For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like APA (NASDAQ:APA), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for APA

How Fast Is APA Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. It is awe-striking that APA's EPS went from US$2.60 to US$11.82 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

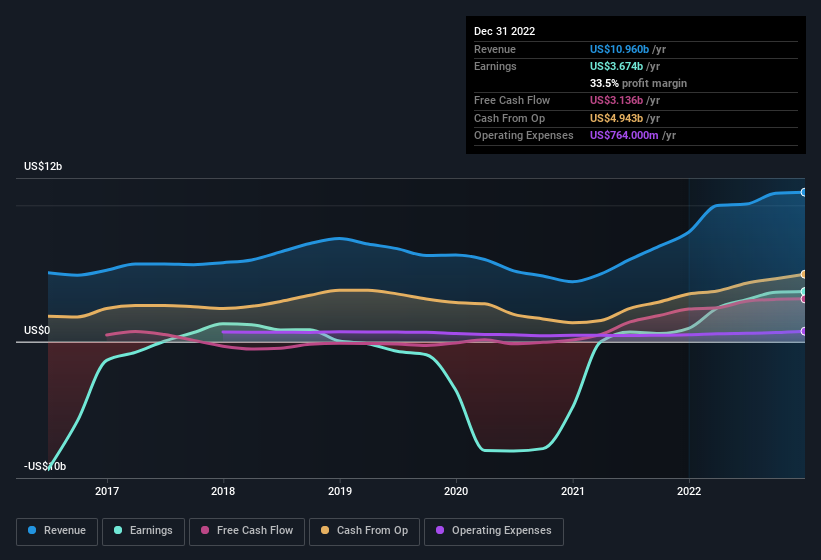

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of APA's revenue last year was revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. APA shareholders can take confidence from the fact that EBIT margins are up from 36% to 47%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for APA.

Are APA Insiders Aligned With All Shareholders?

Owing to the size of APA, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. Holding US$57m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This should keep them focused on creating long term value for shareholders.

Should You Add APA To Your Watchlist?

APA's earnings per share growth have been climbing higher at an appreciable rate. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. Based on the sum of its parts, we definitely think its worth watching APA very closely. Even so, be aware that APA is showing 3 warning signs in our investment analysis , and 1 of those can't be ignored...

Although APA certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:APA

APA

An independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids.

Undervalued established dividend payer.