- United States

- /

- Food

- /

- NasdaqGS:BYND

Beyond Meat, Inc. (NASDAQ:BYND) Stocks Pounded By 30% But Not Lagging Industry On Growth Or Pricing

The Beyond Meat, Inc. (NASDAQ:BYND) share price has fared very poorly over the last month, falling by a substantial 30%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 51% loss during that time.

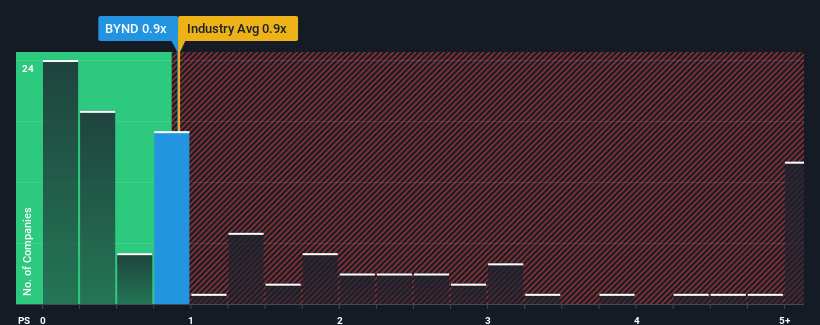

In spite of the heavy fall in price, there still wouldn't be many who think Beyond Meat's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when it essentially matches the median P/S in the United States' Food industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Beyond Meat

How Beyond Meat Has Been Performing

Beyond Meat could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Beyond Meat will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Beyond Meat?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Beyond Meat's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.5%. The last three years don't look nice either as the company has shrunk revenue by 31% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.3% each year during the coming three years according to the eight analysts following the company. That's shaping up to be similar to the 2.9% each year growth forecast for the broader industry.

With this information, we can see why Beyond Meat is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Beyond Meat's P/S

Following Beyond Meat's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Beyond Meat's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Beyond Meat you should be aware of, and 1 of them is a bit unpleasant.

If you're unsure about the strength of Beyond Meat's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Meat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BYND

Beyond Meat

A plant-based meat company, engages in the development, manufacture, marketing, and sale of plant-based meat products under the Beyond brand name in the United States and internationally.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives