- United States

- /

- Oil and Gas

- /

- NYSE:SOC

A Fresh Look at Sable Offshore (SOC) Valuation Following California Court Ruling on Santa Ynez Pipeline Operations

Reviewed by Simply Wall St

A recent California court decision upholding the Coastal Commission's cease and desist order has forced Sable Offshore (SOC) to halt critical repairs on its Las Flores Pipeline System. This has effectively stopped crude oil transport from the Santa Ynez project.

See our latest analysis for Sable Offshore.

Sable Offshore's shares have taken investors on a wild ride this year. After surging on public backing from the U.S. Energy Secretary in October, the stock was hit hard by the court decision and regulatory headwinds, reflected in a steep 28% one-month share price decline. Yet despite these recent blows, the longer view remains compelling. With a three-year total shareholder return still up 33%, momentum may be battered but the long-term story isn't written yet.

If all this volatility has you scanning for what’s next, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock now trading at a significant discount to analyst targets, but facing major regulatory clouds, the real question is whether Sable Offshore’s challenges are already reflected in the price or if there is still a compelling buying opportunity ahead.

Price-to-Book Ratio of 3x: Is it justified?

Sable Offshore’s price-to-book ratio stands at 3x, noticeably higher than both industry peers and the wider market. At a last close of $13.26, this raises real questions about whether the company’s underlying fundamentals actually support such a premium.

The price-to-book ratio compares the current share price to the book value of equity. For oil and gas companies like Sable Offshore, this ratio signals how much investors are willing to pay for every dollar of net assets. A higher ratio typically means the market expects strong future growth or unique advantages. It can also indicate over-optimism or risk mispricing.

In Sable Offshore’s case, this 3x ratio appears elevated compared to the US Oil and Gas industry average of 1.3x and the peer group average of 1.9x. Such a wide gap suggests the market is pricing in big expectations. However, with the company’s recent setbacks and negative profits, investors should be cautious about assuming these premiums will hold.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 3x (OVERVALUED)

However, persistent negative earnings and regulatory pressures could further undermine confidence. These factors may act as catalysts for continued volatility in Sable Offshore’s share price.

Find out about the key risks to this Sable Offshore narrative.

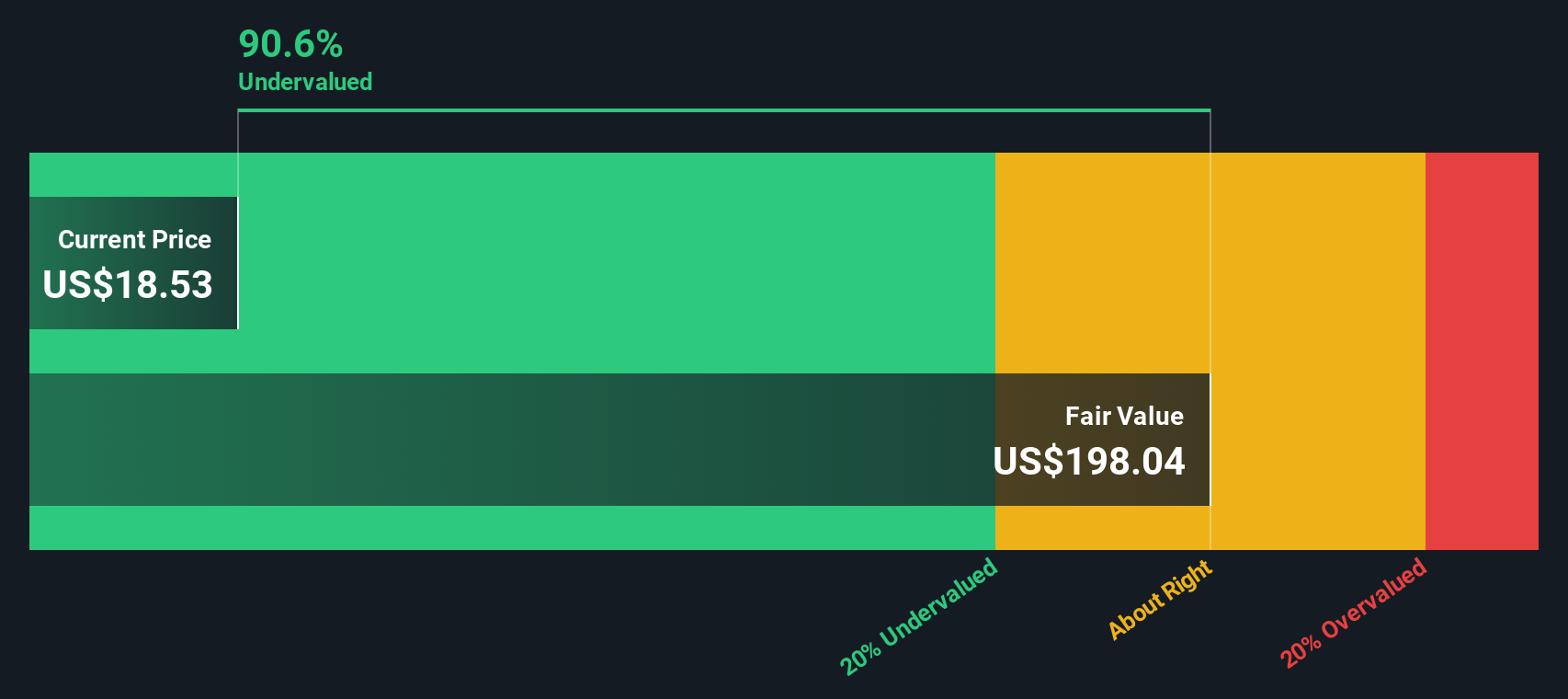

Another View: Discounted Cash Flow Points to Deep Undervaluation

Switching perspectives, our DCF model indicates Sable Offshore’s shares may be dramatically undervalued, with the stock trading over 90% below estimated fair value. This result is in sharp contrast to the caution implied by the price-to-book ratio. Could the market be mispricing Sable’s long-term recovery potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sable Offshore for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sable Offshore Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft your own perspective in just minutes. Do it your way

A great starting point for your Sable Offshore research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Smart Investing Moves?

Don’t let fresh opportunities pass you by. Uncover stocks with superior potential using the Simply Wall Street Screener and position yourself for your next big win.

- Capture income with companies offering strong, reliable payouts by tapping into these 21 dividend stocks with yields > 3% for yields above 3%.

- Get ahead of the curve in artificial intelligence by reviewing these 26 AI penny stocks, which are poised to shape tomorrow’s markets.

- Take advantage of value opportunities and spot stocks trading below intrinsic worth in these 849 undervalued stocks based on cash flows based on rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOC

Sable Offshore

Operates as an independent oil and gas company in the United States.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives