- United States

- /

- Oil and Gas

- /

- NYSE:WMB

Williams Companies (WMB): Exploring Valuation as Shares Hold Steady and Investors Weigh Future Prospects

Reviewed by Simply Wall St

Williams Companies (WMB) has recently seen its shares move within a steady range as investors look for new developments that could provide direction. The pipeline operator’s latest price action comes as investors maintain a broader focus on energy sector performance.

See our latest analysis for Williams Companies.

While Williams Companies’ share price recently edged higher to reach $57.94, the momentum has moderated after an early-year climb. Over the past year, total shareholder return stands at 8.17%, but the longer-term picture remains compelling, boasting a 287% five-year total return. This points to steady progress, even as the latest price pullback has sparked some caution among investors.

If steady performance and resilience in the energy space have you thinking about what else might be out there, it could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

Given Williams Companies’ solid track record and its current share price sitting below analyst targets, the key question now is whether the stock remains undervalued or if future growth prospects are already fully reflected in the price.

Most Popular Narrative: 13.8% Undervalued

The most popular narrative points to Williams Companies being priced below its fair value estimate of $67.22, with the last close at $57.94. This gap is based on detailed forecasts for revenue growth, margin expansion, and pipeline development that could set the agenda for future returns.

Large-scale expansions of Williams' pipeline network, particularly in high-growth regions like the Haynesville, Gulf Coast, and Transco corridor, are underway or recently placed in service to meet surging power, LNG export, and data center demand. This indicates significant volume and revenue growth is expected to accelerate in 2025 and beyond.

Curious what is fueling this premium narrative? The analysts behind it are betting on an aggressive ramp-up in operations, bigger margins, and bold financial targets most investors haven't seen before. Want to see the full forecast recipe that supports this rich fair value? You might be surprised by the scale of assumptions driving the upside.

Result: Fair Value of $67.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and the risk of weaker long-term natural gas demand remain potential hurdles that could challenge the current bullish narrative.

Find out about the key risks to this Williams Companies narrative.

Another View: Looking Through the Lens of Market Ratios

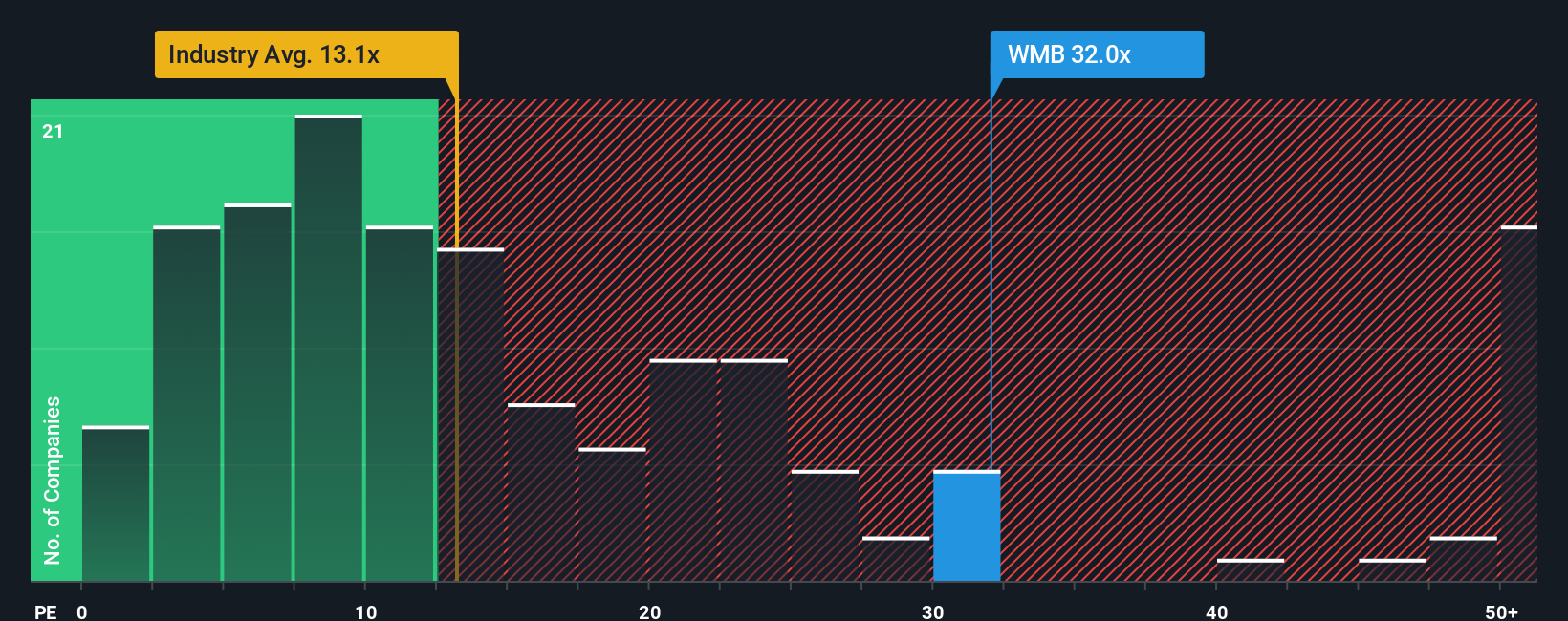

While analysts argue Williams Companies is undervalued based on future expectations, its current price-to-earnings ratio stands out at 29.9x. That is notably higher than the US Oil and Gas industry average of 13.4x, the peer average of 14.4x, and above its own fair ratio of 21.6x. This premium could signal investors are already pricing in a lot of optimism, raising the question of whether there is still genuine value to be found or if the stock is at risk of a reset if expectations fall short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams Companies Narrative

If you have a different perspective or want to dive deeper into the data, you can shape your own Williams Companies story in just a few minutes. Do it your way

A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities pass you by. Sharpen your portfolio by seeking out unique stocks that fit your strategy, powered by insights only available at Simply Wall Street.

- Uncover growth potential by checking out these 863 undervalued stocks based on cash flows stocks that are trading below their intrinsic value and could offer strong upside.

- Capture serious yield with these 17 dividend stocks with yields > 3% stocks designed for investors seeking higher-than-average dividends for lasting income.

- Seize tomorrow’s breakthroughs by spotting leaders among these 25 AI penny stocks that are capitalizing on artificial intelligence’s rapid advances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives