- United States

- /

- Capital Markets

- /

- NYSE:MSCI

How Will MSCI's (MSCI) Latest Debt Raise Shape Its Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- In the past week, MSCI Inc. completed a US$500 million senior unsecured notes offering, announcing that proceeds may be used for corporate purposes including share repurchases, investments, and acquisitions. This move follows a period of active capital management, with MSCI recently completing the repurchase of over 3.3 million shares under its ongoing buyback program.

- The decision to raise debt capital while signaling intent for potential acquisitions and further buybacks highlights MSCI’s multi-pronged approach to balance sheet optimization and growth initiatives.

- To understand the implications of this fresh capital raise, we'll explore how potential acquisitions could impact MSCI's long-term growth outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

MSCI Investment Narrative Recap

To be a shareholder in MSCI, you need to believe in the company's ability to sustain demand for its global indices, analytics, and data solutions as institutional capital shifts toward passive and specialized strategies. The recently completed US$500 million debt raise does not materially alter the near-term outlook, as the biggest catalyst remains relentless ETF inflows, while the major risk continues to be the muted growth among active asset manager clients facing budget constraints.

Of the latest company announcements, MSCI's completion of over US$1.88 billion in share repurchases under its expanded buyback program stands out, reinforcing the focus on returning capital to shareholders. This ongoing capital return policy is especially relevant alongside fresh debt funding, as it may affect how investors weigh both near- and long-term growth versus potential margin pressures from cyclical client headwinds.

However, against continued buybacks and new investments, investors should be aware that lingering weakness in retention rates among analytics and sustainability clients...

Read the full narrative on MSCI (it's free!)

MSCI's outlook anticipates $3.8 billion in revenue and $1.6 billion in earnings by 2028. This scenario depends on an annual revenue growth rate of 8.5% and a $0.4 billion increase in earnings from $1.2 billion today.

Uncover how MSCI's forecasts yield a $655.06 fair value, a 12% upside to its current price.

Exploring Other Perspectives

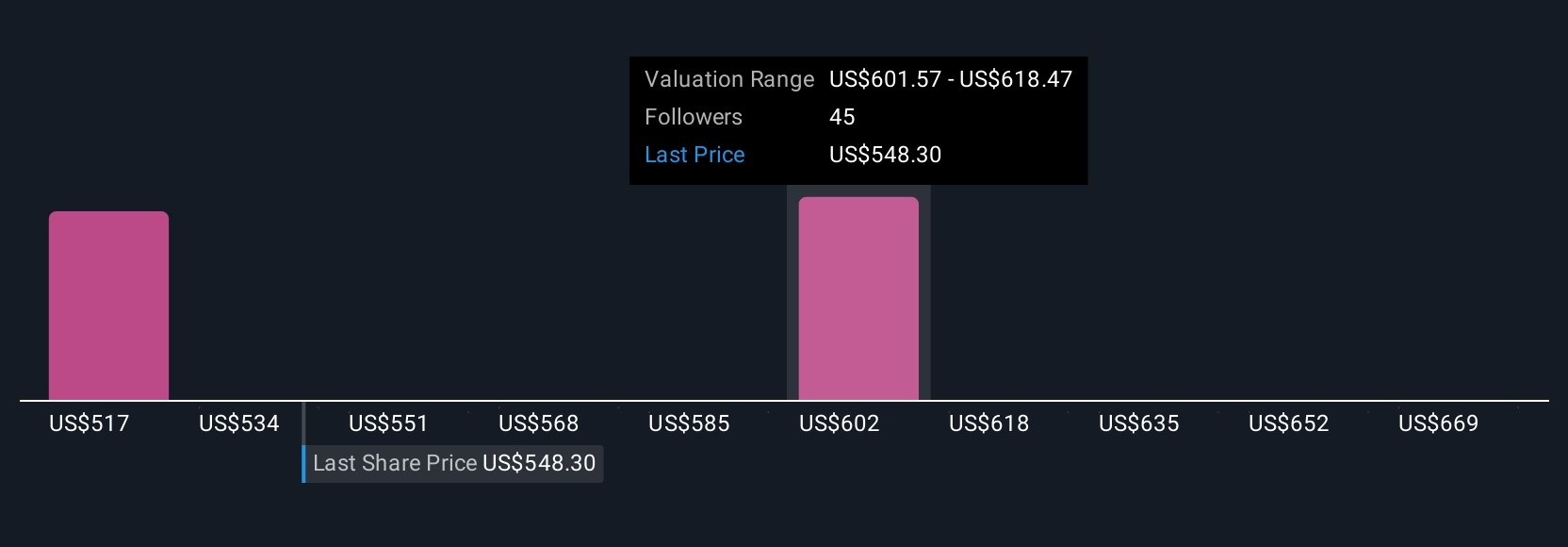

Seven estimates from the Simply Wall St Community place MSCI’s fair value between US$519 and US$686 per share. Even as many see upside, the possibility of slower recurring revenue growth from pressured client budgets is something you will want to explore further.

Explore 7 other fair value estimates on MSCI - why the stock might be worth as much as 18% more than the current price!

Build Your Own MSCI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSCI research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MSCI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSCI's overall financial health at a glance.

No Opportunity In MSCI?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives