- United States

- /

- Oil and Gas

- /

- NYSE:DHT

How Investors May Respond To DHT Holdings (DHT) Robust Q3 Earnings and Fleet Expansion Plans

Reviewed by Sasha Jovanovic

- DHT Holdings reported third quarter 2025 net income of US$44.8 million, an increase over the same period last year, and continued its streak of quarterly dividends while securing major credit facilities to expand its fleet.

- This performance comes amid ongoing strength in the VLCC market, driven by high demand for crude oil transportation and a tightening supply of vessels.

- We will explore how DHT Holdings' robust earnings growth and fleet expansion influence its investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

DHT Holdings Investment Narrative Recap

To be a shareholder in DHT Holdings, you need to believe in the ongoing strength of the global crude oil transport market and the company's ability to capitalize on it through disciplined fleet expansion and operational efficiency. The recent earnings report, highlighting strong year-over-year net income growth and another stable dividend, supports this investment thesis and its most important short-term catalyst: sustained high VLCC demand and utilization. However, the company's high dividend payout policy remains a meaningful risk if vessel earnings soften, though the latest results do not materially alter this concern.

Among the latest developments, DHT’s new US$308.4 million secured credit facility stands out as highly relevant. This financing supports the addition of four newbuild VLCCs, which is directly aligned with the company's ambition to strengthen its fleet amid tightening vessel supply, a key factor supporting revenue growth and future profits. These moves reinforce DHT's positioning for short-term catalysts, even as investors monitor risks around cash flow coverage and capital allocation.

But, in contrast to the robust earnings, investors should keep a close eye on how sustainable the current dividend policy really is if market conditions shift...

Read the full narrative on DHT Holdings (it's free!)

DHT Holdings is projected to reach $497.7 million in revenue and $281.4 million in earnings by 2028. This outlook assumes a 3.7% annual revenue decline and a $91 million increase in earnings from the current $190.4 million.

Uncover how DHT Holdings' forecasts yield a $14.67 fair value, a 11% upside to its current price.

Exploring Other Perspectives

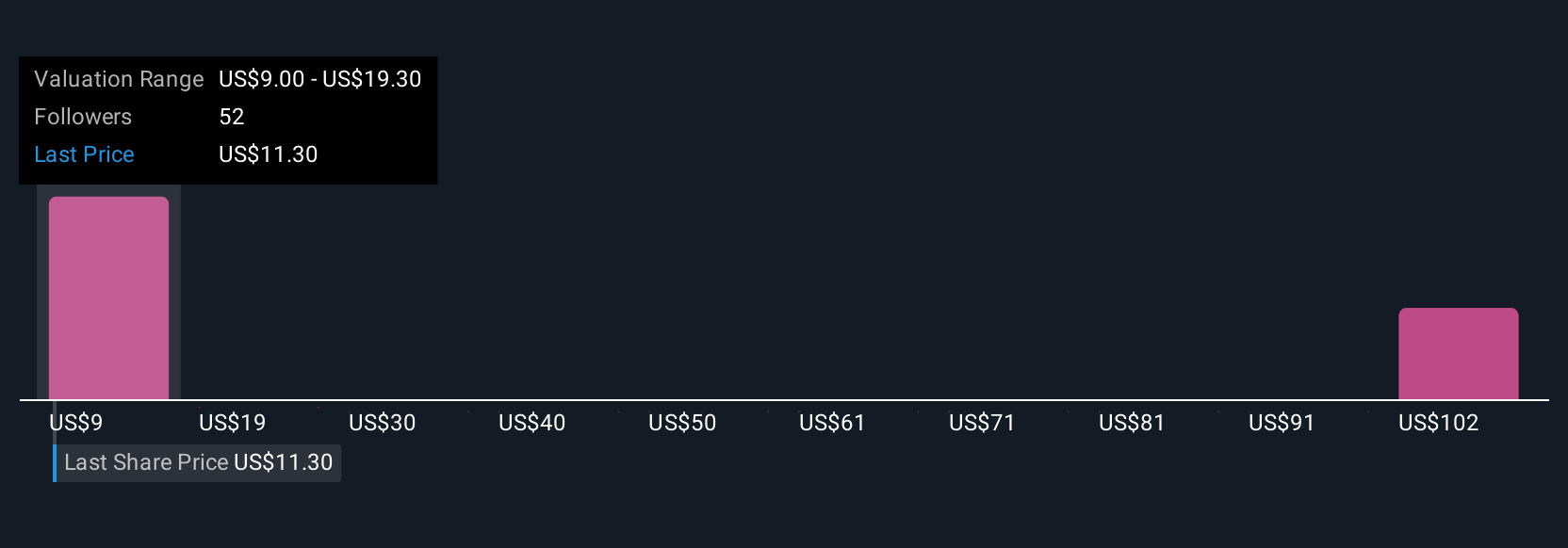

Fair value estimates from eight Simply Wall St Community members span from US$13 to above US$184 per share, illustrating wide-ranging views on DHT’s prospects. With their outlooks, compare how the company's aggressive dividend policy could impact future flexibility and see how these different perspectives might play into your decision-making.

Explore 8 other fair value estimates on DHT Holdings - why the stock might be worth just $13.00!

Build Your Own DHT Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DHT Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DHT Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DHT Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHT

DHT Holdings

Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, Norway, and India.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives