- United States

- /

- Oil and Gas

- /

- NYSE:EOG

EOG Resources (NYSE:EOG) Is Paying Out A Larger Dividend Than Last Year

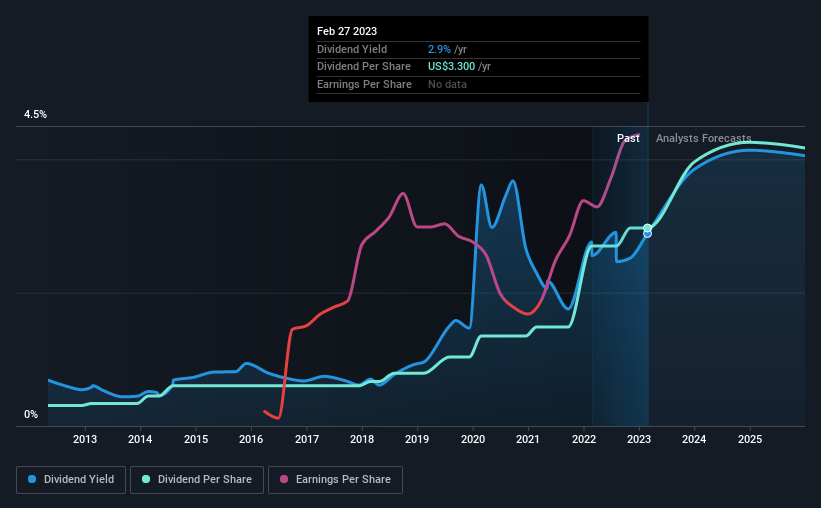

EOG Resources, Inc. (NYSE:EOG) has announced that it will be increasing its dividend from last year's comparable payment on the 28th of April to $0.825. Despite this raise, the dividend yield of 2.9% is only a modest boost to shareholder returns.

Check out our latest analysis for EOG Resources

EOG Resources' Dividend Is Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. However, EOG Resources' earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

EPS is set to fall by 8.5% over the next 12 months. If recent patterns in the dividend continue, we could see the payout ratio reaching 82% in the next 12 months, which is on the higher end of the range we would say is sustainable.

EOG Resources Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $0.34 in 2013, and the most recent fiscal year payment was $3.30. This implies that the company grew its distributions at a yearly rate of about 26% over that duration. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. EOG Resources has seen EPS rising for the last five years, at 24% per annum. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

We Really Like EOG Resources' Dividend

Overall, a dividend increase is always good, and we think that EOG Resources is a strong income stock thanks to its track record and growing earnings. The distributions are easily covered by earnings, and there is plenty of cash being generated as well. If earnings do fall over the next 12 months, the dividend could be buffeted a little bit, but we don't think it should cause too much of a problem in the long term. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for EOG Resources that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if EOG Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EOG

EOG Resources

Explores for, develops, produces, and markets crude oil, natural gas liquids, and natural gas primarily in producing basins in the United States, the Republic of Trinidad and Tobago and internationally.

Undervalued with excellent balance sheet and pays a dividend.