- United States

- /

- Capital Markets

- /

- NYSE:MSCI

A Fresh Look at MSCI’s Valuation Following Strong Results and New Share Buyback Program

Reviewed by Simply Wall St

MSCI (MSCI) just unveiled a new share repurchase program and posted strong third-quarter numbers. The company reported meaningful revenue and net income growth compared to last year. These moves have turned some heads among investors this week.

See our latest analysis for MSCI.

After a year marked by steady execution and headline-worthy repurchases, MSCI's 6.6% share price return over the past 90 days suggests renewed momentum may be building, even though its one-year total shareholder return is down slightly at -0.7%. Recent moves, such as a new buyback program and a completed bond offering, signal management’s upbeat stance and a possible shift in how the market values MSCI’s growth prospects.

If these developments have you searching for other compelling opportunities, this could be an ideal moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares rallying and another round of buybacks in play, the question now is whether MSCI is trading below its underlying value or if recent gains mean the market has already factored in its future growth potential.

Most Popular Narrative: 11% Undervalued

With the narrative fair value at $655.06 and MSCI’s last close at $582.85, the narrative points to notable upside driven by aggressive margin and earnings growth assumptions.

Innovation and cross-selling of proprietary data and tools are strengthening pricing power, revenue diversification, and long-term margin expansion.

Want to know what’s fueling this optimism? The narrative hinges on projections of widening profit margins and rising recurring revenue, along with a bold belief in sustained top-line growth. Dive deeper to uncover the underlying growth bets, profit forecasts and the exact financial mechanics that could justify such a premium fair value.

Result: Fair Value of $655.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing growth in Sustainability products and increased competition could pose challenges to MSCI’s earnings momentum and premium valuation in the future.

Find out about the key risks to this MSCI narrative.

Another View: What Do Earnings Multiples Say?

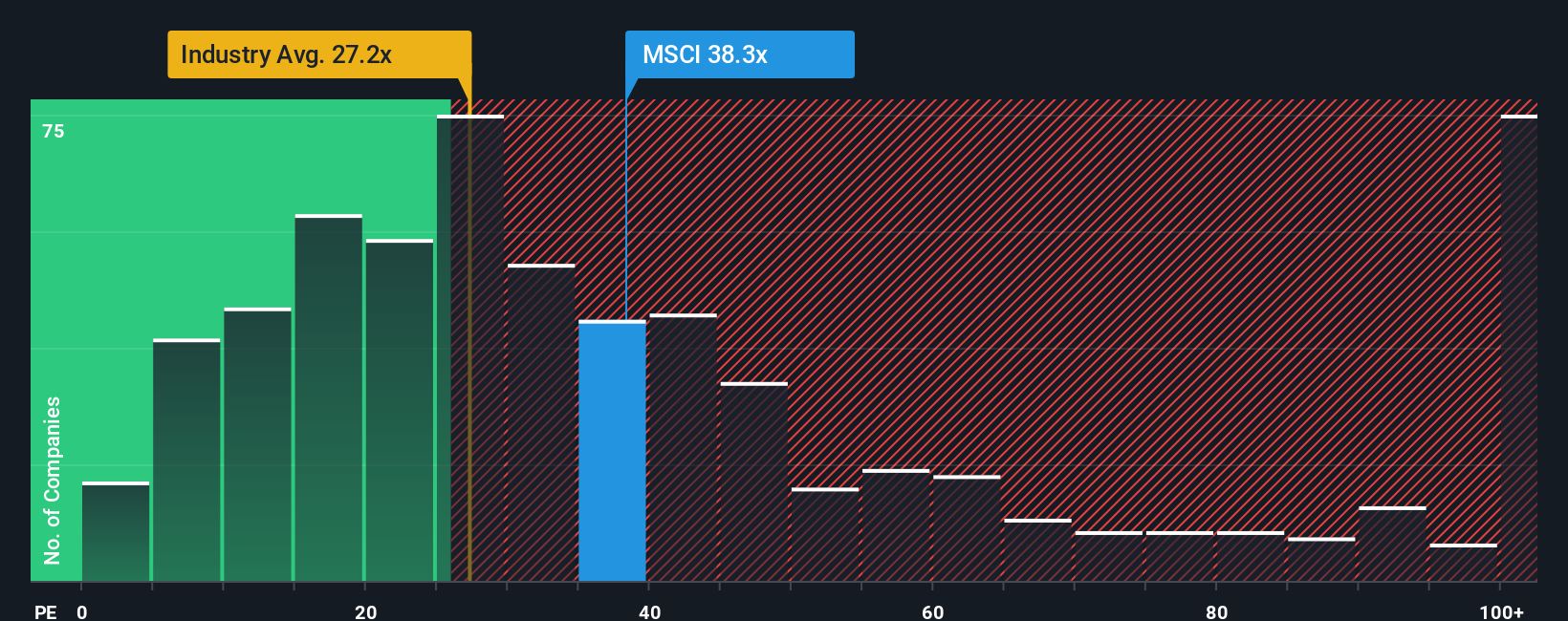

Looking from a different angle, MSCI’s price-to-earnings ratio sits at 35.8x, noticeably above both its industry average of 24.4x and the peer average of 31x. This premium could signal heightened expectations or suggest valuation risk if growth fails to meet forecasts, especially with a fair ratio closer to 16.6x. Is the market leaning too far into future optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSCI Narrative

If you have a different take or want to draw your own insights from the numbers, you can build a personalized MSCI story in under three minutes, so why not Do it your way

A great starting point for your MSCI research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move by tapping into unique investment angles outside the obvious, handpicked to help you get ahead of the crowd and boost your confidence.

- Uncover growth opportunities by searching for these 870 undervalued stocks based on cash flows that may be flying under Wall Street’s radar. These can offer strong fundamentals and attractive entry points.

- Catch the AI-driven momentum early as you check out these 24 AI penny stocks that are powering innovations in machine learning, automation, and intelligent solutions.

- Benefit from reliable income potential by exploring these 16 dividend stocks with yields > 3% paying above-average yields and rewarding shareholders year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives