Is Visa’s Recent Digital Payments Momentum Already Priced In for 2025?

Reviewed by Bailey Pemberton

- Wondering if Visa is fairly valued or if there's a hidden opportunity flying under the radar? You're not alone; many investors are taking a closer look at the stock right now.

- Visa's stock has been on a steady climb this year, boasting a 6.9% return year-to-date and an 8.8% gain over the past twelve months, though it's dipped slightly by 2.2% in the past month.

- Recent market interest has been fueled by Visa's continued leadership in digital payments innovation and strategic partnerships, which have kept investors optimistic despite shifts in the broader economic environment. Updates around emerging payment technologies and global expansion have added context to recent price moves, drawing analyst attention.

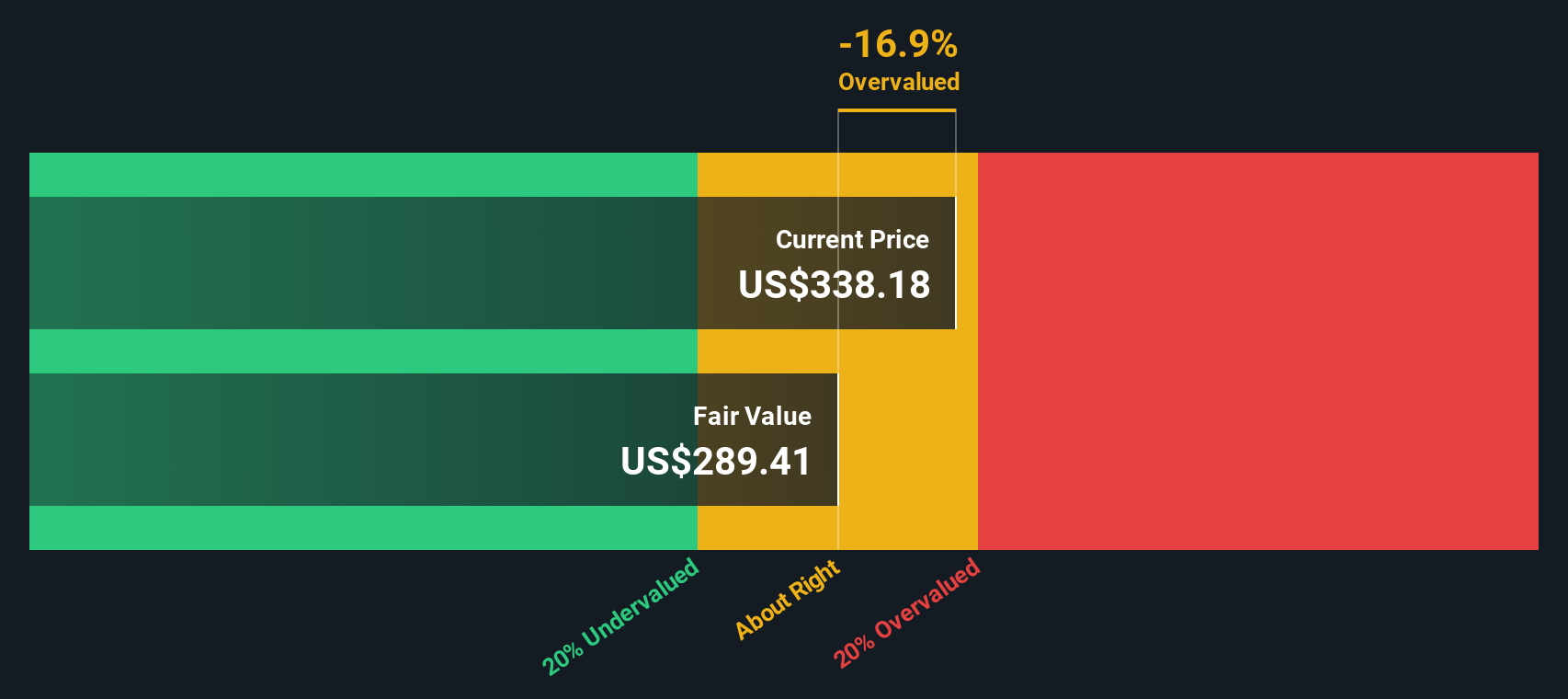

- On our simple valuation scorecard, Visa currently scores 1 out of 6 checks for being undervalued. Up next, we'll dive into how analysts traditionally value the company, and share a smarter way to think about fair value that could change your perspective.

Visa scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Visa Excess Returns Analysis

The Excess Returns valuation assesses how effectively Visa turns its shareholders’ equity into profits above the required cost of equity. In essence, this model focuses on the company’s ability to generate returns greater than what investors might demand for taking on its risk, rather than just looking at earnings or cash flows in isolation.

For Visa, analysts estimate a strong average return on equity of 71.94%, based on forward-looking inputs from 14 analysts. Book value per share sits at $19.38, with estimated stable book value at $22.67 per share. Profitability is also highlighted by a stable earnings-per-share estimate of $16.31, while the annual cost of equity comes in at $1.68 per share. This results in an impressive excess return per share of $14.63, underscoring Visa’s ability to add value for shareholders well above minimum requirements.

Applying the Excess Returns model, the intrinsic value for Visa’s stock is calculated at $374.27 per share. With a discount of 10.2% to recent prices, the model suggests Visa is undervalued compared to its estimated fair value.

Result: UNDERVALUED

Our Excess Returns analysis suggests Visa is undervalued by 10.2%. Track this in your watchlist or portfolio, or discover 875 more undervalued stocks based on cash flows.

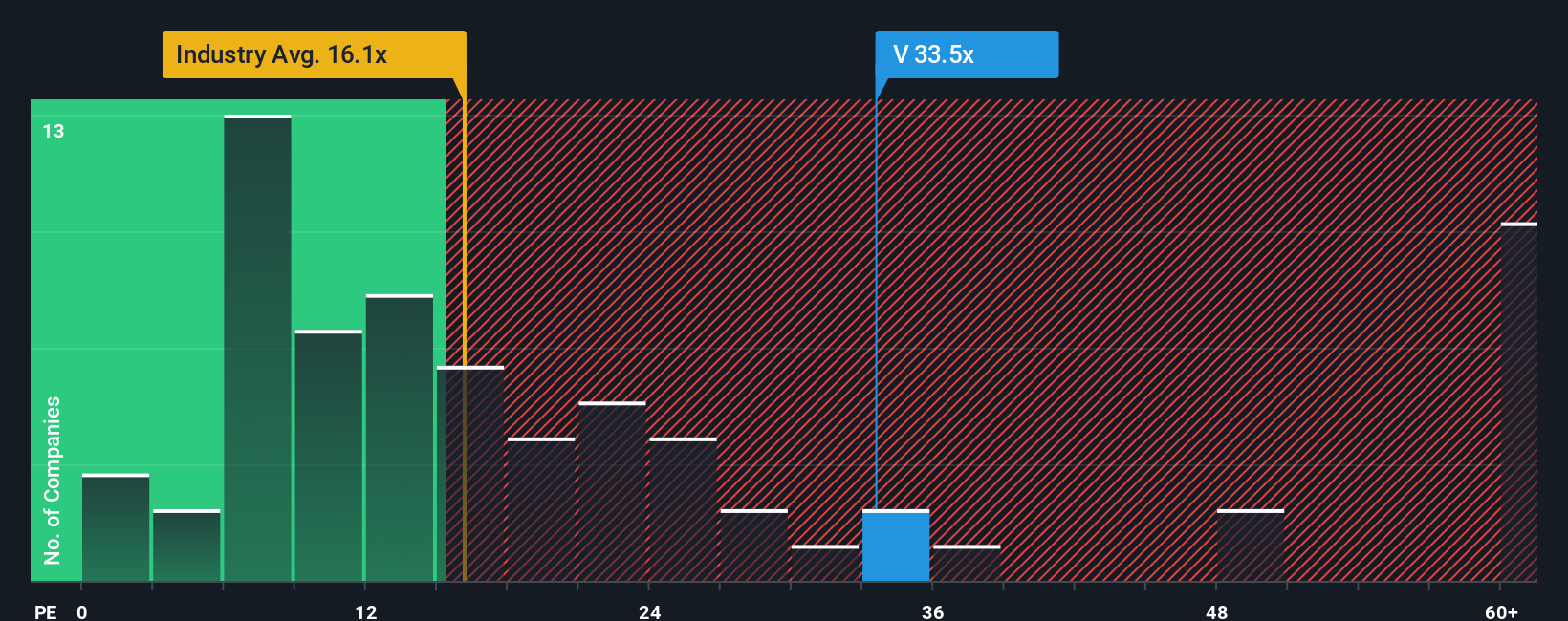

Approach 2: Visa Price vs Earnings

For profitable companies like Visa, the Price-to-Earnings (PE) ratio is a widely accepted metric for valuing stocks. It provides a quick view of how much investors are willing to pay for each dollar of the company’s earnings, making it useful for comparing profitability and market sentiment.

Growth expectations and risk both heavily shape what a "normal" or "fair" PE ratio should be. Companies with higher expected earnings growth or lower risk typically command higher PE multiples, while slower growers or riskier businesses generally trade at lower ratios.

Visa currently trades at a PE ratio of 32.40x. This is substantially higher than the Diversified Financial industry average of 13.14x and its peer average of 17.39x. While this premium might raise eyebrows, it reflects the market’s optimism about Visa’s future growth, scale, and profitability.

Simply Wall St’s “Fair Ratio” offers a more tailored benchmark. Derived from a deep analysis of the company’s earnings growth, profit margins, industry, market cap, and specific risks, Visa’s fair PE ratio is estimated at 20.84x. Unlike a simple peer or industry comparison, the Fair Ratio incorporates all these essential factors to provide a more accurate yardstick for valuation.

Comparing Visa’s actual PE multiple of 32.40x to the fair multiple of 20.84x suggests the stock is trading above what these combined fundamentals would justify. This points to signs of overvaluation.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Visa Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative puts your unique perspective on a company at center stage. It is the story you believe about Visa’s future, brought to life through your own assumptions about growth, margins, and what the business could be worth.

With Narratives, your view is not just a number. It connects your outlook for Visa’s business to a specific forecast, and then to a fair value, helping you see how your beliefs translate into a concrete investment idea. Narratives are simple to use and available to everyone on Simply Wall St’s Community page, where millions of investors create and share their stories about companies like Visa.

By comparing your Narrative’s fair value to the current share price, Narratives make it straightforward to decide whether to buy, hold, or sell. In addition, every Narrative updates automatically as new data, news, or financial results are released, so your analysis stays timely and relevant.

For Visa, some investors expect rapid growth from cross-border payments and set a fair value as high as $430, while others focus on competition and margin pressures, seeing fair value closer to $305. Your story determines your valuation.

Do you think there's more to the story for Visa? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives