- United States

- /

- Food

- /

- NasdaqGS:JJSF

J&J Snack Foods (JJSF): Exploring Current Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

J&J Snack Foods (JJSF) has seen its stock trend lower over the past month, with a steady decline in line with broader industry shifts rather than any single headline event. Investors are watching to see if new developments might shift sentiment.

See our latest analysis for J&J Snack Foods.

J&J Snack Foods’ share price has lost momentum, sliding by 13% over the past month and accumulating a steep year-to-date share price return of -46.8%. With a 1-year total shareholder return of -52.5%, the slide reflects ongoing market caution and some shifting expectations on future growth, even as the company maintains steady revenue and profit growth in the background.

If you’re rethinking your watchlist after J&J’s turbulence, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With J&J Snack Foods’ shares trading far below analyst targets despite steady earnings growth, investors are left wondering: is this significant dip a bargain entry point, or is the market accurately anticipating slower growth ahead?

Most Popular Narrative: 34.5% Undervalued

J&J Snack Foods’ closing share price of $81.84 is far below the narrative’s fair value estimate of $125. Analysts are holding steady on their valuation while the broader market reacts more cautiously to near-term turbulence.

The company is poised to benefit from increasing demand for convenient, ready-to-eat snacks and higher out-of-home entertainment traffic, as demonstrated by robust performance in foodservice pretzels and Dippin' Dots sales tied to venues and theaters. This supports future revenue growth as consumer routines continue to normalize.

Here is the twist: this price target hinges on bold, future-focused estimates. The narrative highlights margin expansion, steady profit gains, and a street-high valuation ratio. Exactly how aggressive are the underlying assumptions? One look at their earnings blueprint may surprise you.

Result: Fair Value of $125 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising ingredient costs and a slowdown in retail segment sales could pressure margins and challenge the optimistic outlook if these headwinds persist.

Find out about the key risks to this J&J Snack Foods narrative.

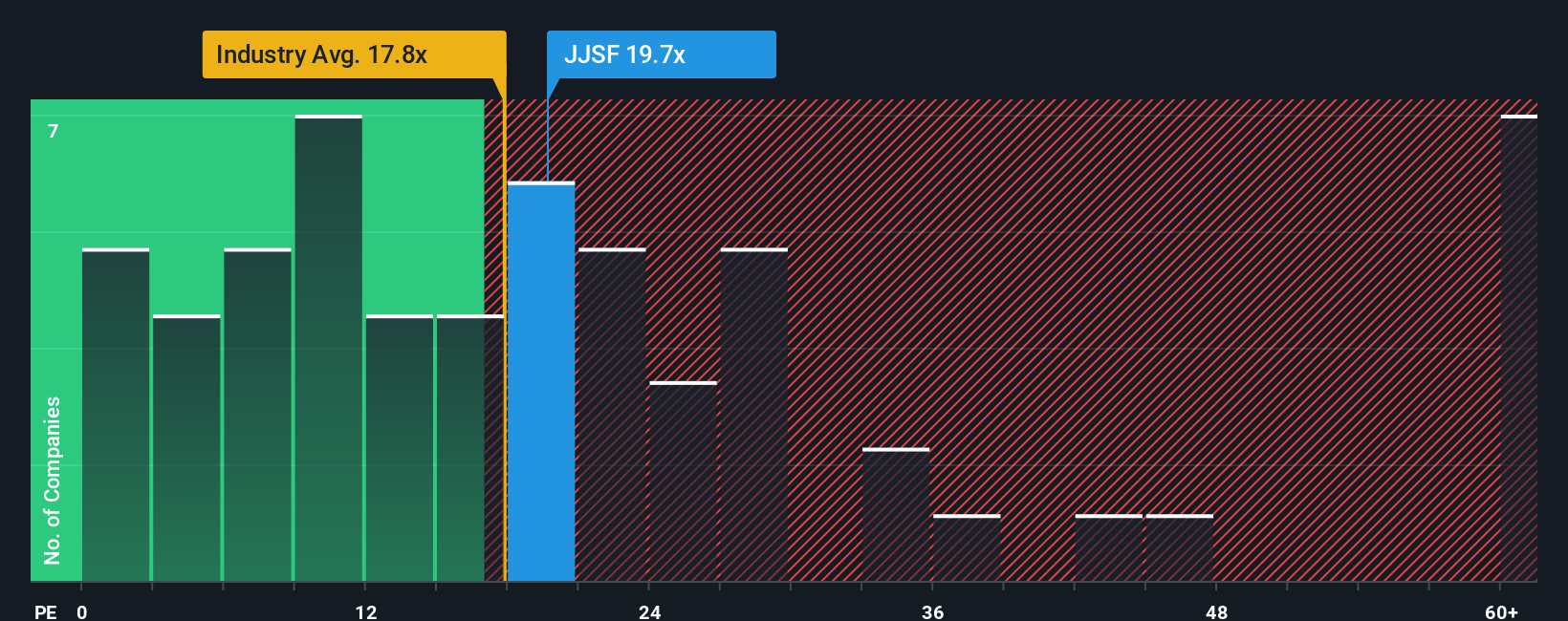

Another View: Market Valuation Ratios Tell a Different Story

While analyst narratives highlight undervaluation, J&J Snack Foods is actually trading at a price-to-earnings ratio of 19x, which is just above the US Food industry average of 18.6x and higher than its fair ratio of 12.3x. This pricing suggests investors may be accepting a premium for stability, or possibly overlooking downside risk. So which valuation story will play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J&J Snack Foods Narrative

If the picture painted here doesn't match your perspective, or you'd rather shape your own view, you can dig into the numbers and craft your personal story in just a few minutes. Do it your way

A great starting point for your J&J Snack Foods research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Give yourself the edge by choosing screeners designed to highlight tomorrow’s winners before the crowd catches on.

- Tap into strong income potential by browsing these 16 dividend stocks with yields > 3% offering yields above 3% to help boost your portfolio’s cash flow.

- Target next-level innovation as you review these 25 AI penny stocks leading the way in artificial intelligence growth and industry disruption.

- Capitalize on value by checking out these 872 undervalued stocks based on cash flows identified for potential outperformance based on rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JJSF

J&J Snack Foods

Manufactures, markets, and distributes nutritional snack food and beverages to the food service and retail supermarket industries in the United States, Mexico, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives