- United States

- /

- Oil and Gas

- /

- NYSE:MPLX

Does MPLX’s Infrastructure Expansion Signal Room for Growth After a 20% Stock Rally?

Reviewed by Bailey Pemberton

- Curious whether MPLX is a hidden bargain or overpriced? You’re not alone. Investors are watching closely to see if there is more value yet to be revealed.

- The stock has gained 1.0% in the last week, 7.3% over the past month, and is up a hefty 20.5% in the past year. This performance is fueling debates about its growth prospects and risk profile.

- Recently, MPLX has been in the news for expanding its midstream infrastructure and progressing on key projects in the Permian Basin. These developments are positioning the company as a significant player in oil and gas transport and have caught market attention by highlighting both MPLX’s growth ambitions and the potential for increased revenue from new capacity.

- On our value score, MPLX checks in at 5 out of 6 for undervaluation, suggesting it stands out among its peers. Different valuation approaches will be explored in a moment, and at the end, an even more insightful way to think about what MPLX is really worth will be revealed.

Approach 1: MPLX Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to their present value. This approach focuses on the company’s ability to generate future cash. It is an insightful way to assess long-term value.

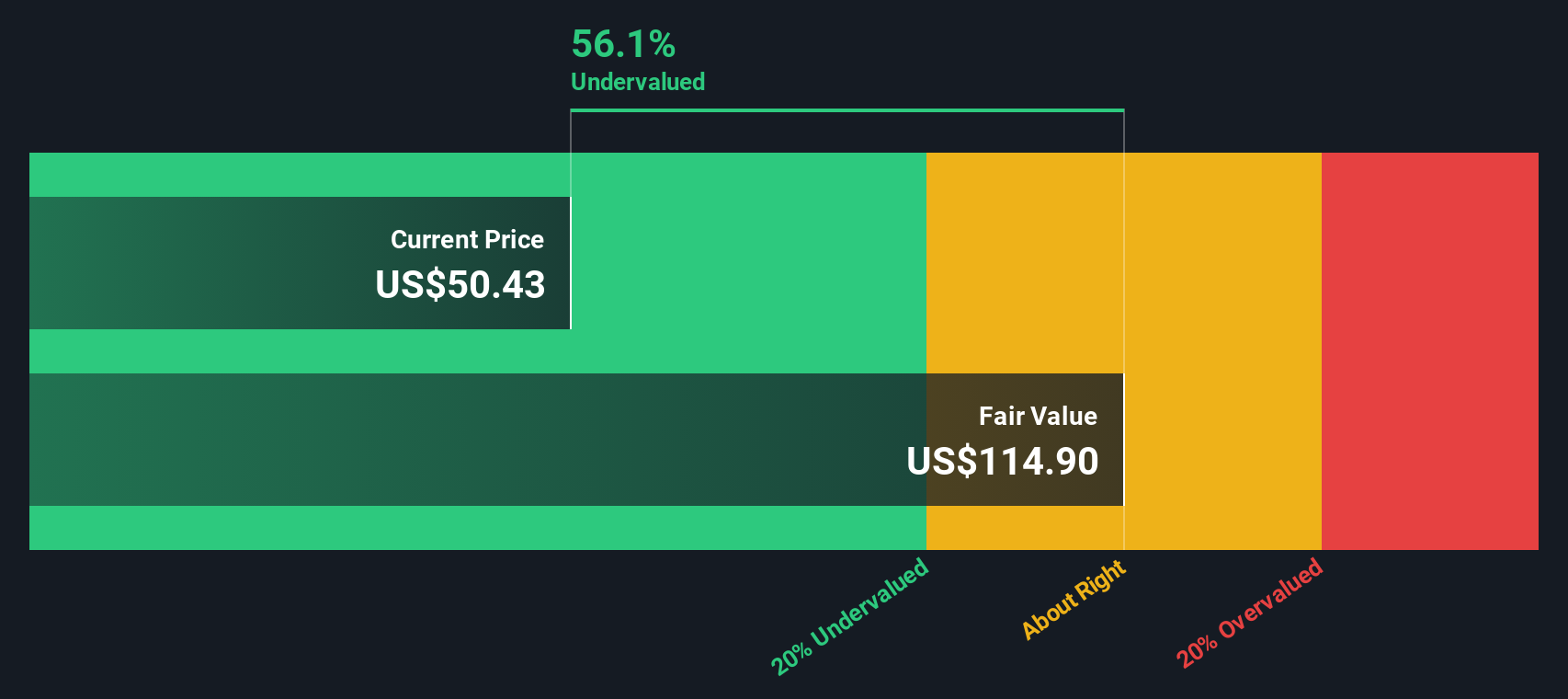

For MPLX, the current Free Cash Flow stands at $5.02 billion. Analyst forecasts suggest this number will steadily increase each year, with five-year projections based on analyst consensus and the following periods extrapolated by Simply Wall St. By 2029, MPLX’s Free Cash Flow is projected to reach $5.4 billion. Extrapolations indicate a potentially higher figure beyond that point.

After crunching the numbers, the DCF model arrives at an intrinsic value of $131.88 per share. Compared to the current share price, this represents an implied discount of 61.1%. This suggests that MPLX stock is significantly undervalued based on its future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MPLX is undervalued by 61.1%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: MPLX Price vs Earnings

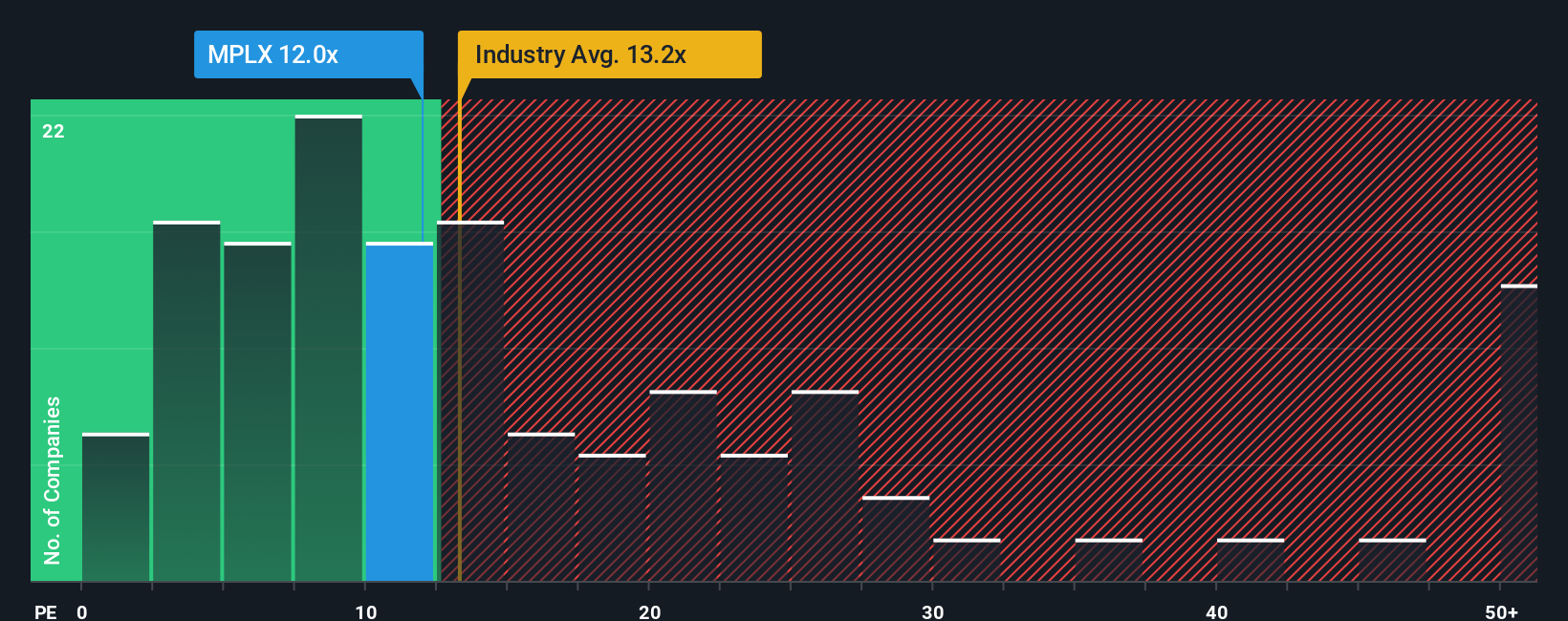

For profitable companies like MPLX, the Price-to-Earnings (PE) ratio is often the go-to valuation metric. It provides a clear snapshot of how much investors are willing to pay for a dollar of earnings. This makes it especially relevant for established firms with steady profits.

Growth expectations and perceived risk play a crucial role in determining what a “normal” PE ratio should be. Higher earnings growth or lower risk typically justifies a higher PE, while slower growth or greater risk tends to pull that ratio down.

Currently, MPLX trades at a PE ratio of 10.9x. This compares favorably to the oil and gas industry average of 13.5x as well as its peer group average of 19.4x. This suggests investors are paying less for each dollar of MPLX earnings than for similar companies.

Simply Wall St calculates a proprietary “Fair Ratio” for each stock, and for MPLX that number is 19.0x. This fair ratio provides a more informed benchmark since it considers not just peer multiples but also MPLX’s growth prospects, profit margins, risks, market cap, and industry specifics. This holistic approach makes the Fair Ratio more relevant than simple peer or industry comparisons.

Since MPLX’s actual PE ratio of 10.9x is well below the fair ratio of 19.0x, this suggests the stock is materially undervalued on this metric and adds another point in favor of the stock’s value.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MPLX Narrative

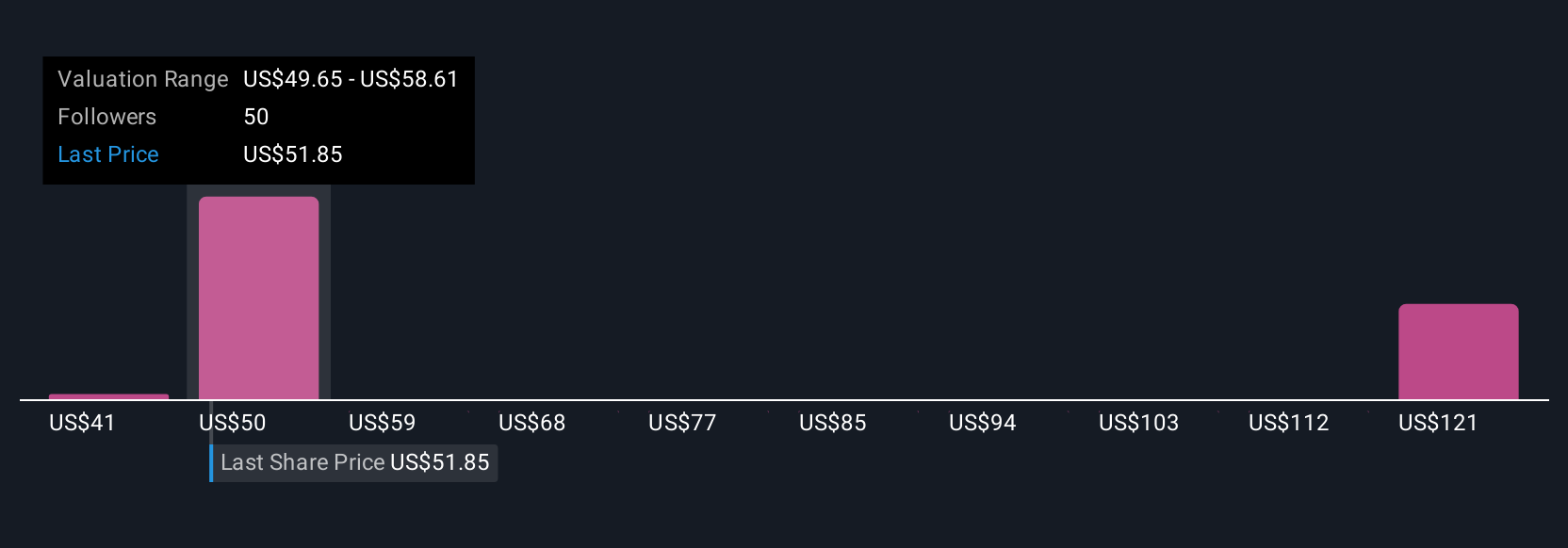

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. Narratives are a new approach that helps you look beyond just the numbers; they let you create or follow a story that connects what you believe about a company’s future to your specific assumptions around its revenue, earnings, margins, and long-term fair value. This means you choose the story that makes sense to you, shape your own expectations about how MPLX will perform, and actually see how these assumptions translate into a fair value estimate.

Narratives are available right now within the Community page on Simply Wall St’s platform, used by millions of investors. With Narratives, you can compare your own view of MPLX to the consensus, see at a glance if the current price offers a worthwhile opportunity, and even decide when to buy or sell, all based on the numbers that matter most to you.

Because Narratives update dynamically as new data and news emerge, you stay up-to-date and can react quickly to changing business conditions. For example, some investors use a bullish narrative to support a $64.0 price target for MPLX, while others see more risk and set their fair value closer to $51.0.

Do you think there's more to the story for MPLX? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPLX

MPLX

Owns and operates midstream energy infrastructure and logistics assets primarily in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives