- United States

- /

- Capital Markets

- /

- NYSE:SF

Stifel Financial (SF): Evaluating Valuation After Strong Recent Gains

Reviewed by Simply Wall St

Stifel Financial (SF) shares have held steady after a strong month, with the company delivering steady year-to-date gains. Investors are looking to recent financial results and long-term trends as they evaluate what could come next for the stock.

See our latest analysis for Stifel Financial.

Momentum has clearly built for Stifel Financial, with the 1-month share price return of 13.8% adding to a year-to-date gain of nearly 15%. While recent moves reflect renewed optimism, the three-year total shareholder return of 100% highlights that the longer-term story is just as compelling.

If you're interested in what else is driving growth, now is a smart time to broaden your investing search and discover fast growing stocks with high insider ownership

The question now is whether Stifel Financial is trading at an attractive value based on its fundamentals, or if the recent surge reflects a market that has already priced in future growth. Could there be a buying opportunity?

Most Popular Narrative: 7.2% Undervalued

With Stifel Financial’s fair value estimate landing just above the last close, this narrative finds more upside ahead, even after recent gains. The subtle margin between price and value invites a deeper look at what drives these expectations.

The firm’s strong pipelines in financial advisory and institutional banking, particularly in sectors like technology, industrial services, and a growing appetite for bank M&A, suggest potential for increased investment banking revenue as market conditions stabilize. Stifel's strategic flexibility to prioritize share repurchases over loan growth reflects an opportunity to enhance earnings per share (EPS) and returns on investment, given current market conditions and undervalued stock prices.

If you want to know the key logic powering this bullish call, look no further than audacious earnings and margin expansions. The narrative hinges on financial projections and future multiples that are not usually seen in the sector. Uncover the core numbers driving this potential re-rating.

Result: Fair Value of $131.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal issues and uncertainty in global markets could weigh on Stifel Financial’s earnings and potentially slow the momentum behind this optimistic outlook.

Find out about the key risks to this Stifel Financial narrative.

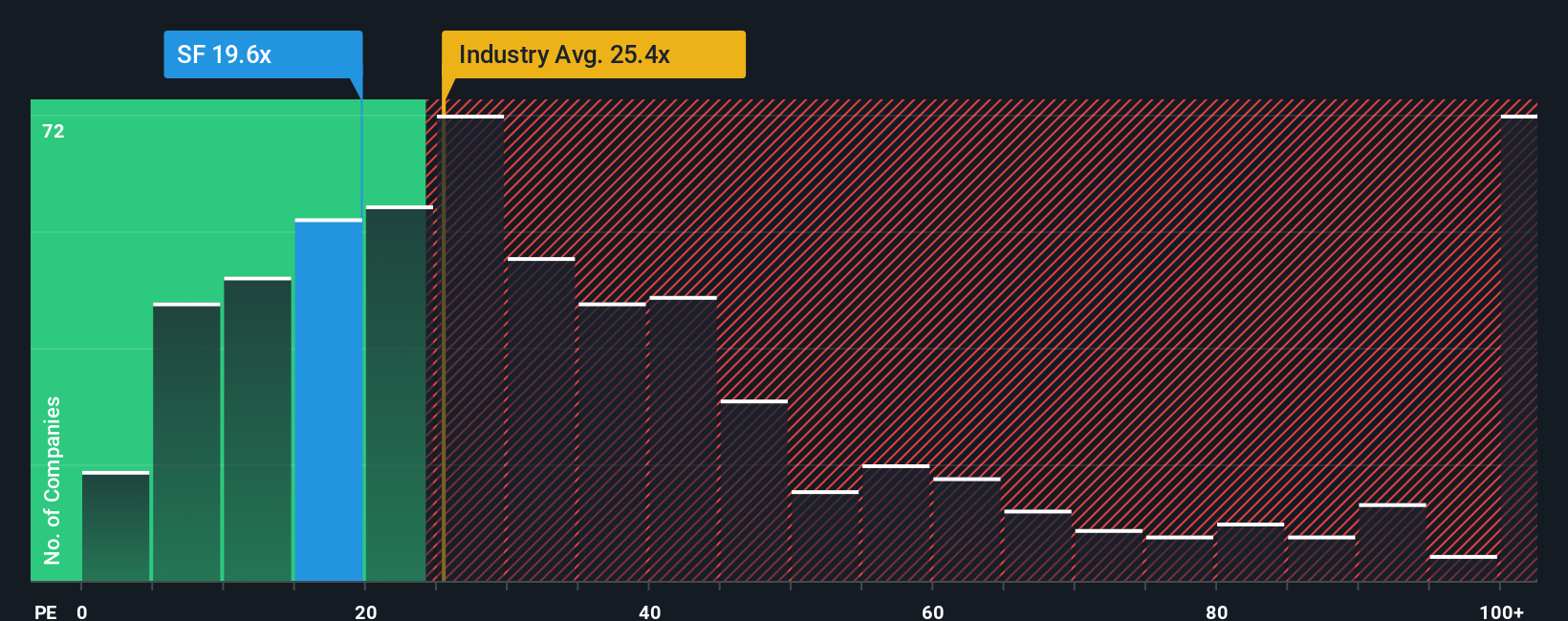

Another View: Price to Earnings Tells a Different Story

From another angle, Stifel Financial is trading at a price-to-earnings ratio of 19.8x, which is below both the peer average of 20.3x and the broader US Capital Markets industry average of 24.2x. However, it is notably above the fair ratio of 15.6x that the market could potentially revert to. This gap means there is valuation risk if sentiment changes, but also a premium if business momentum is sustained. Will investors keep rewarding Stifel with a higher multiple, or could a shift reset expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stifel Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stifel Financial Narrative

If you see the story differently or want a hands-on look at the data, you can dig in and develop your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Stifel Financial.

Looking for more investment ideas?

Smart investors keep opportunities on their radar and seize trends before they hit the mainstream. Don’t miss the chance to put your portfolio ahead of the crowd. Simply Wall Street’s Screener brings top picks right to your fingertips.

- Boost your potential returns by targeting income with these 16 dividend stocks with yields > 3%, which highlights companies offering robust yields above 3%.

- Supercharge your portfolio with futuristic innovation by checking out these 25 AI penny stocks, where artificial intelligence is shaping tomorrow’s winners.

- Spot undervalued bargains prepared for a rebound in these 865 undervalued stocks based on cash flows, featuring stocks with strong fundamentals and attractive price tags.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SF

Stifel Financial

Operates as the bank holding company for Stifel, Nicolaus & Company, Incorporated that provides retail and institutional wealth management, and investment banking services to individual investors, corporations, municipalities, and institutions in the United States and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives