- United States

- /

- Oil and Gas

- /

- NYSE:SBR

Could Sabine Royalty Trust's (SBR) Steady Payouts Indicate Long-Term Income Stability for Investors?

Reviewed by Sasha Jovanovic

- Sabine Royalty Trust has announced its October 2025 production results and declared a monthly cash distribution of $0.356720 per unit, payable on November 28, 2025, to unit holders of record on November 17, 2025.

- This update highlights the trust's ability to convert current oil and gas production into direct cash distributions for investors, offering regular income tied to underlying energy asset performance.

- We'll explore how the latest production and distribution figures inform Sabine Royalty Trust's investment narrative around income stability and resource performance.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Sabine Royalty Trust's Investment Narrative?

To be a shareholder in Sabine Royalty Trust, it helps to believe in the enduring appeal of royalty trusts as income vehicles, especially during periods of fluctuating commodity prices and unpredictable production. The latest October 2025 production results, featuring 65,727 barrels of oil and 1,135,345 Mcf of gas at average prices of $63.80 per barrel and $2.55 per Mcf, were accompanied by a declared distribution of $0.356720 per unit. While this payout underscores Sabine’s continued ability to generate cash for unit holders, the declining distributions over recent months reinforce income volatility as a leading short-term catalyst and risk. The current news event doesn’t mark a sudden change in trend; distributions remain tied tightly to commodity prices and production volumes, factors that can shift rapidly. Given weaker recent earnings and unstable dividend patterns, the main risk to watch is variability in future distributions, rather than the production or payout just announced. However, distribution reliability is still something investors should keep in focus.

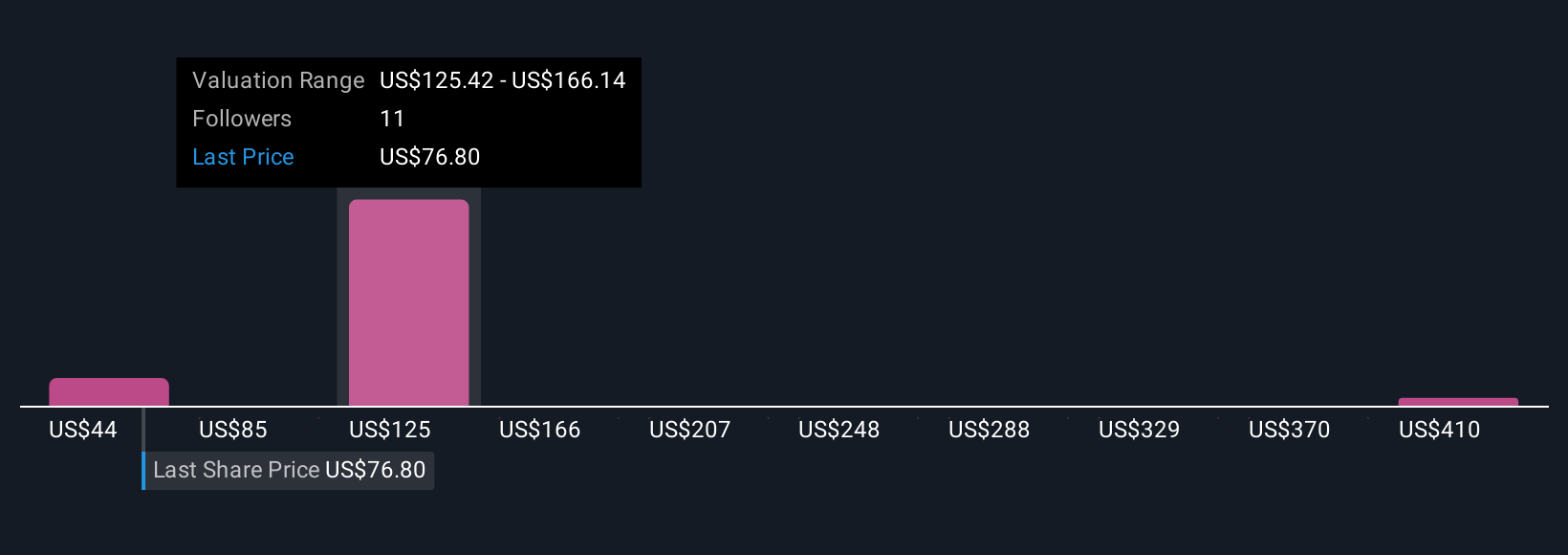

Sabine Royalty Trust's shares have been on the rise but are still potentially undervalued by 47%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Sabine Royalty Trust - why the stock might be worth 43% less than the current price!

Build Your Own Sabine Royalty Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sabine Royalty Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Sabine Royalty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sabine Royalty Trust's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SBR

Sabine Royalty Trust

Sabine Royalty Trust holds royalty and mineral interests in various producing oil and gas properties in the United States.

Flawless balance sheet and fair value.

Market Insights

Community Narratives