- United States

- /

- Diversified Financial

- /

- NYSE:PFSI

Will PennyMac’s (PFSI) Strong Q3 Results and Upbeat Outlook Reshape Its Growth Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, PennyMac Financial Services reported third-quarter earnings that exceeded analyst expectations, with higher-than-forecasted earnings per share and revenues, and disclosed that Director Jones Doug sold 4,318 shares of common stock, totaling US$544,456, while exercising options to acquire the same number of shares.

- The company's strong earnings performance coincided with enhanced operating outlook guidance and upward revisions to analyst forecasts for both earnings and revenue growth.

- We'll explore how PennyMac's stronger-than-expected quarterly results and improved operating outlook affect its investment narrative and growth potential.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

PennyMac Financial Services Investment Narrative Recap

Being a PennyMac Financial Services shareholder means believing in the company's ability to manage through interest rate cycles and capitalize on technology investments in mortgage origination and servicing. The recent third-quarter earnings beat and improved guidance reinforce confidence in short-term profit catalysts, while volatility in mortgage servicing rights valuations remains a substantial ongoing risk. The insider activity by Director Jones Doug is not viewed as materially altering the near-term risk/reward dynamic for the stock.

One recent announcement that ties closely to PennyMac’s Q3 results is the release of upgraded operating return on equity guidance, which has led analysts to boost earnings forecasts for the next three years. This enhanced outlook, following stronger than expected profits, underscores the company’s focus on operational efficiency, which remains a key catalyst for shareholder returns during periods of uncertain mortgage market volumes.

However, while earnings and guidance have improved, investors should also be aware that volatility in mortgage servicing rights valuations can...

Read the full narrative on PennyMac Financial Services (it's free!)

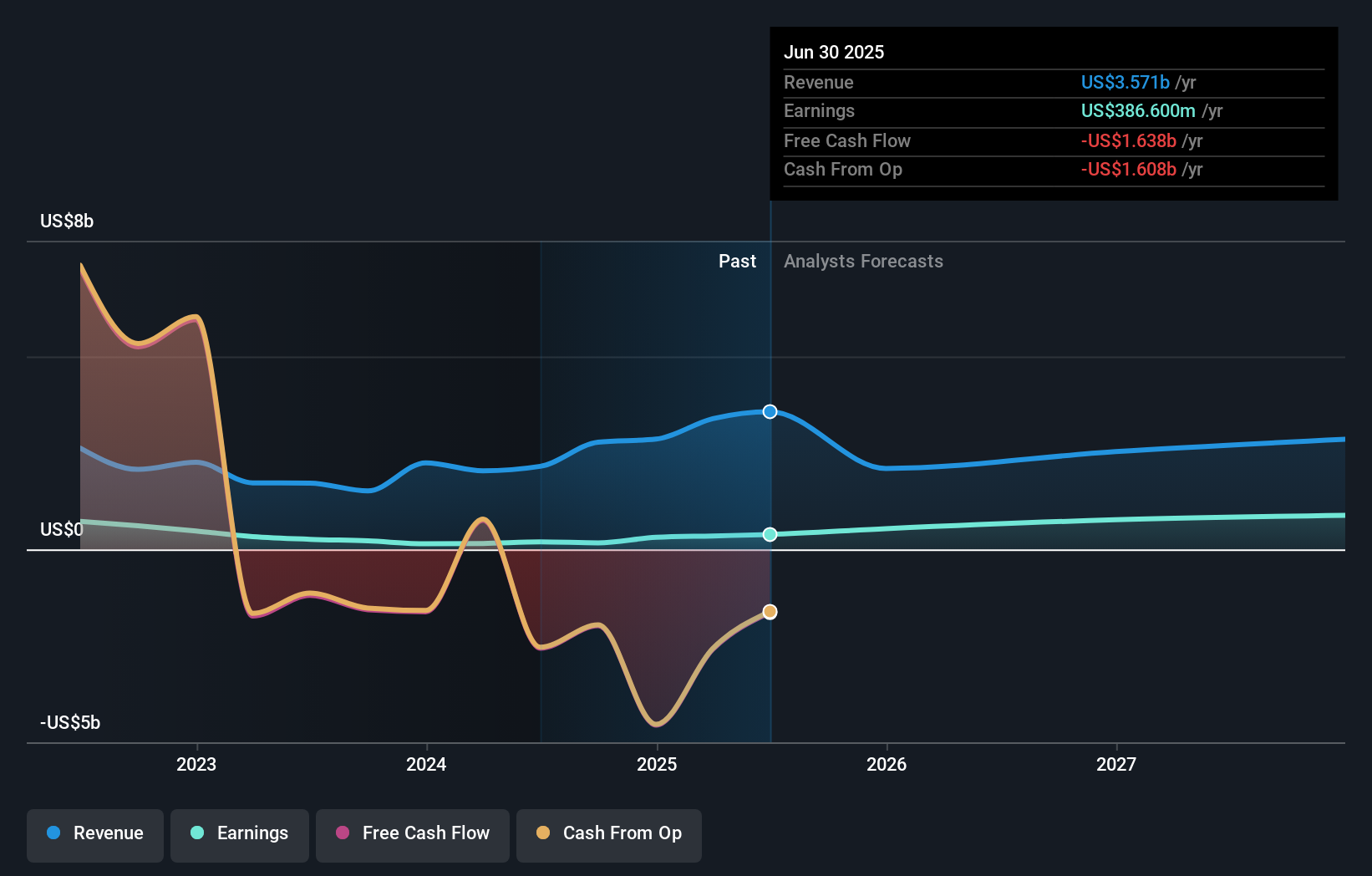

PennyMac Financial Services is projected to deliver $2.5 billion in revenue and $1.1 billion in earnings by 2028. This scenario is based on an annual revenue decline of 11.0% and an increase in earnings of about $713 million from the current earnings of $386.6 million.

Uncover how PennyMac Financial Services' forecasts yield a $138.57 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community members range from US$125.63 to US$138.57, reflecting a spread of expectations for PennyMac’s future. With MSR-related earnings volatility a persistent concern, you can explore several alternative viewpoints from market participants with varying confidence in the company’s margin sustainability.

Explore 2 other fair value estimates on PennyMac Financial Services - why the stock might be worth as much as 10% more than the current price!

Build Your Own PennyMac Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PennyMac Financial Services research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PennyMac Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PennyMac Financial Services' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFSI

PennyMac Financial Services

Through its subsidiaries, engages in the mortgage banking and investment management activities in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives