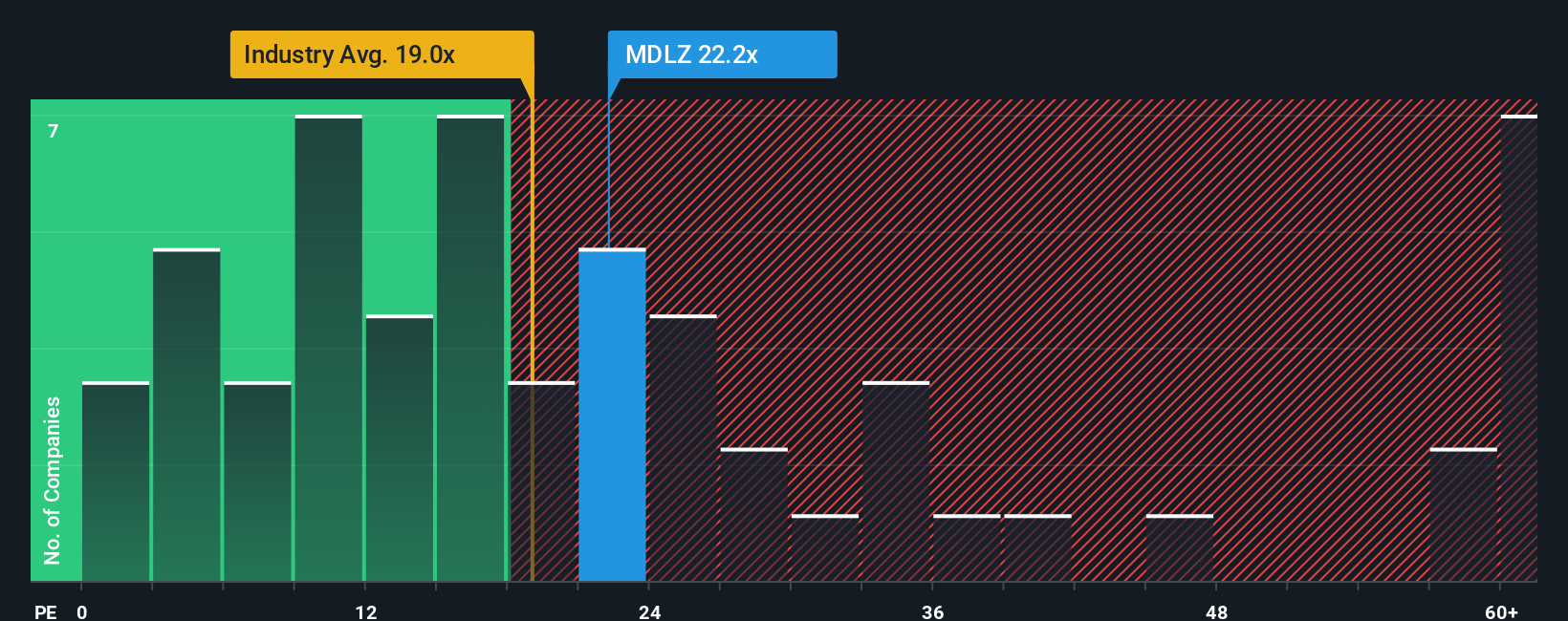

Another View: Examining Market Multiples

While the fair value estimate suggests strong upside, the current price-to-earnings ratio for Mondelez stands at 20.5x. This is higher than both the US Food industry average (18.5x) and its peer average (19.9x). The fair ratio, however, sits at 22.2x, implying the market could still trend higher. Does this premium signal confidence in Mondelez's growth, or is it a red flag for valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mondelez International Narrative

If you have different insights or would rather dig into the numbers yourself, you can build your own take in just a few minutes: Do it your way

A great starting point for your Mondelez International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep fresh opportunities on their radar. Don’t let the next breakout stock or game-changing sector surge pass you by. Now is a good time to strengthen your portfolio.

- Capitalize on fast-paced innovations by checking out these 24 AI penny stocks powering advances in artificial intelligence across industries.

- Catch attractive yields and steady income with these 17 dividend stocks with yields > 3% offering reliable returns above 3% in today’s evolving market.

- Get ahead of the curve with these 82 cryptocurrency and blockchain stocks riding the momentum in cryptocurrency and blockchain technologies that are reshaping tomorrow’s finance sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDLZ

Mondelez International

Through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives