- United States

- /

- Oil and Gas

- /

- NasdaqGS:VNOM

Viper Energy (VNOM): Evaluating Valuation After Revenue Surge, Net Loss, and Major Buyback Completion

Reviewed by Simply Wall St

Viper Energy (VNOM) just released its third quarter earnings, showing major growth in revenue compared to last year, but also reporting a shift to a net loss for the latest period. In addition, the company has wrapped up a considerable part of its multi-year stock buyback program, drawing fresh attention from investors.

See our latest analysis for Viper Energy.

Despite delivering sizable revenue growth over the year and completing a major share buyback, Viper Energy's momentum has cooled. The latest share price is $37.71 with a year-to-date share price return of -24.38%. The total shareholder return over the past year is -25.84%, reflecting a period where optimism around buybacks and higher production guidance has not been enough to offset shifting risk sentiment and the impact of recent net losses.

If these shifts in Viper Energy’s outlook have you curious about broader opportunities, now’s the time to see what’s possible and discover fast growing stocks with high insider ownership

With shares currently trading well below analyst targets and a significant intrinsic discount, investors are left to ponder if Viper Energy is a bargain at today's price or if the market has already factored in its future prospects.

Most Popular Narrative: 26% Undervalued

Viper Energy’s most popular narrative sets a fair value of $50.94 per share, compared to the most recent close of $37.71. This difference has caught the eye of those looking for value in energy equities, as narrative supporters believe a mix of operational catalysts and shareholder returns can fuel a turnaround.

The combination of organic production growth, especially from Diamondback-operated assets (projected to deliver 15% higher oil production per share in 2026 vs. 2025), and consistent share repurchases at currently depressed valuations, creates a powerful catalyst for per-share earnings growth and higher total shareholder return.

Want to know the secret behind Viper’s double-digit discount? This narrative leans on relentless oil production upgrades and aggressive buybacks, suggesting assumptions more commonly seen in high-flying growth sectors. Curious to uncover the financial projections and bold expectations driving such a premium? Discover what’s fueling this valuation before the next move.

Result: Fair Value of $50.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, headwinds remain. A heavy reliance on third-party operators and potential setbacks in integrating recent acquisitions could challenge Viper Energy’s growth story.

Find out about the key risks to this Viper Energy narrative.

Another View: Trading at a Premium?

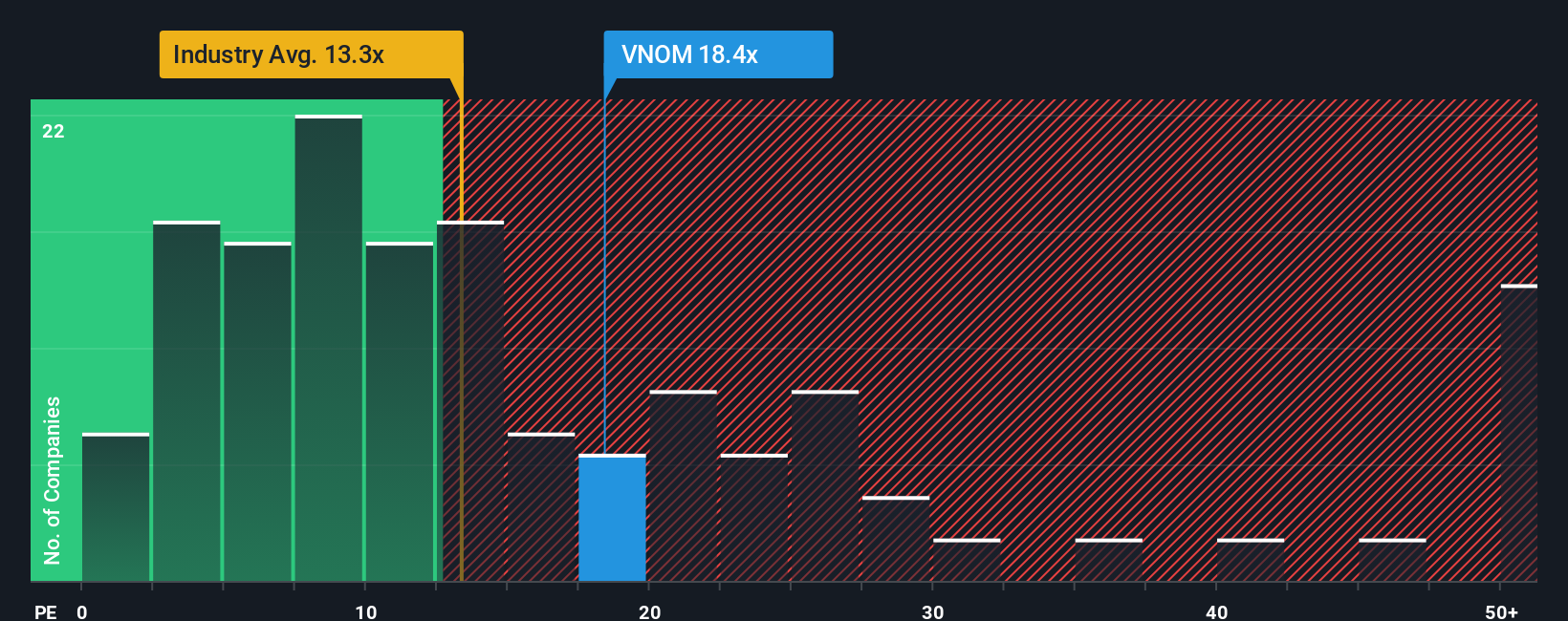

While bullish narratives highlight Viper Energy’s value, the reality through the lens of earnings multiples tells a different story. The company trades at a 26x ratio, which is notably higher than both its peer average (19.4x) and the broader US Oil and Gas industry (13.5x). The market’s fair ratio sits at 17.6x, suggesting Viper is priced at a substantial premium.

With this premium in mind, is there a valuation risk the market cannot ignore, or could Viper’s profitability justify the higher price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Viper Energy Narrative

If you see the trends differently or want to dig into the numbers yourself, it's simple to craft your own perspective in just minutes, so why not Do it your way

A great starting point for your Viper Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let tomorrow’s winning stock slip past you. The right research tools can put you a step ahead and help shape a portfolio built on opportunity and growth.

- Tap into potential market disruptors by evaluating these 24 AI penny stocks, which are harnessing artificial intelligence for next-level innovation and real-world impact.

- Target consistent income by reviewing these 16 dividend stocks with yields > 3% with reliable yields, allowing your money to work harder while minimizing risk.

- Seize early-mover advantages by assessing these 28 quantum computing stocks at the forefront of technological breakthroughs and high-growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNOM

Viper Energy

Owns, acquires, and exploits oil and natural gas properties in North America.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives