- United States

- /

- Oil and Gas

- /

- NYSE:VG

Can Venture Global’s (VG) New Greece LNG Deal Reshape Its Role in European Energy Security?

Reviewed by Sasha Jovanovic

- Venture Global, Inc. and Greece’s Atlantic-See LNG recently announced a landmark twenty-year sales and purchase agreement for at least 0.5 million tonnes per annum of U.S. liquefied natural gas, with deliveries set to begin in 2030 and options for future expansion.

- This milestone represents Greece’s first long-term LNG supply agreement with a U.S. exporter, underscoring deepening transatlantic energy ties and Venture Global’s role in European energy security through its Alexandroupolis terminal investment.

- We’ll examine how this long-term LNG deal with Greece signals Venture Global’s growing influence in European energy markets.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Venture Global's Investment Narrative?

For shareholders, the big picture at Venture Global is about believing in the company’s ability to lock down multi-decade supply deals and expand its foothold in global LNG markets, especially as Europe diversifies energy imports. The recent 20-year agreement with Greece could act as a credible vote of confidence, highlighting growing demand for U.S. LNG and possibly improving sentiment following the stock’s severe 90-day price drop. However, it’s important to keep in mind that while this deal reinforces Venture Global’s long-term growth story and could support major projects like Alexandroupolis and CP2, its impact on near-term catalysts, like the upcoming earnings release or short-term cash flow, is likely limited given the delayed revenue start in 2030. Recent announcements also follow legal challenges tied to the company’s IPO and an inexperienced board and management team, both of which remain significant factors that investors should weigh with slightly shifted emphasis in light of the latest contract win.

On the flip side, those IPO-related lawsuits are still an ongoing concern that investors should be aware of.

Exploring Other Perspectives

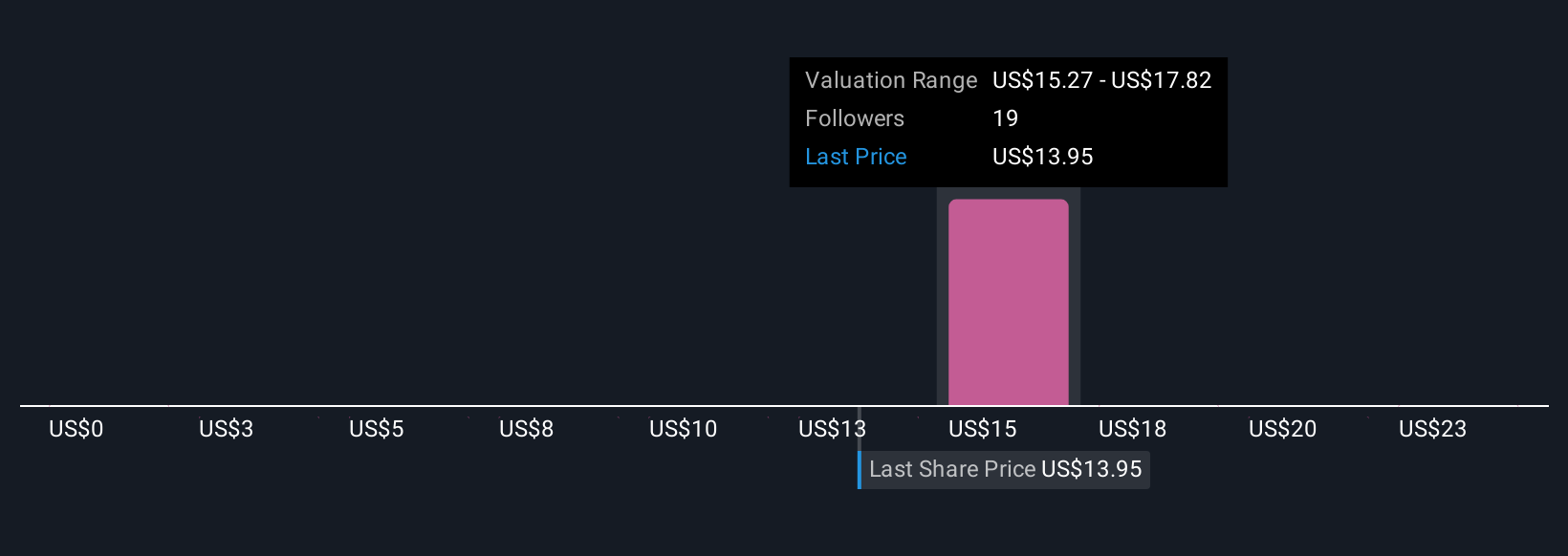

Explore 8 other fair value estimates on Venture Global - why the stock might be worth less than half the current price!

Build Your Own Venture Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Venture Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Venture Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Venture Global's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VG

Venture Global

Engages in the development, construction, and production of natural gas liquefaction and export projects near the U.S.

Fair value with very low risk.

Similar Companies

Market Insights

Community Narratives