- United States

- /

- Oil and Gas

- /

- NYSE:DTM

Will Record Earnings and Pipeline Expansion Shift DT Midstream’s (DTM) Growth Narrative?

Reviewed by Sasha Jovanovic

- DT Midstream recently reported strong third-quarter earnings, with sales rising to US$314 million and net income reaching US$115 million, alongside announcing a 40% expansion of the Guardian Pipeline capacity backed by long-term utility contracts.

- The company also raised its 2025 adjusted EBITDA guidance midpoint by 18%, highlighting early project completions and new growth opportunities, while receiving supportive new analyst coverage reflecting optimism about its operational momentum and expansion plans.

- We'll explore how higher earnings and record Haynesville volumes support DT Midstream's investment narrative and future expectations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

DT Midstream Investment Narrative Recap

To be a DT Midstream shareholder, you need conviction in the ongoing demand for natural gas transport and storage, especially as infrastructure expansion is paired with resilient, long-term customer contracts. The latest quarterly earnings and elevated 2025 EBITDA guidance reinforce the company’s near-term growth catalyst, accelerating project completions and higher Haynesville volumes, while the headline expansion news does little to reduce the prevailing risk tied to large capital commitments if future gas demand weakens.

This quarter’s final investment decision on a 40% expansion of the Guardian Pipeline, anchored by multi-decade utility contracts, showcases DT Midstream’s approach to securing recurring cash flow and maximizing system utilization, providing visible revenue amid a competitive and evolving energy market.

However, investors should be aware that, despite the promising contracts, a key risk remains if the pace of decarbonization accelerates or regional demand shifts...

Read the full narrative on DT Midstream (it's free!)

DT Midstream's narrative projects $1.6 billion revenue and $606.6 million earnings by 2028. This requires 12.0% yearly revenue growth and a $230.6 million earnings increase from $376.0 million today.

Uncover how DT Midstream's forecasts yield a $115.42 fair value, a 3% upside to its current price.

Exploring Other Perspectives

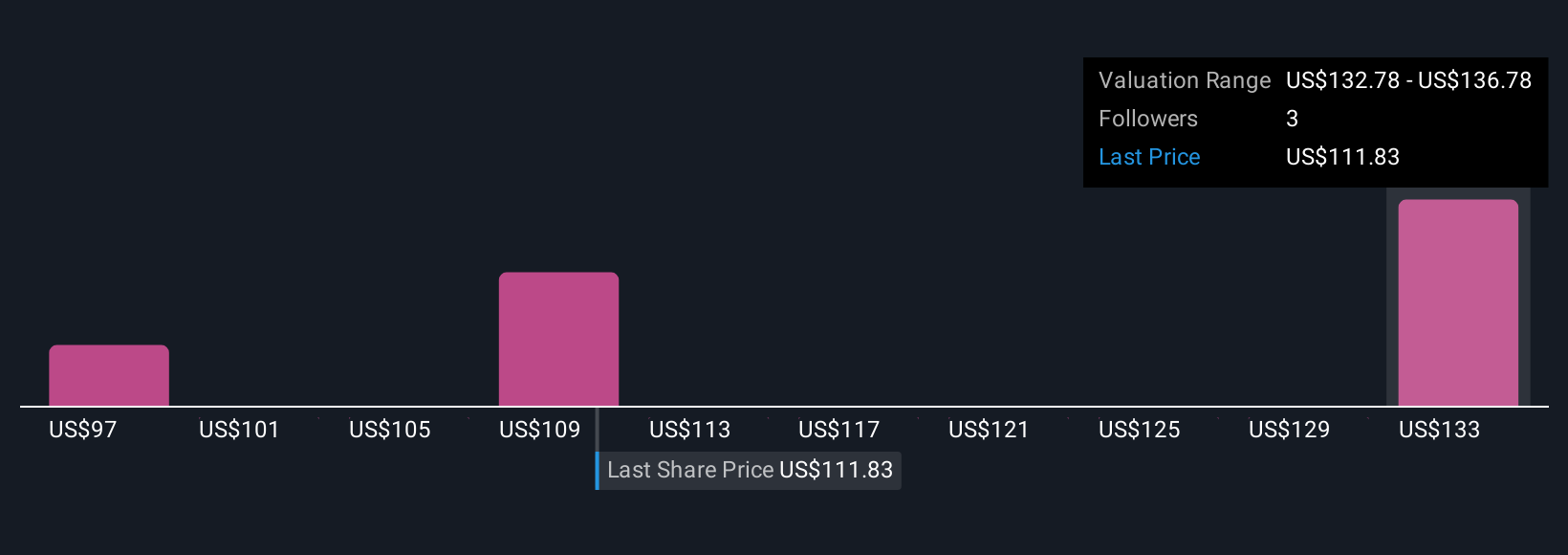

Three private investors in the Simply Wall St Community provided fair value estimates for DT Midstream ranging from US$96.75 to US$115.42. While these differ, the company’s rapid project acceleration and dependence on long-term demand remain central to its performance story, review more peer insights to broaden your understanding.

Explore 3 other fair value estimates on DT Midstream - why the stock might be worth 13% less than the current price!

Build Your Own DT Midstream Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DT Midstream research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DT Midstream research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DT Midstream's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTM

DT Midstream

Provides integrated natural gas services in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives