- United States

- /

- Oil and Gas

- /

- NYSE:TNK

How Investors May Respond To Teekay Tankers (TNK) Surpassing EPS Forecasts and Declaring Dividend

Reviewed by Sasha Jovanovic

- Teekay Tankers Ltd. recently reported third-quarter 2025 earnings, revealing revenue of US$229.02 million and net income of US$92.08 million, with earnings per share notably higher than the previous year; a US$0.25 per share cash dividend was also announced for the quarter.

- The company’s strong net income despite lower revenue underscores robust operational performance and effective cost management amid shifting market conditions.

- We'll examine how Teekay Tankers' stronger-than-expected quarterly profits may influence its investment outlook moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Teekay Tankers Investment Narrative Recap

If you're considering Teekay Tankers as an investment, the core belief is that tanker shipping will remain essential for global oil trade, benefiting from supply constraints and fleet renewal. The recent strong quarterly profits, despite softer revenue, reinforce confidence around cost discipline but do not materially change the sector’s key short-term catalyst: continued global oil exports and demand. The primary risk remains persistent market and regulatory uncertainty affecting tanker demand and earnings visibility.

Of the latest company developments, the ongoing fixed cash dividend of US$0.25 per share is most relevant today, as it underscores Teekay Tankers’ commitment to returning cash to shareholders. This regular payout, even as seasonal earnings fluctuate, keeps capital returns aligned with one of the company’s most compelling catalysts, balance sheet strength supporting shareholder value over the cycle.

Yet in contrast, investors should keep in mind the ongoing risk posed by volatile tanker markets and shifting global regulations…

Read the full narrative on Teekay Tankers (it's free!)

Teekay Tankers' outlook anticipates $464.3 million in revenue and $238.5 million in earnings by 2028. This implies a 22.5% annual revenue decline and a $43.8 million decrease in earnings from the current $282.3 million.

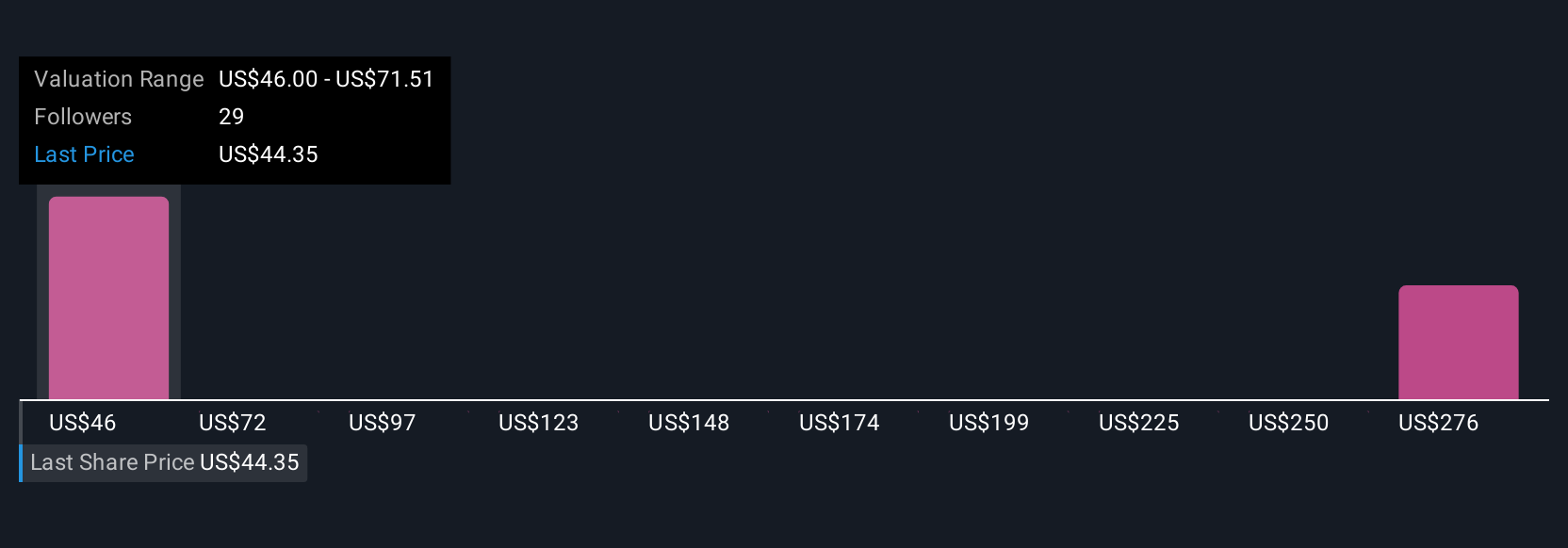

Uncover how Teekay Tankers' forecasts yield a $63.50 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community put their fair value estimates for Teekay Tankers between US$61.10 and US$409.47. Listed company catalysts supporting capital returns may appeal, but outcomes depend on fast-changing global oil trade patterns and regulatory shifts, explore how your view aligns with theirs.

Explore 5 other fair value estimates on Teekay Tankers - why the stock might be worth over 6x more than the current price!

Build Your Own Teekay Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teekay Tankers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Teekay Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teekay Tankers' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives