- United States

- /

- Diversified Financial

- /

- NYSE:PFSI

A Look at PennyMac Financial Services’s Valuation After Strong Earnings and Upbeat Analyst Forecasts

Reviewed by Simply Wall St

PennyMac Financial Services (PFSI) just delivered third-quarter results that landed above what Wall Street had expected, with earnings and revenue both coming in higher than forecasts. The company also provided improved return on equity guidance, which prompted some upward revisions to future estimates from analysts.

See our latest analysis for PennyMac Financial Services.

PennyMac’s strong quarterly showing seems to have energized investors, with the share price up over 26% in the past 90 days and 7.6% in the last month, on top of a stellar 127% total shareholder return over three years. Momentum is building, and the market is taking notice.

If you’re interested in what else could be gaining traction on Wall Street, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But after such a strong run and raised estimates, does PennyMac Financial Services still have room to surprise, or have expectations and recent gains already priced in all its future growth, leaving little room for upside?

Most Popular Narrative: 9.1% Undervalued

With PennyMac Financial Services' last close at $126 and the most popular analyst narrative fair value estimate at $138.57, sentiment leans bullish as the consensus suggests room for further upside. The following quote encapsulates one of the central reasons supporting this valuation focus.

PennyMac's AI-driven technology platform and continuous investment in process automation are expected to deliver significant cost reductions and expanded operating efficiencies, positioning the company to improve net margins and return on equity as loan volumes scale.

Curious what fuels belief in that higher price target? The narrative is driven by bold assumptions about soaring efficiency, major margin expansion, and a turning point for mortgage revenue. Get the full picture of these headline-grabbing projections; there is a lot more behind these numbers than meets the eye.

Result: Fair Value of $138.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high interest rates or greater competition in mortgage technology could quickly challenge these bullish assumptions and put pressure on PennyMac's future results.

Find out about the key risks to this PennyMac Financial Services narrative.

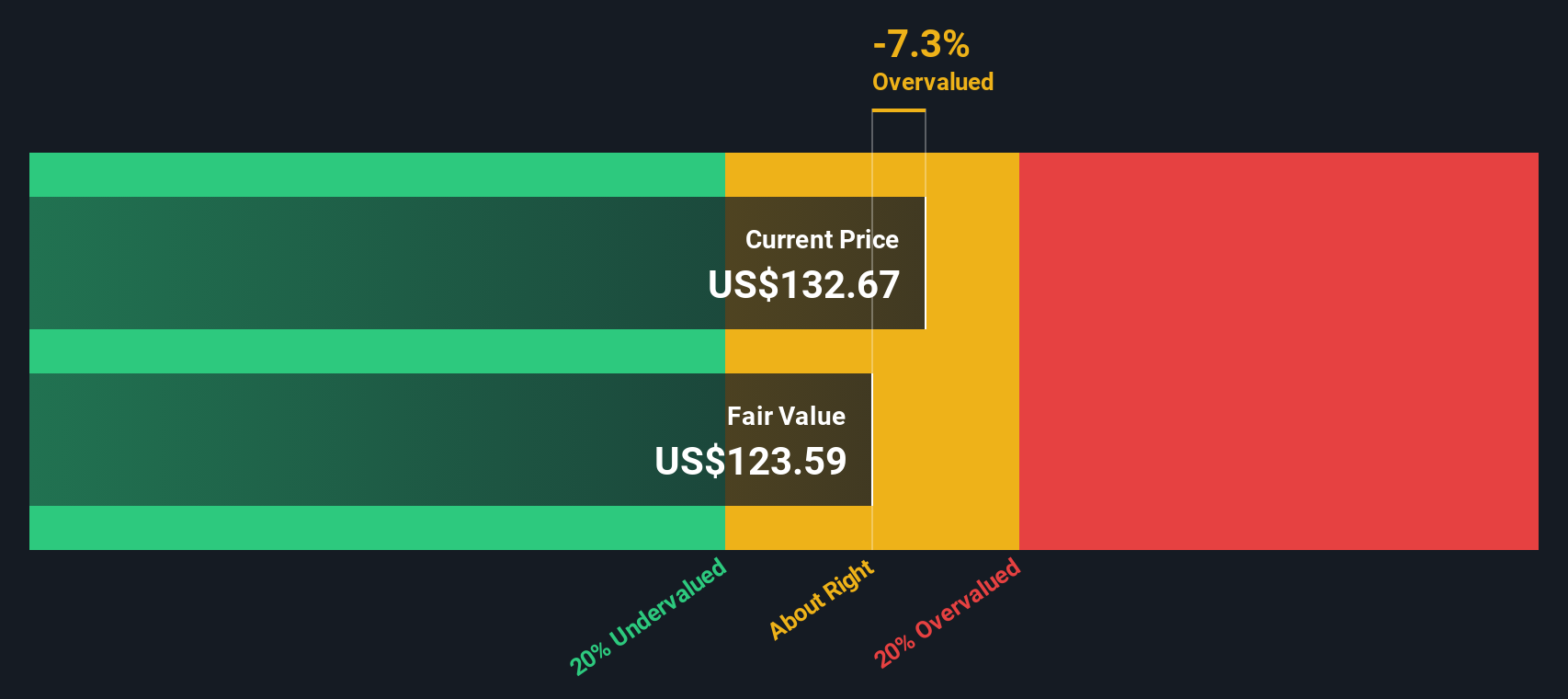

Another View: Checking the SWS DCF Model

While analyst consensus sees PennyMac Financial Services as undervalued, our DCF model comes to a different conclusion. Based on SWS DCF estimates, the current share price of $126 sits just above a fair value of $125.52. This may indicate that shares are already trading near their true worth. Could this mean limited upside, or do the analysts know something the market doesn't?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PennyMac Financial Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PennyMac Financial Services Narrative

If you see the story differently or just want to dig into the numbers yourself, why not craft your own view in a few minutes with Do it your way?

A great starting point for your PennyMac Financial Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let potential winners slip through your fingers. Take charge and target market opportunities that fit your goals using these powerful tools from Simply Wall Street:

- Start your hunt for sharp value by reviewing these 874 undervalued stocks based on cash flows. This tool helps you pinpoint stocks where current prices may not reflect their true growth potential.

- Cash in on big yield trends by checking out these 16 dividend stocks with yields > 3%, where you can uncover companies providing income streams above 3% to strengthen your returns.

- Seize the future of healthcare with these 32 healthcare AI stocks. Explore companies driving breakthroughs in medicine and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFSI

PennyMac Financial Services

Through its subsidiaries, engages in the mortgage banking and investment management activities in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives