- United States

- /

- Capital Markets

- /

- NYSE:SPGI

How Raised Earnings Guidance and Buybacks at S&P Global (SPGI) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- S&P Global Inc. recently reported strong third quarter 2025 results, highlighted by sales of US$3.89 billion and net income of US$1.18 billion, and raised its full-year GAAP diluted EPS guidance to between US$14.80 and US$15.05.

- This upward revision follows ongoing share repurchases, with over 22.57 million shares bought back since 2022, reflecting active capital return and bolstered confidence in its operating momentum.

- With the full-year earnings guidance lifted after a robust quarter, we'll explore how this improved outlook shapes S&P Global's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is S&P Global's Investment Narrative?

S&P Global’s story hinges on trust in its ability to deliver steady growth, robust profit margins and continued relevance as a data and analytics powerhouse for global markets. The latest quarter’s jump in earnings and the higher full-year outlook mark a positive shift, possibly strengthening short-term momentum and reaffirming confidence from both management and the board, as shown through ongoing share repurchases and consistent dividends. This improved earnings guidance materially reduces the risk that near-term earnings might fall short of consensus, turning attention instead toward longer-term questions: Can the recent AI product launches and partnerships keep S&P Global ahead of digital shifts affecting financial data providers? While the upbeat results help to support optimism, recent executive departures and a still-expensive valuation mean underlying execution and return on equity remain under scrutiny. The market appears encouraged, but key risks deserve a close look.

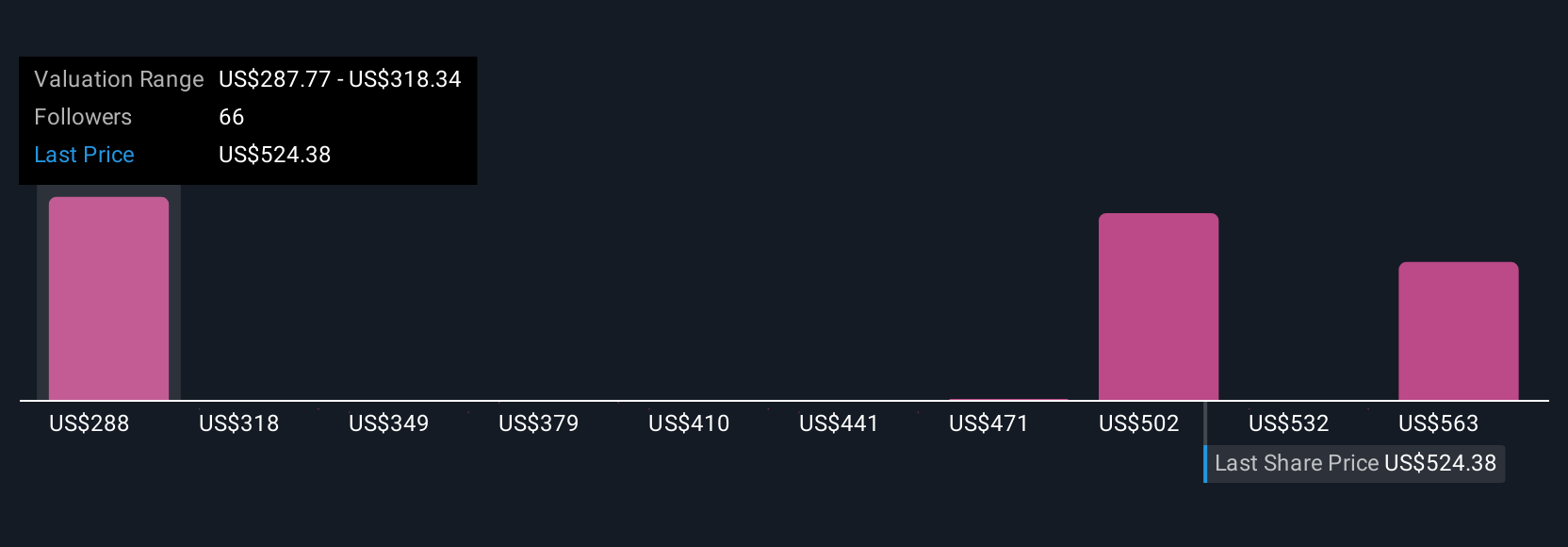

Yet, executive turnover and valuation concerns could still shape S&P Global’s outlook. S&P Global's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 24 other fair value estimates on S&P Global - why the stock might be worth 38% less than the current price!

Build Your Own S&P Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your S&P Global research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free S&P Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate S&P Global's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPGI

S&P Global

Provides credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives