- United States

- /

- Diversified Financial

- /

- NYSE:MTG

A Fresh Look at MGIC Investment’s (MTG) Valuation After Quarterly Earnings and Share Buybacks

Reviewed by Simply Wall St

MGIC Investment (MTG) just reported third quarter results, highlighting a bump in earnings per share even as revenue and net income slipped slightly. Investors are also watching the company’s recently completed share buybacks, which signal ongoing capital return.

See our latest analysis for MGIC Investment.

MGIC Investment’s steady earnings growth and active share buybacks appear to be fueling its momentum. The stock has delivered an impressive 18.4% year-to-date share price return and a 17.1% total shareholder return over the past year. Over the longer term, MGIC has rewarded shareholders with consistent gains, including a near 180% five-year total return that stands out among financials.

If recent buybacks have you thinking bigger, now’s a great moment to expand your search and discover fast growing stocks with high insider ownership

With MGIC shares continuing to outperform, investors are left to ask whether the stock’s solid track record and recent buybacks point to an undervalued opportunity or if markets have already priced in its future growth.

Most Popular Narrative: Fairly Valued

At $28.03, MGIC Investment’s share price sits just above the most widely followed fair value estimate of $27.67. This draws attention to the slim divide between current sentiment and future expectations.

MGIC's continued strong portfolio credit performance, prudent risk management, and lower-than-expected claim frequencies suggest lasting improvements in net margins and lower loss ratios. These factors contribute to higher future earnings stability.

Want to know what numbers could tip the scales? Hint: this fair value relies on future profits compressing, resilient revenue growth, and a surprisingly low valuation multiple. The narrative brings together detailed financial forecasts, so discover what is fueling this precise estimate and how much the story depends on one major assumption.

Result: Fair Value of $27.67 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently soft insurance growth or an unexpected rise in delinquencies could quickly challenge MGIC’s current valuation and positive outlook.

Find out about the key risks to this MGIC Investment narrative.

Another View: DCF Points to Deep Discount

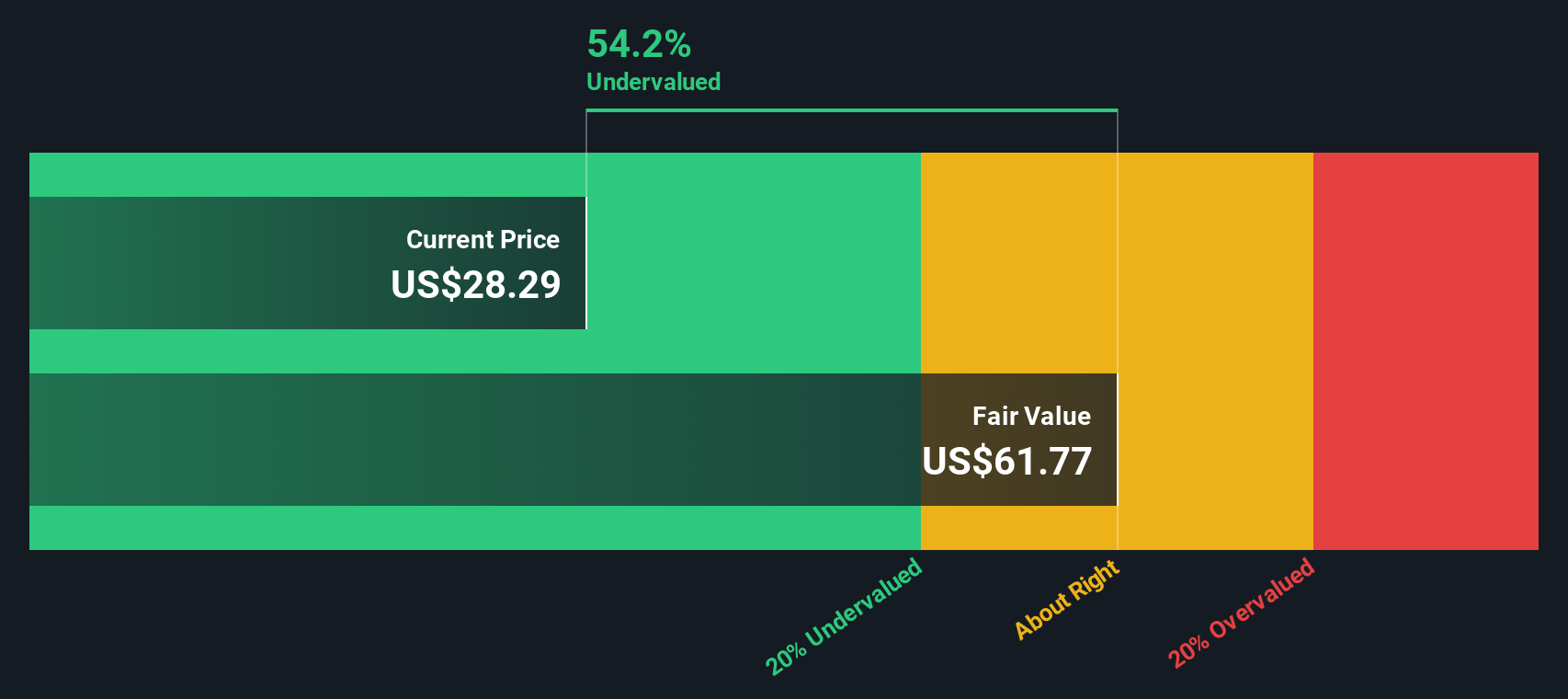

Looking beyond the fair value estimates based on earnings and multiples, our SWS DCF model indicates MGIC shares are trading at a substantial discount. With a DCF-calculated fair value of $61.77 per share, the current price is more than 50% below what the company’s future cash flows might justify. Does this suggest a significant upside opportunity is being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MGIC Investment Narrative

Whether you see the story differently or want to dig into the numbers yourself, you can build your own MGIC Investment narrative in just a few minutes, your way. Do it your way

A great starting point for your MGIC Investment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let today’s opportunity pass you by. These other winning strategies are ready to open new possibilities for your portfolio right now.

- Capture high yields and bolster your passive income with these 16 dividend stocks with yields > 3% that constantly outperform benchmarks.

- Tap into the future of medicine by searching these 32 healthcare AI stocks, where transformative AI is reshaping the healthcare landscape.

- Uncover hidden value and beat the market averages with these 875 undervalued stocks based on cash flows recognized for compelling growth potential based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTG

MGIC Investment

Through its subsidiaries, provides private mortgage insurance, other mortgage credit risk management solutions, and ancillary services in the United States, the District of Columbia, Puerto Rico, and Guam.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives