- United States

- /

- Oil and Gas

- /

- NYSE:WMB

The Bull Case for Williams Companies (WMB) Could Change Following Major NESE Regulatory Approval

Reviewed by Sasha Jovanovic

- In recent days, Williams Companies announced a major regulatory win for its Northeast Supply Enhancement project, securing crucial environmental permits from New Jersey and New York state authorities to expand natural gas infrastructure into New York City while affirming continued progress on its Constitution Pipeline initiative.

- This regulatory progress is expected to enable over US$1 billion in investment, create thousands of construction jobs, and bring long-term economic and environmental benefits to the region by supporting lower-emission natural gas usage and improved energy security.

- We'll examine how Williams' successful NESE permitting advances its infrastructure growth and reinforces the company's long-term investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Williams Companies Investment Narrative Recap

To be a Williams Companies shareholder, you need to see continued demand for natural gas infrastructure overcoming both regulatory barriers and energy transition risks. The recent permitting win for the Northeast Supply Enhancement (NESE) project removes a short-term overhang and supports a key catalyst, new capacity expansion, but does not fully mitigate the persistent risk that future policy shifts or decarbonization efforts could still challenge project approvals across core regions.

Among recent company announcements, the 5.3% dividend increase stands out. This move is especially relevant, as it underscores Williams’ conviction in the durability of its cash flows following critical progress on high-profile pipeline projects like NESE, which underpin near-term earnings visibility and dividend support for investors seeking income-driven returns.

However, against the momentum of these wins, investors should be aware that reversal in regulatory sentiment...

Read the full narrative on Williams Companies (it's free!)

Williams Companies' outlook forecasts $14.5 billion in revenue and $3.3 billion in earnings by 2028. To reach these numbers, analysts are assuming annual revenue growth of 8.6% and an earnings increase of $0.9 billion from the current $2.4 billion.

Uncover how Williams Companies' forecasts yield a $67.22 fair value, a 13% upside to its current price.

Exploring Other Perspectives

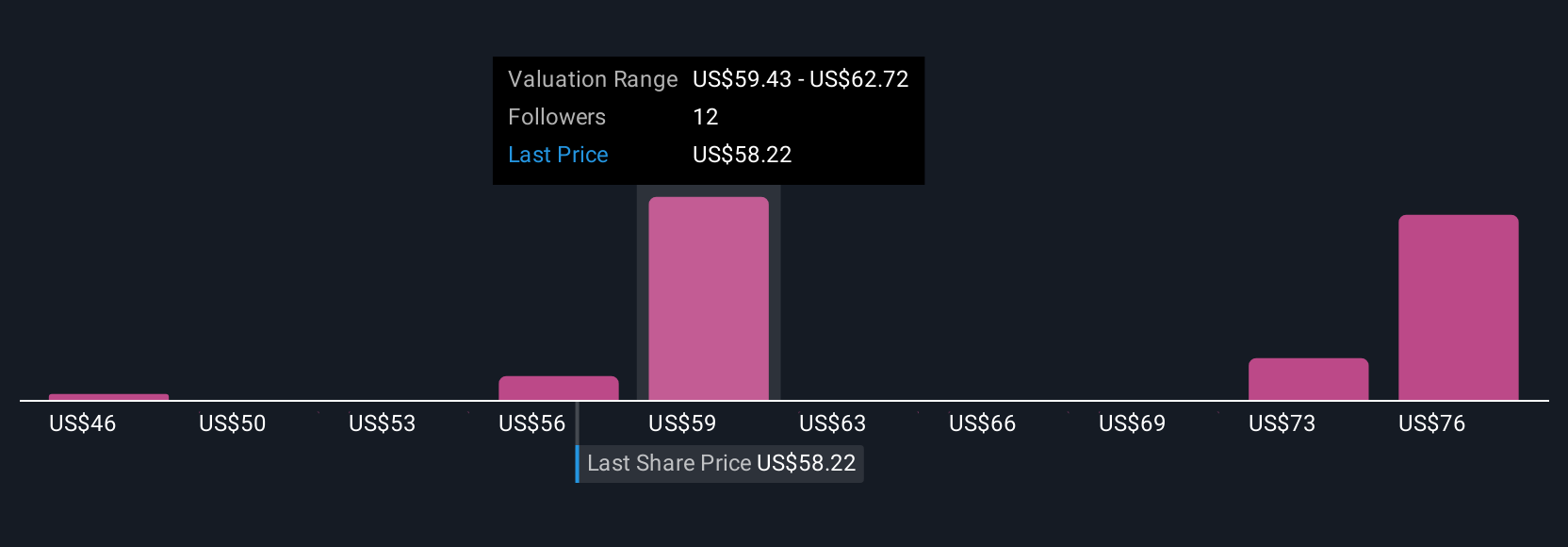

Six fair value estimates from the Simply Wall St Community cover a broad range from US$49.47 to US$78.86 per share. With permitting improvements fueling optimism about expansion projects, you will find perspectives that weigh these catalysts differently and offer many alternative viewpoints to consider.

Explore 6 other fair value estimates on Williams Companies - why the stock might be worth 17% less than the current price!

Build Your Own Williams Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Williams Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams Companies' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives