- United States

- /

- Oil and Gas

- /

- NYSE:EPD

Did Enterprise Products Partners' (EPD) Buyback Expansion Signal a Turning Point Amid Declining Q3 Earnings?

Reviewed by Sasha Jovanovic

- Enterprise Products Partners L.P. recently reported third-quarter 2025 results, showing sales of US$12.02 billion and net income of US$1.34 billion, both down compared to the same period last year, while also raising its equity buyback authorization by US$3 billion to a total of US$5 billion.

- Alongside these results, management emphasized ongoing growth initiatives and increased capital returns, signaling continued confidence in the company's operational resilience despite near-term earnings declines.

- With the expanded buyback program reflecting management’s confidence amid lower quarterly earnings, we’ll explore how these developments influence the investment narrative for Enterprise Products Partners.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Enterprise Products Partners Investment Narrative Recap

To be a shareholder in Enterprise Products Partners, you need to believe in the ongoing demand for midstream energy infrastructure and the company’s ability to grow earnings and distributions despite periods of lower earnings. The recent quarterly decline in sales and net income does not appear to materially change the main near-term catalyst, growth from new processing and export projects. However, it also leaves the company exposed to its biggest current risk: further operational disruptions or external market shocks could weigh on future profitability.

Among the announcements, the US$3 billion increase in the equity buyback authorization stands out. This move, especially at a time when near-term earnings have softened, signals a focus on capital returns that could help support per-share metrics if growth projects ramp up as planned.

Yet, in contrast to the optimistic signals from management, investors should remain mindful of one important risk: any unexpected operational downtime...

Read the full narrative on Enterprise Products Partners (it's free!)

Enterprise Products Partners is projected to reach $53.5 billion in revenue and $6.6 billion in earnings by 2028. This outlook is based on an annual revenue decline of 0.8% and an $0.8 billion increase in earnings from the current $5.8 billion level.

Uncover how Enterprise Products Partners' forecasts yield a $35.89 fair value, a 16% upside to its current price.

Exploring Other Perspectives

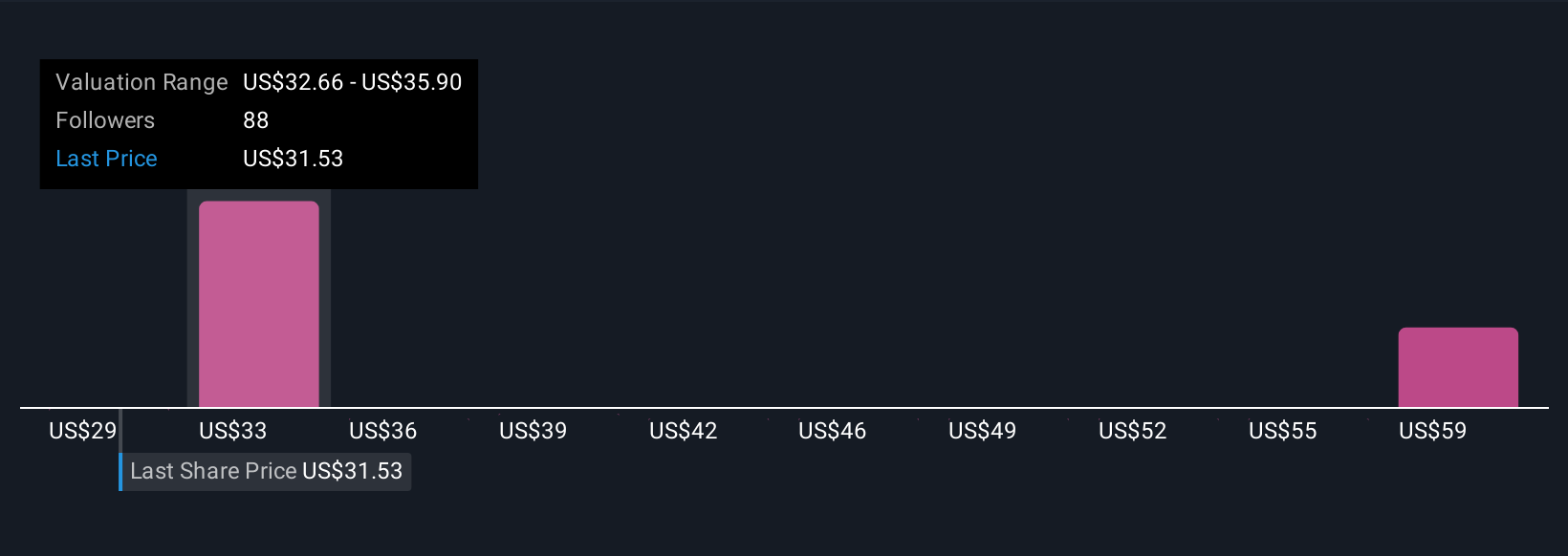

Ten fair value estimates from the Simply Wall St Community range from US$29.42 to US$64.72 per unit. With such a spread of views, remember that future export demand and tariffs are a key factor that could shift opinions on Enterprise Products Partners’ outlook.

Explore 10 other fair value estimates on Enterprise Products Partners - why the stock might be worth over 2x more than the current price!

Build Your Own Enterprise Products Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enterprise Products Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enterprise Products Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enterprise Products Partners' overall financial health at a glance.

No Opportunity In Enterprise Products Partners?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Products Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPD

Enterprise Products Partners

Provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives