Stock Analysis

- United States

- /

- Oil and Gas

- /

- NYSE:PR

Here's Why Permian Resources (NYSE:PR) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Permian Resources (NYSE:PR). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Permian Resources

Permian Resources' Improving Profits

In the last three years Permian Resources' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. In previous twelve months, Permian Resources' EPS has risen from US$1.43 to US$1.50. That's a fair increase of 5.2%.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Permian Resources is growing revenues, and EBIT margins improved by 16.1 percentage points to 50%, over the last year. Both of which are great metrics to check off for potential growth.

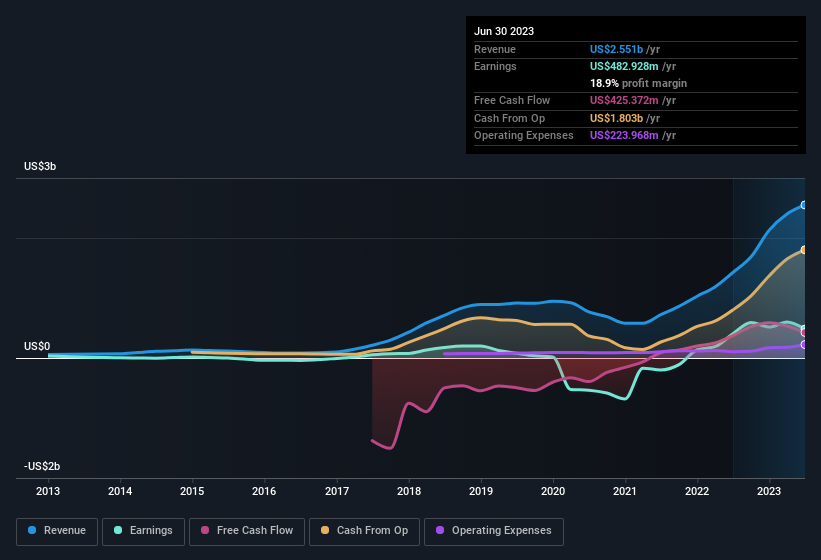

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Permian Resources' forecast profits?

Are Permian Resources Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$7.9b company like Permian Resources. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth US$269m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Does Permian Resources Deserve A Spot On Your Watchlist?

One positive for Permian Resources is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination definitely favoured by investors so consider keeping the company on a watchlist. You should always think about risks though. Case in point, we've spotted 4 warning signs for Permian Resources you should be aware of, and 1 of them shouldn't be ignored.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Permian Resources is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PR

Permian Resources

Permian Resources Corporation, an independent oil and natural gas company, focuses on the development of crude oil and related liquids-rich natural gas reserves in the United States.

Reasonable growth potential second-rate dividend payer.