- United States

- /

- Oil and Gas

- /

- NasdaqGS:DMLP

Assessing Dorchester Minerals (DMLP) Valuation After Recent Share Price Uptick and Ongoing Weakness

Reviewed by Simply Wall St

Dorchester Minerals (DMLP) has seen a slight share price uptick, closing at $23.47, while returns over the past week remain negative. Investors may be weighing its long-term value after a tough year, given shifting trends in the energy sector.

See our latest analysis for Dorchester Minerals.

Dorchester Minerals' share price has struggled throughout the year, with a 1-year share price decline of over 32% and a total shareholder return of -23.17%, painting a picture of fading momentum. Despite this week’s brief uptick, the recent bounce suggests investors are watching closely for signs of a turnaround. However, the long-term trend still outweighs short-lived gains.

If you’re looking for the next opportunity in today’s shifting market, consider expanding your search and discover fast growing stocks with high insider ownership

With this recent volatility and a multi-year decline in performance, the key question now is whether Dorchester Minerals is trading below its true value or if the market has already accounted for any future growth prospects.

Price-to-Earnings of 14.3x: Is it justified?

With Dorchester Minerals currently trading at a price-to-earnings (P/E) ratio of 14.3x and a last close of $23.47, the stock is considered expensive relative to its industry, despite recent share price weakness.

The P/E ratio compares a company’s current share price to its per-share earnings and offers investors a basic gauge of value. For resource companies like Dorchester Minerals, this is closely monitored to assess perceived growth or risk against future profits.

While the market is effectively paying more for each dollar of Dorchester Minerals' earnings compared to most U.S. oil and gas peers, it is possible that investors expect a recovery or superior earnings quality. However, there is no current fair ratio figure provided to balance or refute this premium.

This premium is notable as Dorchester Minerals’ P/E of 14.3x stands above the industry average of 12.8x, signaling a higher market expectation despite recent underperformance.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 14.3x (OVERVALUED)

However, ongoing uncertainty around revenue growth and unclear analyst forecasts could quickly shift expectations and change the perceived value of Dorchester Minerals.

Find out about the key risks to this Dorchester Minerals narrative.

Another View: Discounted Cash Flow Model

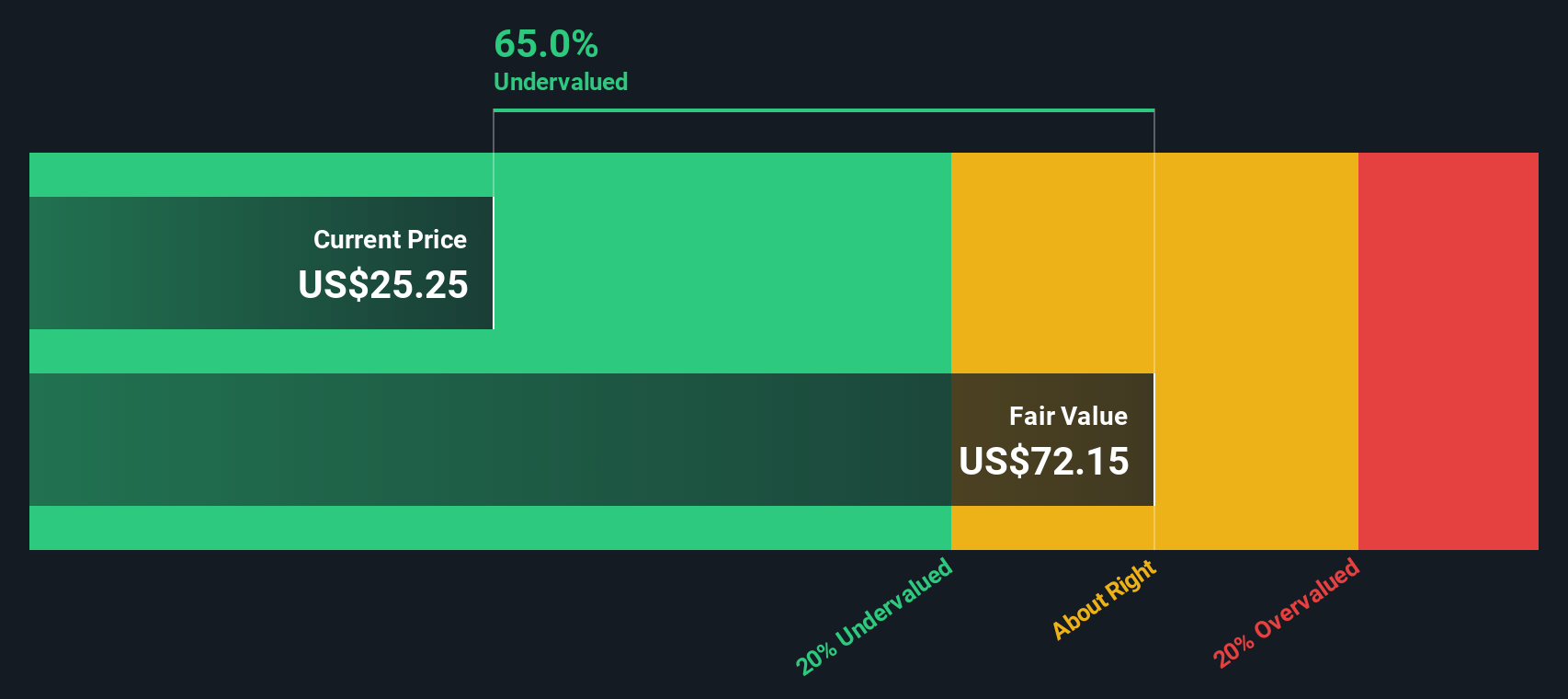

Taking a different perspective, the SWS DCF model estimates Dorchester Minerals' fair value at $72.02 per share. This approach stands in strong contrast to the earlier valuation and suggests the stock may be trading well below its intrinsic value. Could this deep discount signal a potential opportunity, or is there more to the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dorchester Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dorchester Minerals Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can shape your own story about Dorchester Minerals in just a few minutes. Do it your way

A great starting point for your Dorchester Minerals research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to outpace the crowd and spot opportunities early, you should be scanning the market for unique strengths that fit different strategies. The right stock could be a click away.

- Supercharge your portfolio with higher yields by targeting these 17 dividend stocks with yields > 3% that consistently deliver strong income potential.

- Tap into innovations shaping the next decade by backing companies leading the AI revolution. Start with these 25 AI penny stocks.

- Strengthen your holdings with undervalued stocks boasting robust cash flows by filtering through these 861 undervalued stocks based on cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DMLP

Dorchester Minerals

Engages in the acquisition, ownership, and administration of royalty properties in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives