- United States

- /

- Mortgage REITs

- /

- NYSE:TWO

A Look at Two Harbors Investment’s (TWO) Valuation Following Shelf Registration and Earnings Release

Reviewed by Simply Wall St

Two Harbors Investment (TWO) is back in the spotlight after filing a shelf registration for over $7 million in common stock, along with its latest quarterly earnings release. Both developments have investors weighing future scenarios.

See our latest analysis for Two Harbors Investment.

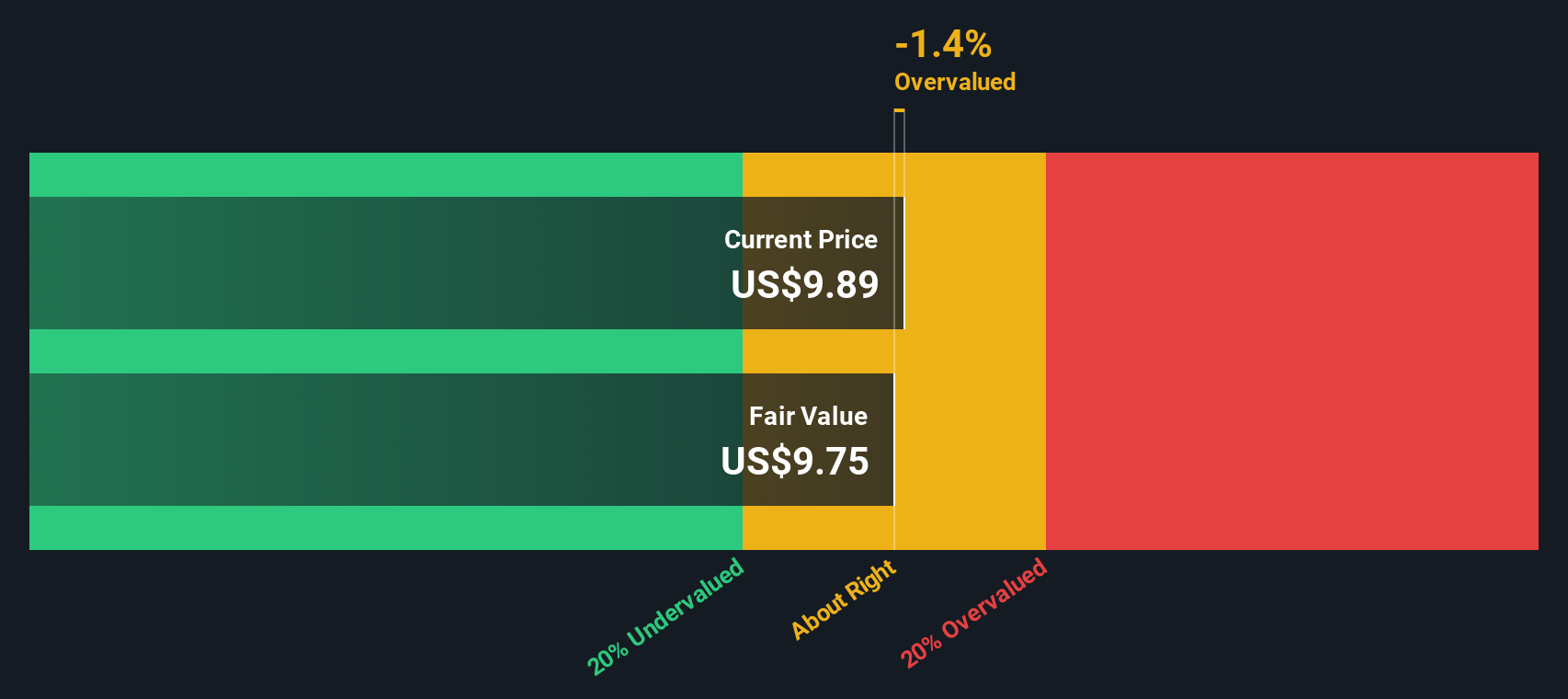

After announcing a new shelf registration for common stock and revealing extended net losses in its quarterly report, Two Harbors Investment’s share price remains under pressure. The 1-year total shareholder return of -5.88% shows momentum is still fading despite recent swings.

If moves like this have you wondering what other opportunities are out there, this is a great moment to broaden your search and uncover fast growing stocks with high insider ownership

With shares now trading below analyst price targets and a notable intrinsic discount, investors are left to consider where value lies. They must determine whether recent weakness offers a buying opportunity or if the market is already looking ahead.

Price-to-Sales Ratio of 1.9x: Is it justified?

Two Harbors Investment trades at a price-to-sales ratio of 1.9x, notably lower than both its industry peers and SWS' calculated fair multiple. With shares last closing at $9.68, the valuation appears more compelling relative to the sector.

The price-to-sales ratio measures how much investors are paying for each dollar of the company's revenue. This metric is especially relevant for asset-heavy and financially complex sectors such as mortgage REITs. A low ratio can indicate that the market has concerns about future revenue growth or business stability, while a higher ratio often reflects stronger growth or profitability expectations.

Compared to the US Mortgage REITs industry average of 5.0x and a peer group average of 4.6x, Two Harbors stands out as meaningfully cheaper when using this metric alone. However, our estimated fair price-to-sales ratio is 0.3x. This highlights the possibility that the market could adjust the share price downward toward this fair value if challenges persist.

Explore the SWS fair ratio for Two Harbors Investment

Result: Preferred multiple of 1.9x (OVERVALUED)

However, sustained negative revenue growth and ongoing net losses could outweigh any perceived value. This could quickly reverse the argument for a potential recovery.

Find out about the key risks to this Two Harbors Investment narrative.

Another View: What Does the SWS DCF Model Suggest?

While the price-to-sales ratio points to overvaluation, the SWS DCF model takes a different perspective. It estimates Two Harbors Investment's fair value at $15.24 per share, which is far above the latest close. This suggests the stock is trading at a significant discount. Is the market being too pessimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Two Harbors Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Two Harbors Investment Narrative

If you see things differently or want to dive into the numbers yourself, it only takes a few minutes to craft your own perspective. Do it your way

A great starting point for your Two Harbors Investment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one stock when fresh opportunities are right at your fingertips. Take action now and stay ahead of the curve by uncovering potential winners in high-potential sectors and themes.

- Target income with confidence and pursue these 16 dividend stocks with yields > 3% with yields greater than 3%, offering your investments a steady stream of returns in changing markets.

- Unlock the innovation boom by exploring these 25 AI penny stocks as they reshape entire industries through smart technology and offer rapid growth potential.

- Find the next undervalued leader early and take advantage of mispriced gems with these 876 undervalued stocks based on cash flows based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Two Harbors Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWO

Two Harbors Investment

Invests in, finances, and manages mortgage servicing rights (MSRs), agency residential mortgage-backed securities (RMBS), and other financial assets through RoundPoint in the United States.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives