- United States

- /

- Oil and Gas

- /

- NYSE:ET

How Recent Infrastructure Investments Are Shaping Energy Transfer’s Current Stock Value

Reviewed by Bailey Pemberton

- Ever wondered if Energy Transfer could be a hidden bargain or if the price truly reflects its long-term strengths? You're not alone in asking where this stock stands on value right now.

- The share price has dipped slightly in the past week by 2.3% and is down 1.3% over the last month, but over five years, it has surged an incredible 356.7%. This performance has caught the eye of both value seekers and growth investors.

- Recent news highlights ongoing optimism around infrastructure investments, as well as regulatory discussions impacting the broader energy sector. These developments have influenced Energy Transfer's perception in the market and continue to shape sentiment around pipeline operations and growth opportunities.

- When we put Energy Transfer through our valuation checks, it scores a perfect 6 out of 6, an impressive result for any stock. Let's walk through what different valuation methods reveal about this company. Be sure to stick around, because there's a smarter way to spot value you'll want to see at the end.

Approach 1: Energy Transfer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects future cash flows of a company and discounts them to today’s value, aiming to estimate what the entire business might be worth right now. For Energy Transfer, analysts have calculated the current Free Cash Flow at over $7.1 billion. Over the next decade, this cash-generating ability is expected to climb each year, reaching nearly $10.3 billion by 2035 according to extrapolations based on available analyst estimates and future growth assumptions.

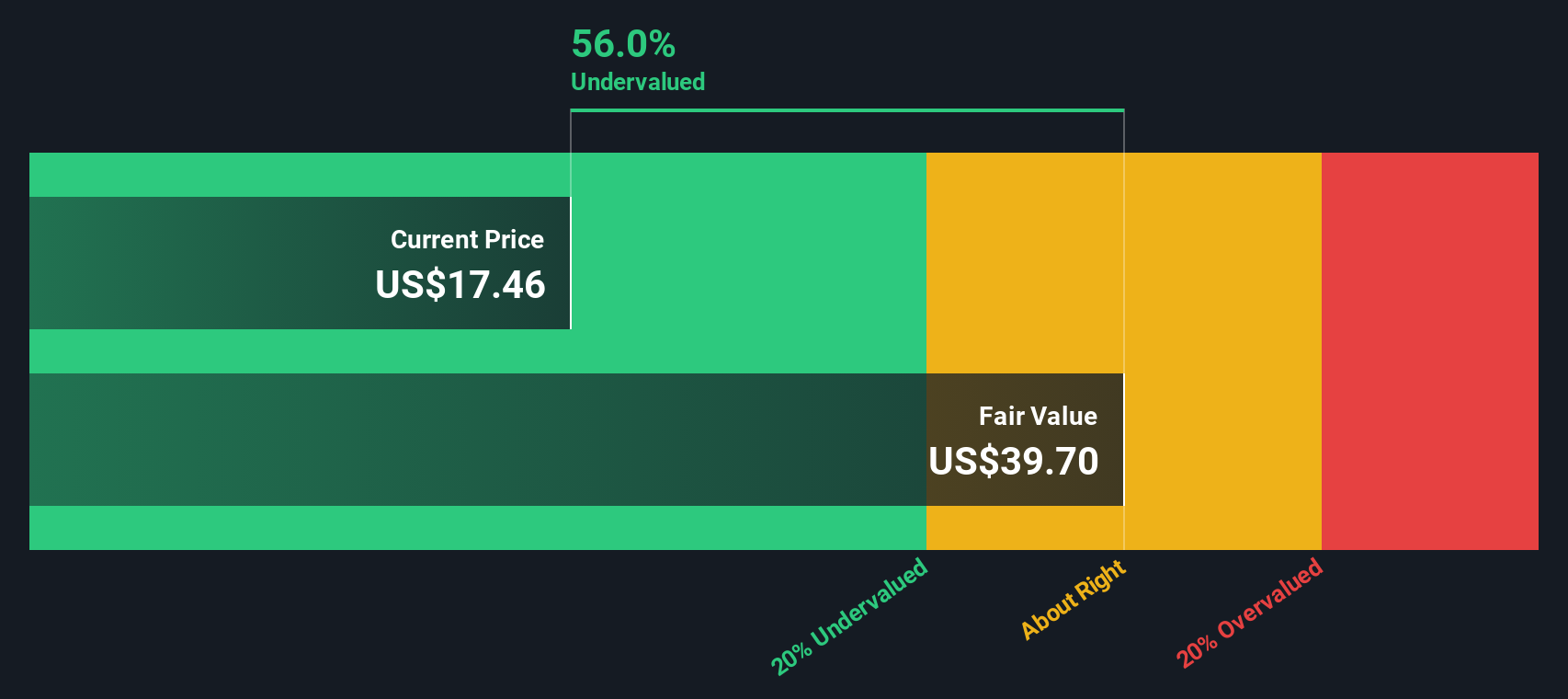

It is important to note that while analysts provide solid Free Cash Flow numbers up to 2029, projections beyond that are modeled out by Simply Wall St to provide a longer-term outlook. These robust cash flows are run through the DCF model and this process ultimately arrives at an intrinsic value of $46.90 per share. When compared to the current market price, this valuation suggests that Energy Transfer is trading at a deep discount of 64.9%.

This significant undervaluation signals that the stock may have major upside based on cash flow fundamentals alone.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Energy Transfer is undervalued by 64.9%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Energy Transfer Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely respected metric for valuing profitable companies like Energy Transfer, because it directly measures how much investors are willing to pay today for a dollar of current earnings. When a company is generating consistent profits, the PE ratio offers a quick snapshot of market expectations in relation to its bottom line.

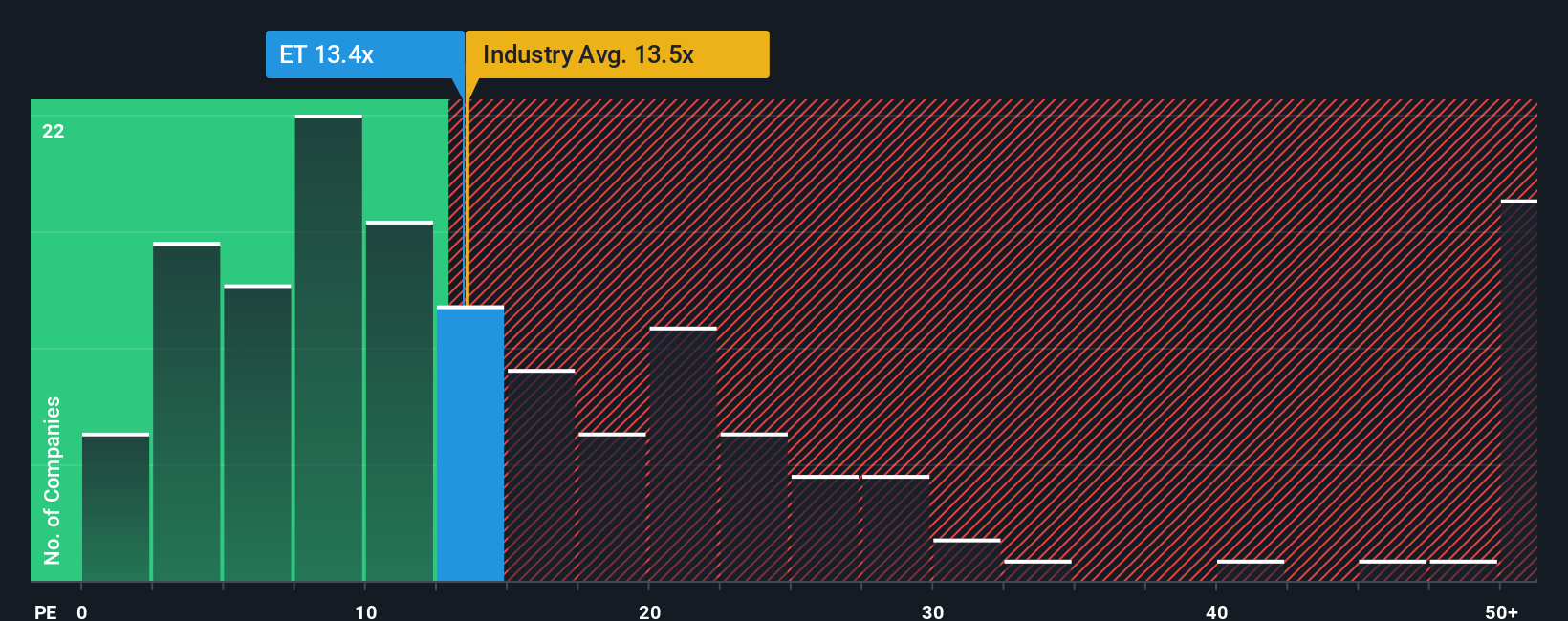

Growth prospects and risk both play major roles in determining what a "normal" or "fair" PE ratio should be. If a company is expected to rapidly grow earnings, investors will generally accept a higher PE, while increased risk might push the fair ratio lower. With this context, Energy Transfer’s current PE ratio stands at 13.1x. For comparison, the Oil and Gas industry average PE is 13.5x, while the peer group trades around 18.8x.

To go deeper than just peers and industry snapshots, Simply Wall St calculates a proprietary “Fair Ratio.” This is a tailored PE multiple that takes into account not just the sector, but also a company’s earnings growth, profit margin, risks, and even its market cap. This approach offers a more nuanced benchmark for valuation, as it can reflect hidden strengths or weaknesses not evident from broad averages alone. In Energy Transfer’s case, its Fair Ratio is 20.4x, which is notably higher than both the current PE and the industry average. This suggests the stock is trading at a meaningful discount based on company-specific fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Energy Transfer Narrative

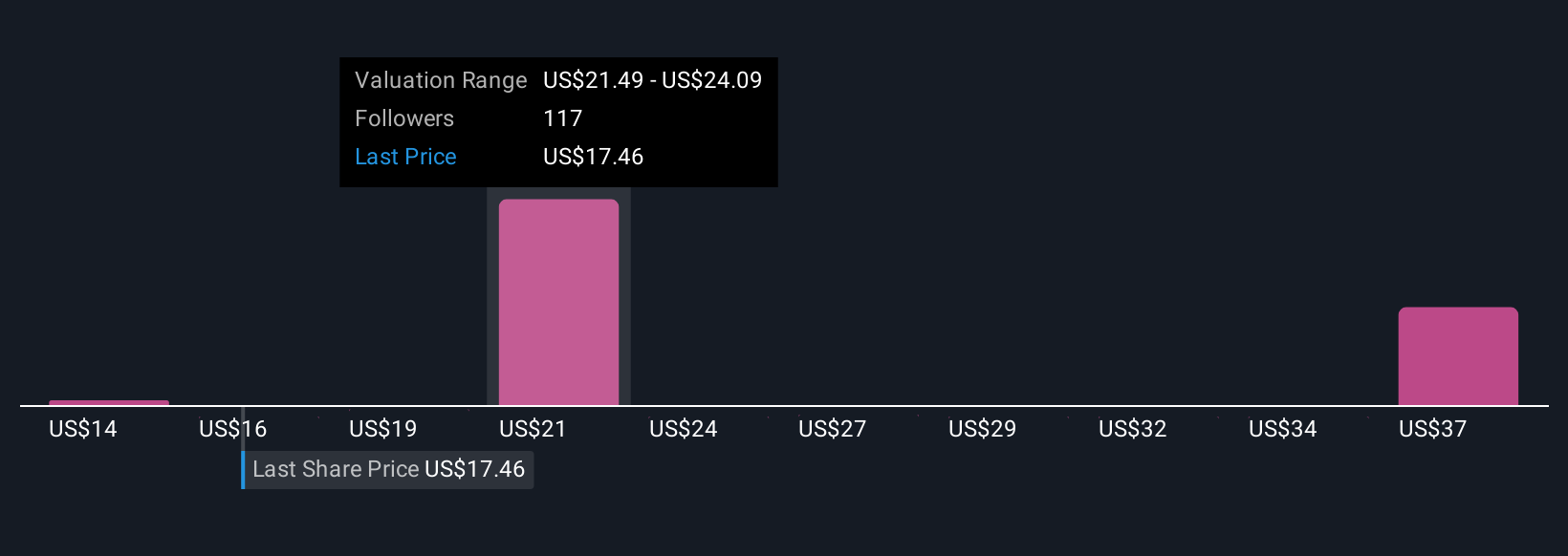

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative tells the company's story behind the numbers, allowing you to map your view of Energy Transfer’s future, such as revenue growth, profit margins, risk factors, and fair value, into a personalized forecast rather than relying only on industry multiples or analyst consensus.

On Simply Wall St, Narratives connect a company’s unique story to your own financial estimates and automatically generate a fair value. This simple, accessible tool, available within the Community page used by millions of investors, helps you visualize whether the current share price is above or below your estimate of fair value and guides your decision on when to buy or sell.

The real power of Narratives is that they update dynamically as new company announcements, news, or earnings reports are published. This ensures your valuation always stays connected to the latest events.

For example, one investor may believe expanding US pipeline and export infrastructure will drive Energy Transfer’s profits far above expectations, supporting a $25 price target. In contrast, another might see regulatory hurdles and energy transition concerns, arriving at a more cautious $20 target. Narratives empower you to set your own course by combining your perspective with the numbers, giving greater confidence in your investment decisions.

Do you think there's more to the story for Energy Transfer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Transfer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ET

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives