- United States

- /

- Capital Markets

- /

- NYSE:SF

Stifel Financial (SF) Valuation in Focus Following Wave of Analyst Upgrades and Raised Outlooks

Reviewed by Kshitija Bhandaru

Stifel Financial (SF) just caught the attention of investors as a wave of upgrades from leading research firms, including TD Cowen and Citigroup. This reflects growing confidence in the company’s direction and future performance.

See our latest analysis for Stifel Financial.

This string of upgrades comes on the heels of Stifel Financial's recent efforts to strengthen its client services and leadership team. This underscores renewed market optimism despite some bumps along the road. While the 1-day share price return dipped to -3.85%, the stock’s 1-year total shareholder return of 11.74% and an impressive three-year total return near 118% suggest that longer-term momentum is still firmly on investors’ side.

If you’re looking to expand your opportunity set after this wave of upgrades, now’s the perfect time to discover fast growing stocks with high insider ownership.

With analysts projecting nearly 20% upside from current levels and market optimism growing, the key question becomes whether Stifel Financial is still trading at a discount or if the recent upgrades have fully priced in its future growth potential.

Most Popular Narrative: 14.6% Undervalued

With the latest fair value calculation sitting at $125.43 and shares last closing at $107.06, the most followed narrative views Stifel Financial as undervalued and primed for potential upside if key assumptions hold true.

The ongoing investment in technology and adviser productivity tools is positioned to strengthen Stifel’s Global Wealth Management segment. This could improve net margins by increasing efficiency and delivering tailored advice, enhancing future asset growth and stability.

Curious about the numbers fueling this story? The narrative’s fair value rests on bullish forecasts for both profit margins and expansion in earnings per share. Which bold business moves and financial leaps are behind this upside? Unpack the pivotal projections and see what could propel the price beyond today’s levels.

Result: Fair Value of $125.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing market volatility and unresolved legal issues could quickly dampen optimism and shift expectations for Stifel Financial’s near-term growth trajectory.

Find out about the key risks to this Stifel Financial narrative.

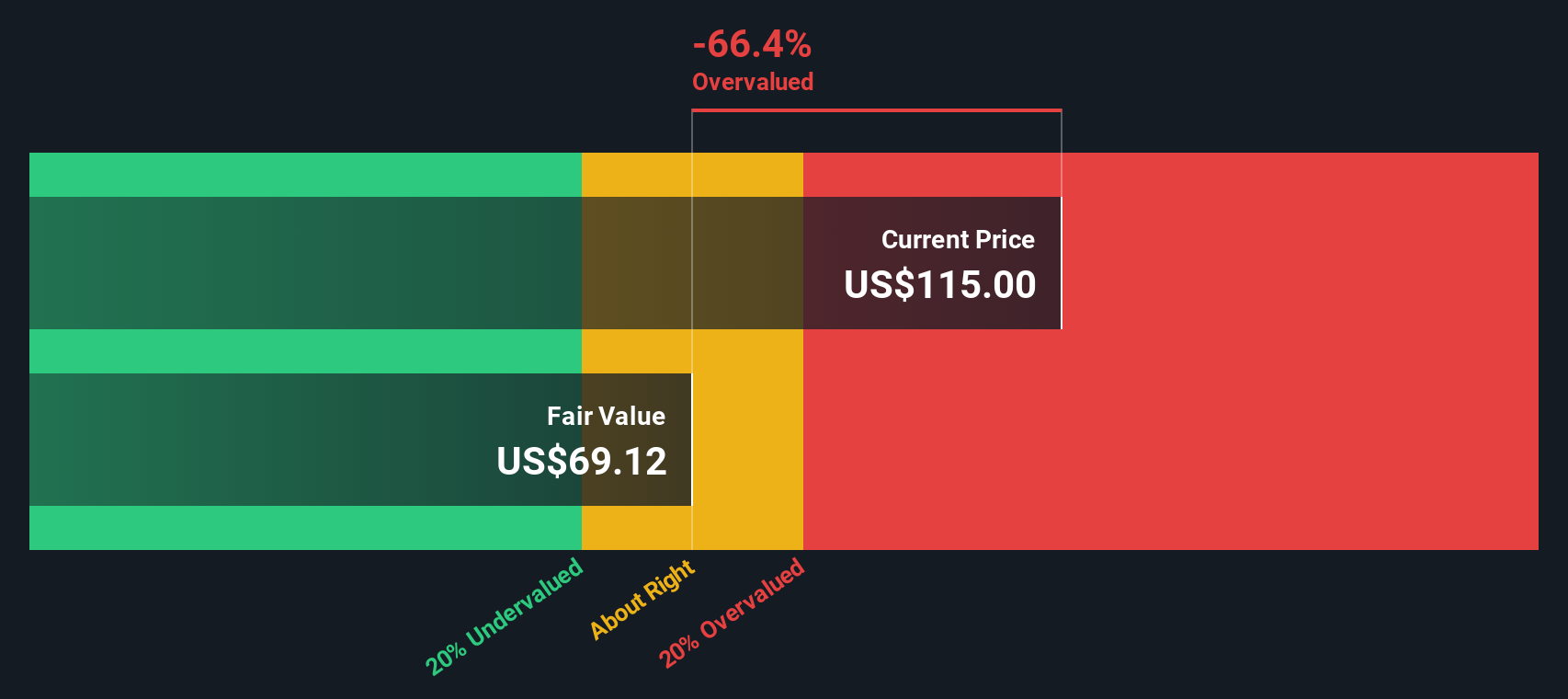

Another View: DCF Model Suggests the Opposite

Stepping back from analyst forecasts, our DCF model paints a more cautious picture. It estimates Stifel Financial’s fair value at $85.52 per share, making the current price look a bit expensive. This contrasts with the narrative of undervaluation and reminds us that different models often tell very different stories. Which one will play out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stifel Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stifel Financial Narrative

If these perspectives do not quite align with your own, you can explore the numbers and shape your personal view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Stifel Financial.

Looking for More Investment Ideas?

Smart investors do not limit their horizons. Open new doors with these powerful screens you can use right now for your next move:

- Unlock opportunity with these 892 undervalued stocks based on cash flows and uncover companies trading below their real worth, waiting for savvy investors to take notice.

- Capture high yields by checking out these 19 dividend stocks with yields > 3%, featuring stocks with robust dividend payouts that can boost your portfolio’s long-term growth.

- Tap into the future of life sciences using these 33 healthcare AI stocks; these innovative companies are revolutionizing healthcare with AI-driven breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SF

Stifel Financial

Operates as the bank holding company for Stifel, Nicolaus & Company, Incorporated that provides retail and institutional wealth management, and investment banking services to individual investors, corporations, municipalities, and institutions in the United States and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives