- United States

- /

- Oil and Gas

- /

- NYSE:SBR

Sabine Royalty Trust (SBR): Revisiting Valuation After Recent Gains and Outperformance

Reviewed by Simply Wall St

See our latest analysis for Sabine Royalty Trust.

Sabine Royalty Trust's strong move this month builds on a pattern of growth. Its 1-year total shareholder return stands at nearly 32%, and the five-year total return tops 320%. Momentum seems to be picking up again, reflecting investor optimism toward oil and gas royalty trusts.

If you’re weighing what other opportunities are catching investors’ eyes right now, it’s a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

But with shares near recent highs and a notable history of outsized returns, investors are left to ponder whether Sabine Royalty Trust is still undervalued at these levels or if the market has fully priced in its growth prospects.

Price-to-Earnings of 15.2x: Is it justified?

Sabine Royalty Trust trades at a price-to-earnings multiple of 15.2x, which is noticeably higher than the US Oil and Gas industry average of 13.5x. At its last close of $76.8, the shares appear more expensive than many peers. This raises questions about whether investors are paying a premium for its history or prospects.

The price-to-earnings (P/E) ratio tells investors how much they are paying for each dollar of earnings. In mature resource sectors like oil and gas, this metric can reflect expectations around production stability, asset life, and consistency of distributions.

A P/E ratio above the industry norm indicates that the market is factoring in something extra for Sabine Royalty Trust. This could be due to the quality of assets, income stream reliability, or prospects often associated with royalty trusts. However, against the peer average of 31.8x, Sabine still appears attractively valued. This suggests that while it carries a premium to the sector, it trades below similar royalty-focused companies.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 15.2x (ABOUT RIGHT)

However, any sustained weakness in energy prices or shifts in royalty distributions could challenge Sabine Royalty Trust's current growth momentum and valuation levels.

Find out about the key risks to this Sabine Royalty Trust narrative.

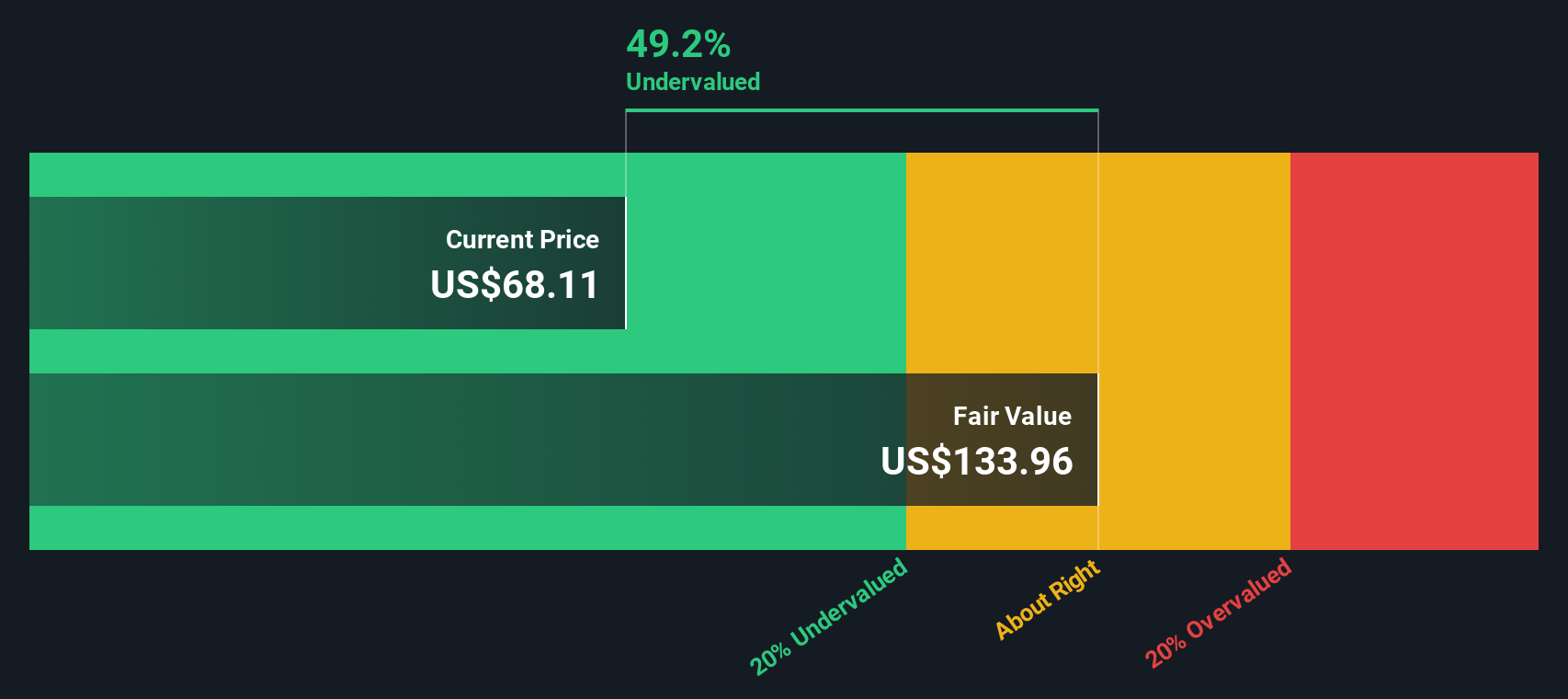

Another View: Discounted Cash Flow Suggests Undervaluation

While Sabine Royalty Trust's earnings multiple puts it at a premium to its sector, our DCF model paints a much more optimistic picture. According to this method, SBR is trading 47% below its intrinsic fair value of $145.36. If accurate, recent gains could be just the beginning.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sabine Royalty Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sabine Royalty Trust Narrative

If you see the story differently, or simply want to dive deeper into the data yourself, you can easily craft your own perspective in just a few minutes. Do it your way

A great starting point for your Sabine Royalty Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move and get ahead of the crowd by checking out stocks with huge growth drivers, stable income, or disruptive future potential. Don’t let the best opportunities slip by while others take action.

- Fuel your portfolio with growth as you check out these 28 quantum computing stocks for transformative advances in computing power and industry-changing applications.

- Target reliable income streams when you browse these 16 dividend stocks with yields > 3% for consistently delivering yields above 3% for investors who prioritize steady cash flow.

- Spot tomorrow’s potential market leaders by reviewing these 25 AI penny stocks at the forefront of artificial intelligence, automation, and next-generation data analytics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SBR

Sabine Royalty Trust

Sabine Royalty Trust holds royalty and mineral interests in various producing oil and gas properties in the United States.

Flawless balance sheet and fair value.

Market Insights

Community Narratives