- United States

- /

- Oil and Gas

- /

- NYSE:ETRN

Investors Interested In Equitrans Midstream Corporation's (NYSE:ETRN) Revenues

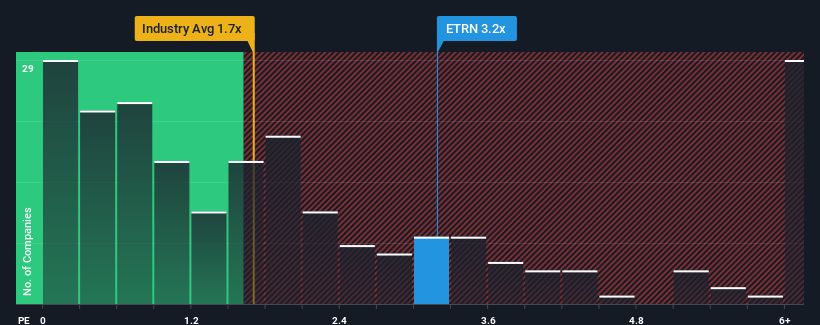

When you see that almost half of the companies in the Oil and Gas industry in the United States have price-to-sales ratios (or "P/S") below 1.7x, Equitrans Midstream Corporation (NYSE:ETRN) looks to be giving off some sell signals with its 3.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Equitrans Midstream

How Equitrans Midstream Has Been Performing

Recent times have been pleasing for Equitrans Midstream as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Equitrans Midstream.How Is Equitrans Midstream's Revenue Growth Trending?

Equitrans Midstream's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. However, this wasn't enough as the latest three year period has seen an unpleasant 12% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should demonstrate the company's robustness, generating growth of 7.7% per year as estimated by the nine analysts watching the company. That would be an excellent outcome when the industry is expected to decline by 0.4% each year.

In light of this, it's understandable that Equitrans Midstream's P/S sits above the majority of other companies. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Bottom Line On Equitrans Midstream's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we anticipated, our review of Equitrans Midstream's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Equitrans Midstream (at least 1 which is concerning), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Equitrans Midstream, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Equitrans Midstream might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ETRN

Equitrans Midstream

Owns, operates, acquires, and develops midstream assets in the Appalachian Basin.

Average dividend payer and fair value.