- United States

- /

- Oil and Gas

- /

- NYSE:EQT

Will EQT's (EQT) LNG Moves and Consortium Talks Reshape Its Long-Term Global Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, AUB Group approved EQT's request to form a consortium with CVC for a joint proposal, while EQT also finalized a new take-or-pay agreement with Smart Sand and asked for extra time to conduct due diligence, extending talks through December 4, 2025.

- This development arrives as EQT benefits from record US LNG exports and rising demand for American natural gas in both Europe and Asia.

- We'll now explore how surging natural gas prices and record LNG exports may influence EQT's longer-term investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

EQT Investment Narrative Recap

To be an EQT shareholder, you’ll likely believe in the company's ability to capture expanding U.S. natural gas demand through LNG exports and long-term supply contracts, while managing the execution and costs of major infrastructure projects. The current news around new consortium talks and contract extensions does little to shift the primary near-term catalyst: record American LNG exports supporting higher natural gas prices. The biggest risk still revolves around regulatory headwinds and cost inflation as EQT grows its footprint. Among the recent announcements, EQT’s September deal securing 1.0 MTPA of liquefaction capacity with Commonwealth LNG stands out, directly connecting to the LNG export-driven catalyst underpinning short-term optimism. This long-term agreement positions EQT to potentially lock in higher-margin volumes, supporting projected revenue growth as the global focus on U.S. LNG supply accelerates. In contrast, investors should be aware that while global LNG demand looks robust, tightening environmental regulations could ...

Read the full narrative on EQT (it's free!)

EQT's narrative projects $9.8 billion revenue and $3.8 billion earnings by 2028. This requires 11.3% yearly revenue growth and a $2.7 billion earnings increase from $1.1 billion today.

Uncover how EQT's forecasts yield a $63.41 fair value, a 4% upside to its current price.

Exploring Other Perspectives

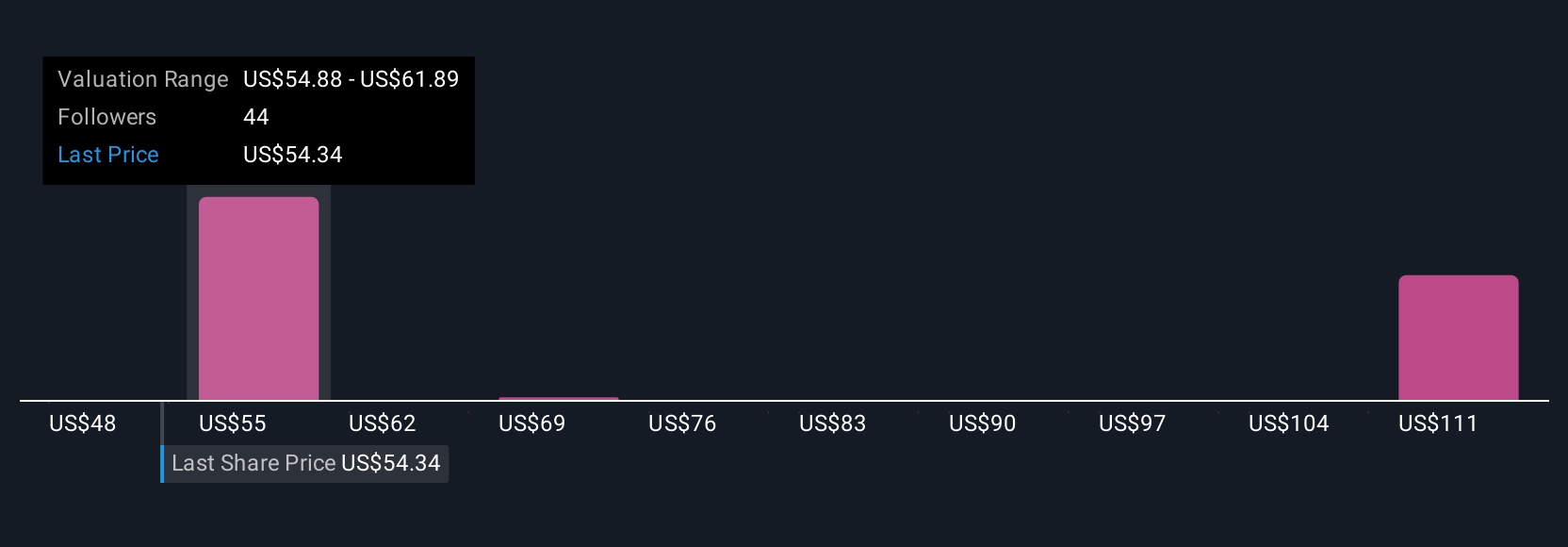

Five members of the Simply Wall St Community estimate EQT's fair value from US$47.87 to US$87.56 per share. While many are focused on growth from LNG export contracts, global decarbonization efforts and new regulations remain influential forces you should consider.

Explore 5 other fair value estimates on EQT - why the stock might be worth 21% less than the current price!

Build Your Own EQT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EQT research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free EQT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EQT's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQT

EQT

Engages in the production, gathering, and transmission of natural gas.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives