- United States

- /

- Oil and Gas

- /

- NYSE:BKV

How Investors Are Reacting To BKV (BKV) Surging Q3 Results and Aggressive Expansion in Gas and Power

Reviewed by Sasha Jovanovic

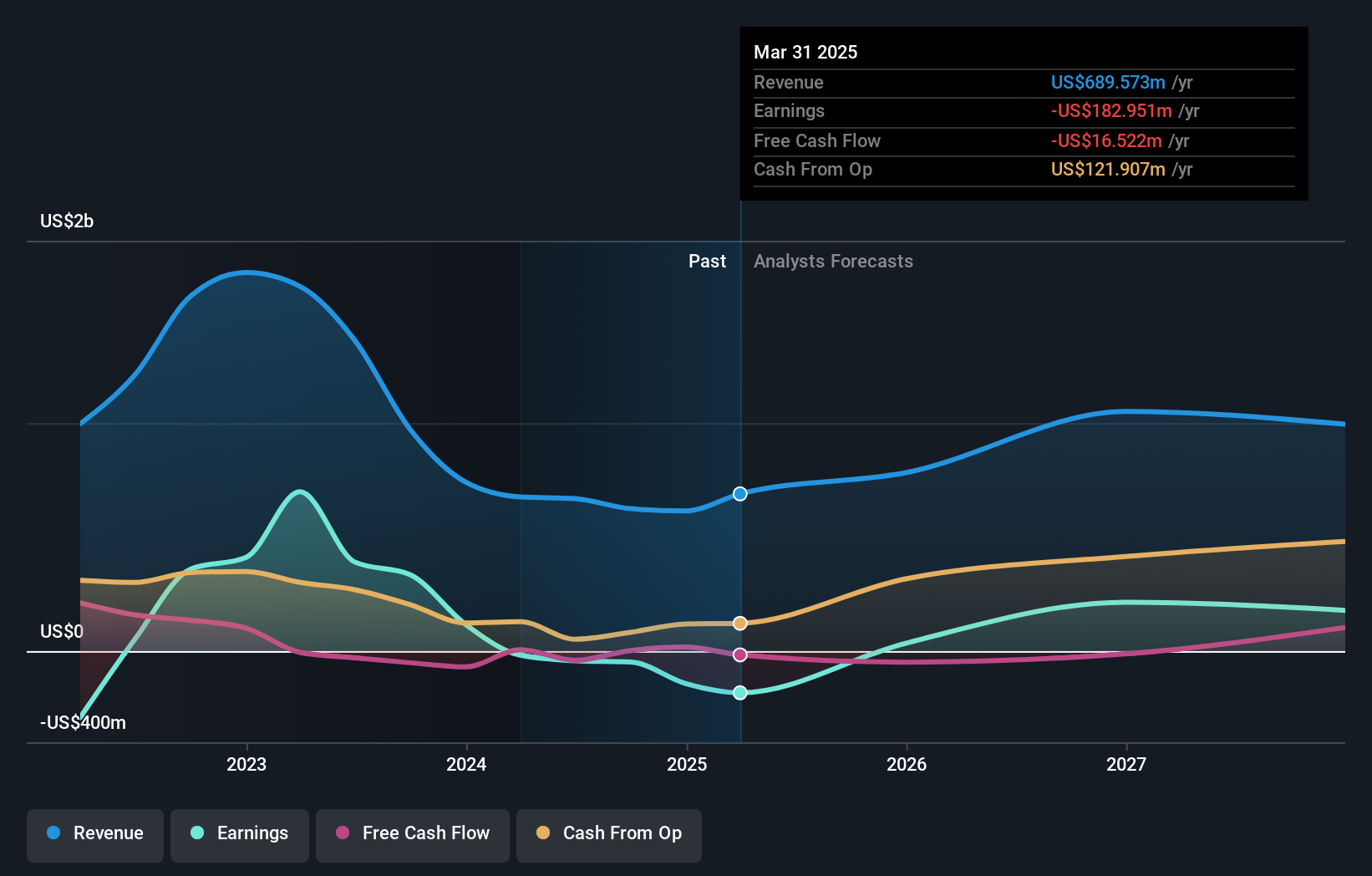

- BKV Corporation recently reported sharp year-over-year revenue and net income gains for Q3 2025, issued higher production guidance for the coming quarter, and announced the acquisition of Bedrock’s Barnett Shale assets along with plans to boost its ownership in a key power joint venture.

- These developments signal BKV’s intention to solidify its presence in both natural gas production and power generation, while highlighting an expanding focus on carbon capture initiatives.

- Let’s explore how BKV’s move to increase control in its power joint venture could shape its investment narrative going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is BKV's Investment Narrative?

For shareholders to be comfortable owning BKV today, the thesis hinges on belief in the company’s ability to execute on its integrated energy strategy and realize the upside of its recent moves. The Q3 report reflected robust gains in revenue and net income, while BKV’s decision to issue higher production guidance and take majority control of its power joint venture could set up new momentum. With acquisitions like Bedrock’s Barnett Shale assets and capital allocation aimed at combining natural gas, power, and carbon capture, BKV is positioning itself to diversify cash flows and address emerging industry trends. These steps may boost short-term catalysts, especially as analysts raise price targets and shares rally strongly after the news. However, the rapid scaling, new debt from acquisitions, and a board with low independence all add to risks, potentially shifting investor focus more toward execution and balance sheet management.

But there's another side to the story: BKV’s board independence remains a key risk for investors to watch.

Exploring Other Perspectives

Explore 2 other fair value estimates on BKV - why the stock might be worth just $28.14!

Build Your Own BKV Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BKV research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free BKV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BKV's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BKV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKV

BKV

Produces and sells natural gas in the Barnett Shale in the Fort Worth Basin of Texas and in the Marcellus Shale in the Appalachian Basin of Northeast Pennsylvania.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives