- United States

- /

- Oil and Gas

- /

- NYSE:STNG

Does Scorpio Tankers’ (STNG) Fleet Renewal Signal a Strategic Shift in Long-Term Growth Priorities?

Reviewed by Sasha Jovanovic

- Scorpio Tankers Inc. recently announced agreements to sell four 2014-built MR product tankers for US$32.0 million each and acquire four new MR newbuildings for US$45.0 million per vessel, with deliveries expected in 2026 and 2027.

- This move reflects ongoing fleet modernization, following the company's third-quarter earnings report and a declared quarterly dividend to shareholders.

- We'll now explore how Scorpio Tankers' planned fleet renewal could influence its investment narrative and future growth potential.

Find companies with promising cash flow potential yet trading below their fair value.

Scorpio Tankers Investment Narrative Recap

To be a shareholder in Scorpio Tankers, you need to believe in the resilience of global refined product trade and the company's ability to modernize its fleet ahead of regulatory changes. The sale of older tankers and acquisition of newbuilds signals a commitment to operational efficiency but does not materially alter the near-term risks or most important catalysts, which remain driven by shifts in oil product demand and potential overcapacity in the tanker market.

Among recent announcements, the declared quarterly dividend of US$0.42 per share stands out as a relevant update. It underscores management's confidence in maintaining shareholder returns despite recent earnings volatility and highlights how capital allocation remains front of mind alongside fleet renewal.

Yet, despite these updates, investors should be aware that overcapacity risk from the sizeable order book remains a concern if...

Read the full narrative on Scorpio Tankers (it's free!)

Scorpio Tankers' narrative projects $972.2 million revenue and $302.6 million earnings by 2028. This requires 2.0% yearly revenue growth and a $56.4 million decrease in earnings from $359.0 million today.

Uncover how Scorpio Tankers' forecasts yield a $72.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

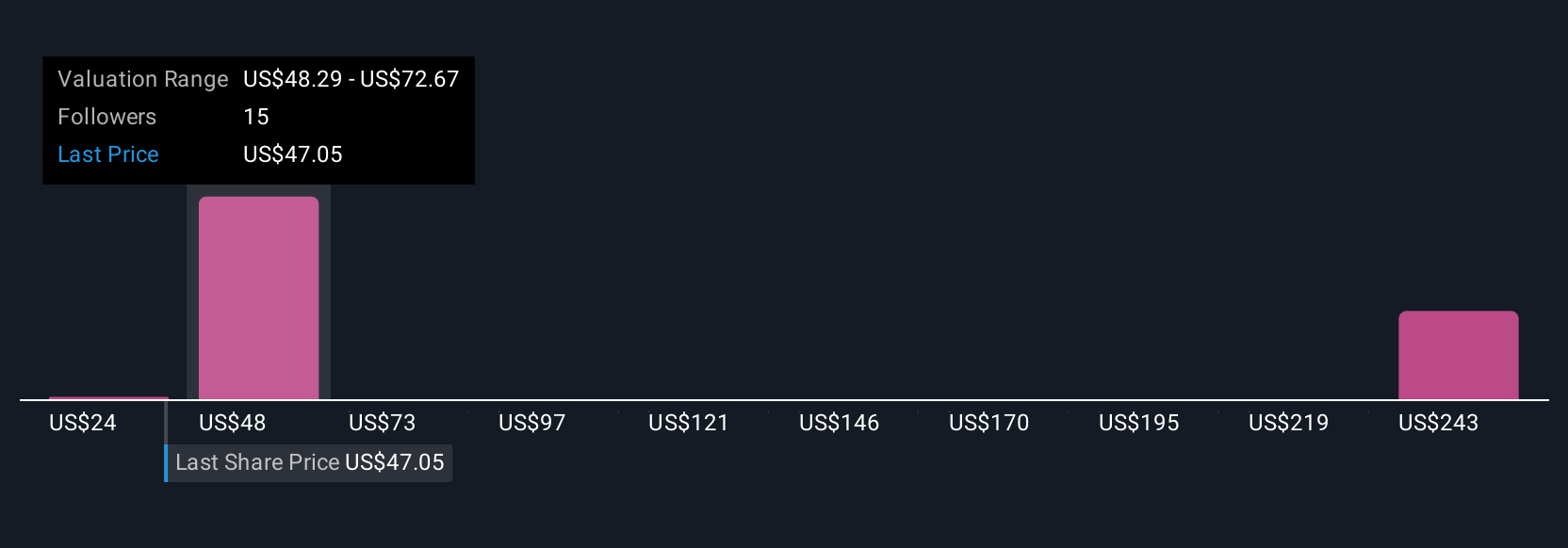

Four members of the Simply Wall St Community set fair value estimates for Scorpio Tankers between US$23.90 and US$304.37, reflecting a wide spectrum of outlooks. Many still focus on the overcapacity risk in product tankers, which could challenge profit margins in the years ahead.

Explore 4 other fair value estimates on Scorpio Tankers - why the stock might be worth over 4x more than the current price!

Build Your Own Scorpio Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scorpio Tankers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Scorpio Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scorpio Tankers' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STNG

Scorpio Tankers

Engages in the seaborne transportation of crude oil and refined petroleum products worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives