- United States

- /

- Food

- /

- OTCPK:APPH.Q

Further weakness as AppHarvest (NASDAQ:APPH) drops 13% this week, taking one-year losses to 87%

Even the best investor on earth makes unsuccessful investments. But it's not unreasonable to try to avoid truly shocking capital losses. We wouldn't blame AppHarvest, Inc. (NASDAQ:APPH) shareholders if they were still in shock after the stock dropped like a lead balloon, down 87% in just one year. That'd be a striking reminder about the importance of diversification. AppHarvest hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 52% in about a quarter. That's not much fun for holders. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

After losing 13% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for AppHarvest

SWOT Analysis for AppHarvest

- Debt is well covered by earnings.

- Expensive based on P/S ratio compared to estimated Fair P/S ratio.

- Shareholders have been diluted in the past year.

- Forecast to reduce losses next year.

- Debt is not well covered by operating cash flow.

- Has less than 3 years of cash runway based on current free cash flow.

Because AppHarvest made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year AppHarvest saw its revenue grow by 88%. That's a strong result which is better than most other loss making companies. So on the face of it we're really surprised to see the share price down 87% over twelve months. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

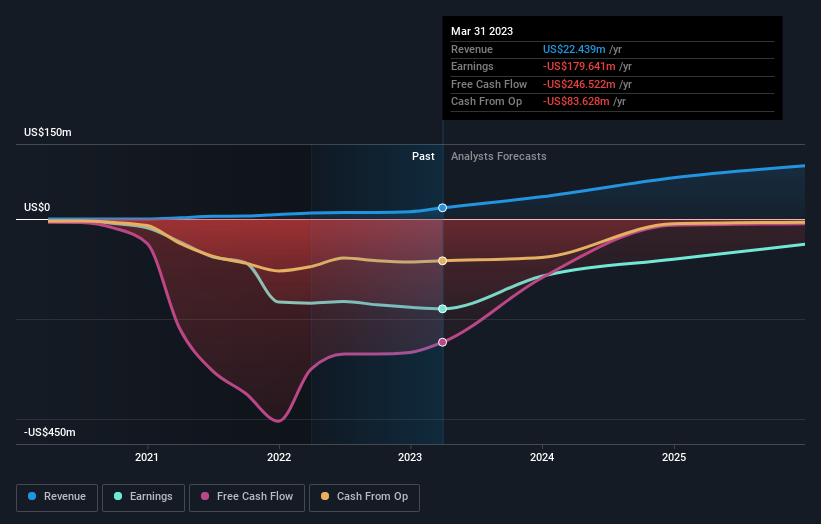

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling AppHarvest stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While AppHarvest shareholders are down 87% for the year, the market itself is up 3.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 52%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand AppHarvest better, we need to consider many other factors. Even so, be aware that AppHarvest is showing 5 warning signs in our investment analysis , and 2 of those are significant...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:APPH.Q

AppHarvest

AppHarvest, Inc., an applied agricultural technology company, develops and operates indoor farms with robotics and artificial intelligence to build climate-resilient food system.

Slightly overvalued with worrying balance sheet.