- United States

- /

- Diversified Financial

- /

- NYSE:WU

How Western Union’s (WU) Launch of a USD Stablecoin on Solana Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On October 28, 2025, The Western Union Company announced its plan to launch a U.S. Dollar Payment Token (USDPT), built on the Solana blockchain and issued by Anchorage Digital Bank, aiming to create a compliant and efficient Digital Asset Network connecting digital and fiat currencies globally.

- This marks a significant move for Western Union into digital assets, seeking to leverage blockchain and stablecoins to modernize international money transfers and expand access for customers, agents, and partners.

- We'll explore how Western Union's adoption of a USD-backed stablecoin could reshape its investment outlook and competitive position.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Western Union Investment Narrative Recap

For shareholders in Western Union, the core thesis depends on the company’s ability to modernize its cross-border payments business, successfully transitioning from its traditional cash-based model toward digital and blockchain-powered remittances. The recent announcement regarding its U.S. Dollar Payment Token (USDPT) positions Western Union to address the immediate catalyst of digital transformation, but does not materially reduce the persistent risk of customer attrition to faster-moving fintechs or further softness in U.S. to Mexico transaction volumes.

Among recent developments, the October share buyback, completing nearly 6.3% of total shares outstanding, stands out as most relevant. This capital return supports Western Union’s commitment to shareholder value, yet it does not directly mitigate fundamental headwinds facing core retail channels or competitive digital threats that are front and center for the stock’s near-term outlook.

By contrast, investors should also be mindful of...

Read the full narrative on Western Union (it's free!)

Western Union's narrative projects $4.3 billion in revenue and $543.0 million in earnings by 2028. This requires 1.3% yearly revenue growth and a $353 million decrease in earnings from $896.1 million today.

Uncover how Western Union's forecasts yield a $9.32 fair value, in line with its current price.

Exploring Other Perspectives

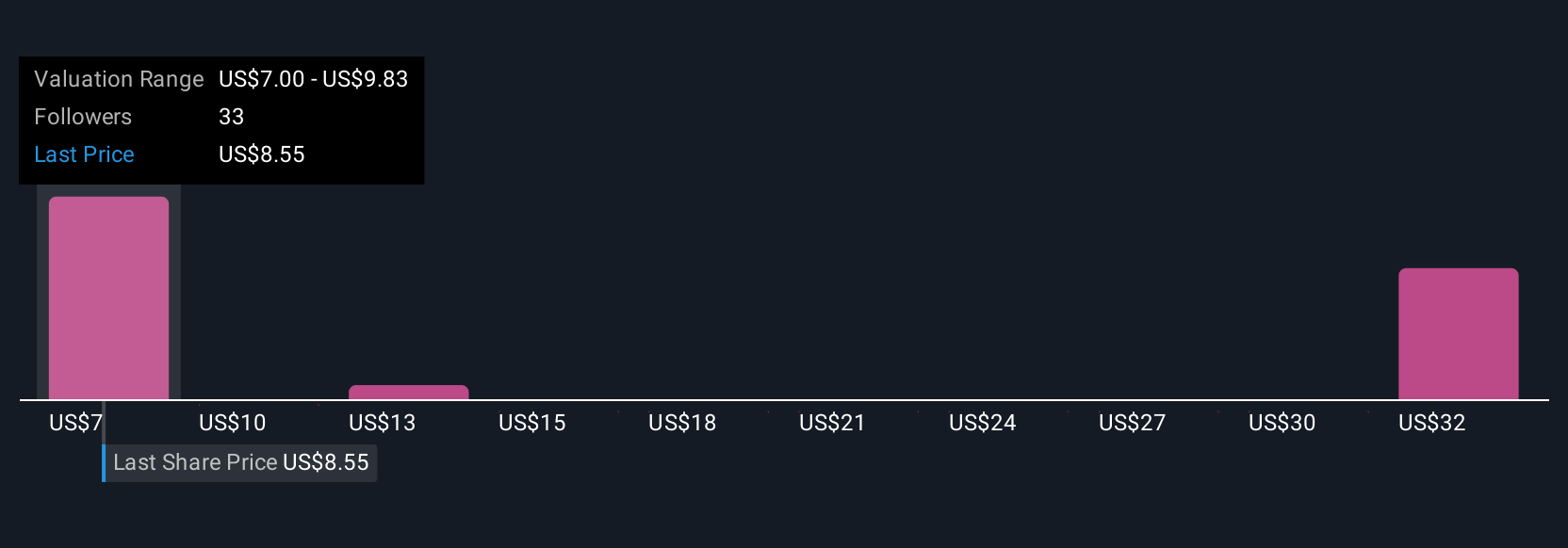

Ten community-sourced fair value estimates for Western Union range from US$7 to US$42.57 per share, underscoring strong differences across private investor models. While some anticipate deep upside, a key risk remains if digital initiatives do not offset share loss to new money transfer disruptors.

Explore 10 other fair value estimates on Western Union - why the stock might be worth over 4x more than the current price!

Build Your Own Western Union Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Union research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Western Union research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Union's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WU

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives