- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Block (SQ) Valuation in Focus After Q3 Earnings Miss and Analyst Downgrades

Reviewed by Simply Wall St

Block (NYSE:SQ) stock took a hit after the company’s third-quarter earnings missed Wall Street expectations. This was mainly due to slower revenue growth and tighter profit margins in its key Square business. Higher expenses and risk loss charges further weighed on overall results.

See our latest analysis for Block.

After the earnings disappointment, Block’s share price has been stuck in reverse, dropping nearly 12% over the past month alone and extending its year-to-date slide to a total shareholder return of -24%. Even with recent buybacks and encouraging signals from Cash App, the market’s risk appetite for Block has faded, with momentum clearly trending downward lately.

If you’re looking for what else could surprise the market next, now is a great moment to expand your search and discover fast growing stocks with high insider ownership

With Block’s stock now trading well below its average analyst price target, the key question is whether this recent drop means shares are attractively priced, or if the market is simply bracing for more challenging quarters ahead.

Most Popular Narrative: 25.5% Undervalued

Block’s fair value, according to the most widely followed narrative, stands well above its last close. This has become a major talking point for investors weighing recovery potential against recent weakness.

Accelerated product launches, embedded banking, and cryptocurrency integration are driving user growth, deeper engagement, and expansion into higher-margin revenue streams. Innovation in business tools and aggressive international and upmarket expansion boost Block's relevance and market share. These factors support the outlook for long-term revenue and margin growth.

What is powering this valuation leap? It is a blueprint of relentless growth bets and a profit outlook shaped by bold revenue expansion assumptions. Want to know how innovation and margin swings could fuel even higher targets? Reveal the full narrative analysis shaping Block’s striking price target.

Result: Fair Value of $88.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition and reliance on cryptocurrency revenues could challenge Block’s growth trajectory, potentially resulting in more volatile quarters ahead.

Find out about the key risks to this Block narrative.

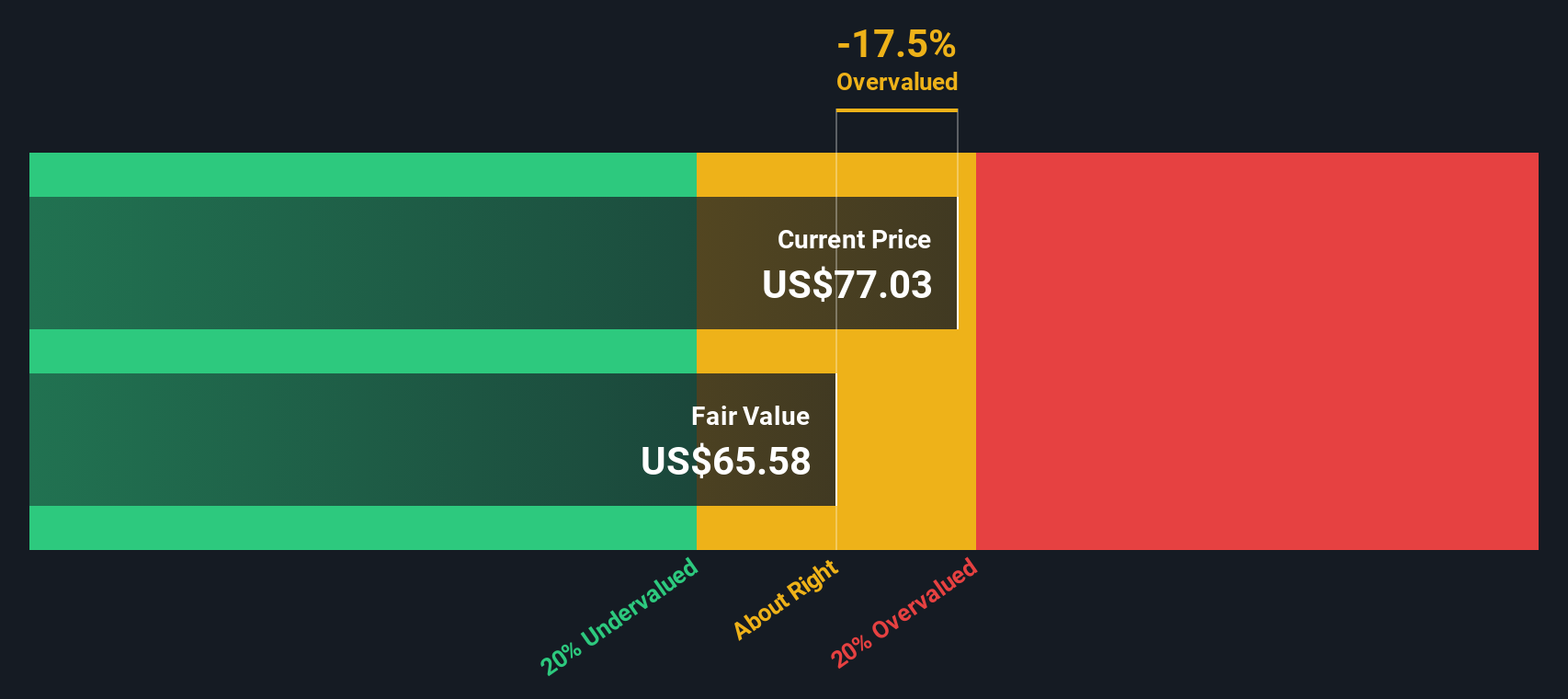

Another View: Discounted Cash Flow Tells a Different Story

While industry comparisons suggest Block is attractively valued, our DCF model offers a contrasting take. According to the SWS DCF model, Block’s share price of $65.91 is actually above its estimated fair value of $60.20. This indicates the stock may not be quite as discounted as it seems. Does this challenge the market’s optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Block for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 858 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Block Narrative

If you want to look past consensus or run the numbers your own way, it’s easy to develop your own data-driven view of Block in just a few minutes. Do it your way

A great starting point for your Block research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The market is always moving and the smartest investors never settle for one playbook. See what you could be missing by checking top opportunities on Simply Wall Street today.

- Accelerate your portfolio growth by targeting value opportunities with these 858 undervalued stocks based on cash flows. These have room to run, backed by strong fundamentals and market mispricing.

- Tap into stable income streams by reviewing these 15 dividend stocks with yields > 3% that offer reliable yields and help cushion your returns even when markets get shaky.

- Ride the AI innovation wave and access early exposure to emerging leaders with these 25 AI penny stocks which are reshaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives