- United States

- /

- Oil and Gas

- /

- NYSE:SOC

Sable Offshore (SOC) Is Down 54.7% After Costly Loan Amendments and Leadership Scrutiny—What's Changed

Reviewed by Sasha Jovanovic

- On November 3, 2025, Sable Offshore Corp. announced an amended loan agreement with Exxon Mobil, raising the interest rate to 15% and requiring Sable to secure at least US$225 million in new equity, while upholding strict cash balances.

- These developments coincide with a special committee investigating CEO Jim Flores over allegations of selective disclosure about funding and regulatory pressures to select investors.

- We'll examine how Sable Offshore's urgent equity raise and governance controversy are shaping its current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Sable Offshore's Investment Narrative?

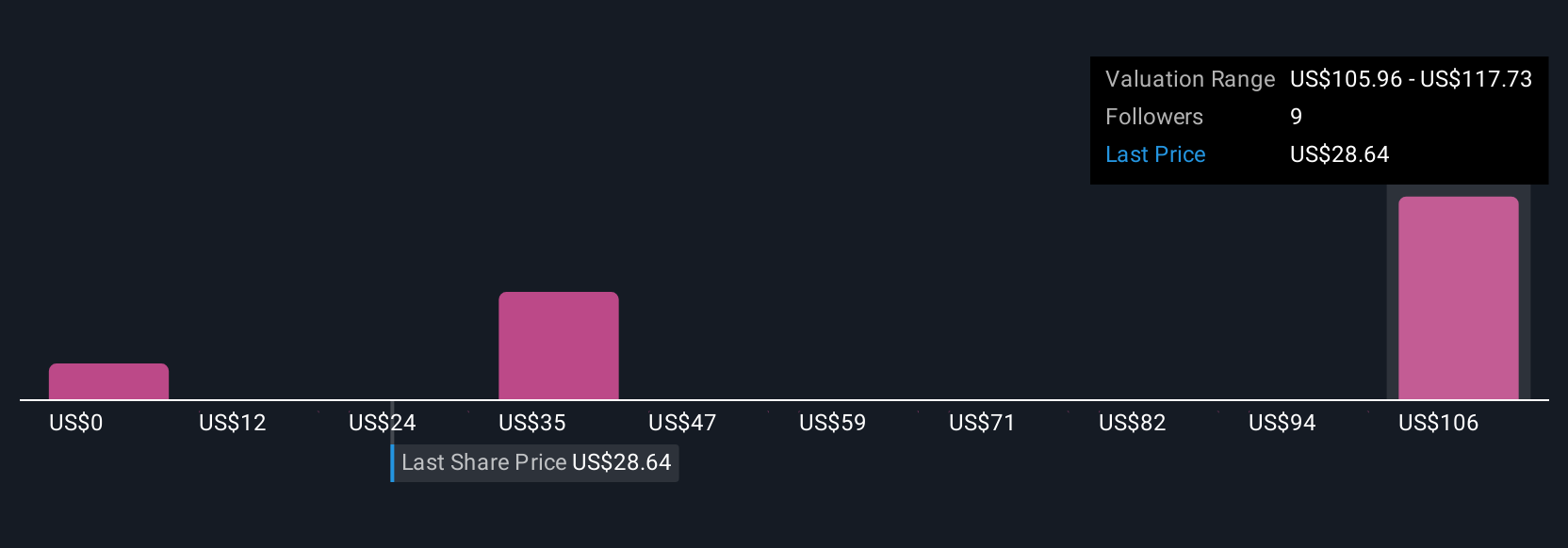

To own Sable Offshore stock right now, an investor must believe in the company’s ability to secure the required US$225 million equity on tight timelines and to address its governance and disclosure issues. The recent loan amendment with Exxon Mobil heightens near-term urgency: extended maturity could help if Sable raises the funds, but the leap in interest rates and strict cash balance requirements put even more pressure on already limited flexibility. Recent legal setbacks over pipeline repairs and ongoing class action suits add further layers of uncertainty. Previously, Sable was seen as undervalued with huge growth potential amid improving but still large losses and forecast high revenue growth. However, the governance investigation, emergency equity raise, and potential asset loss now sharply increase execution risk, meaning short-term risks are not just higher, they’re potentially existential. On the other hand, any shortfall in the equity raise could change Sable’s outlook overnight.

Despite retreating, Sable Offshore's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 5 other fair value estimates on Sable Offshore - why the stock might be worth just $17.44!

Build Your Own Sable Offshore Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sable Offshore research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Sable Offshore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sable Offshore's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOC

Sable Offshore

Operates as an independent oil and gas company in the United States.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives