- United States

- /

- Capital Markets

- /

- NYSE:MIAX

Does Miami International Holdings Rally Make Sense After 37% Year to Date Gain in 2025?

Reviewed by Bailey Pemberton

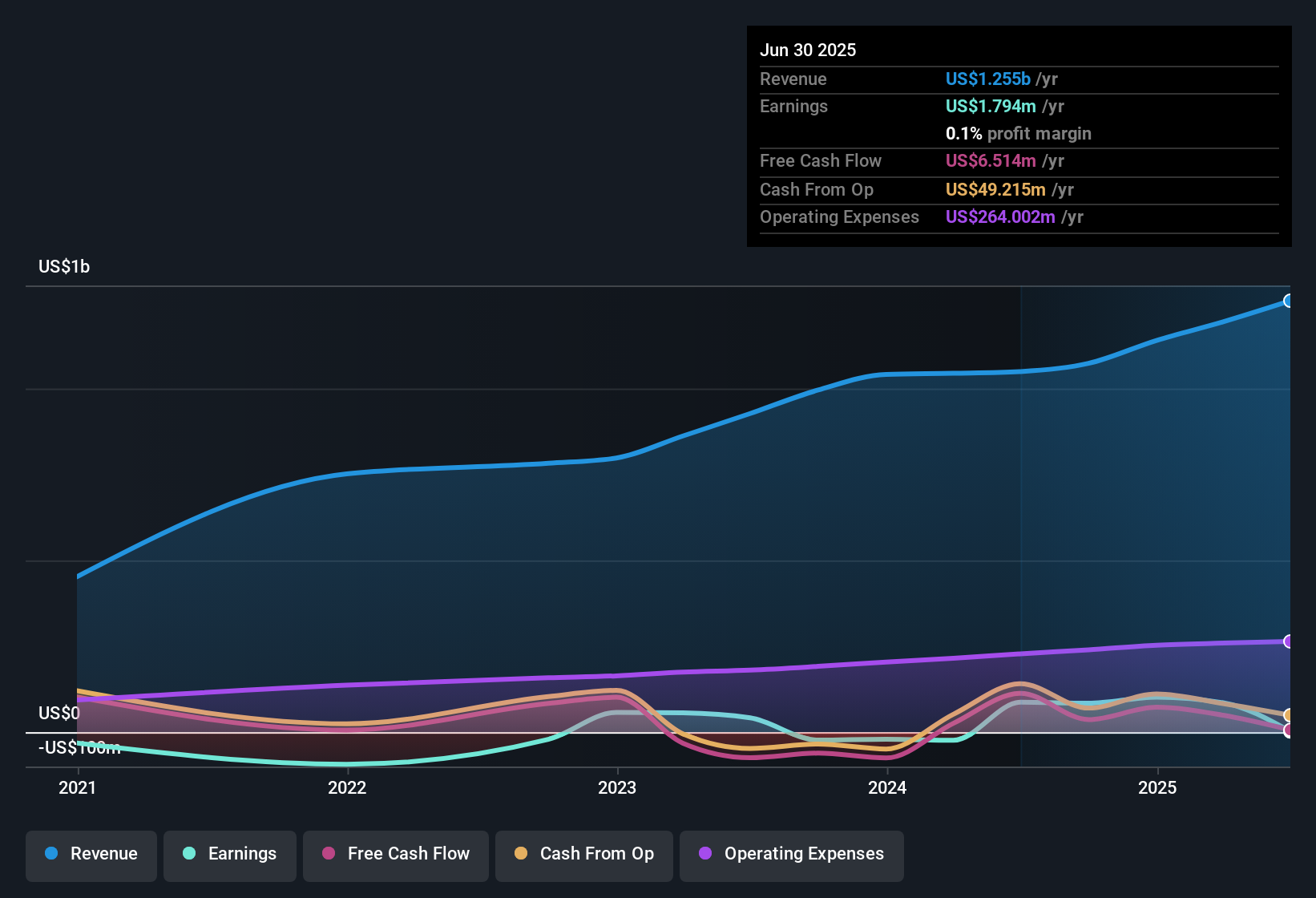

Trying to decide what to do with Miami International Holdings stock? You are not alone. With shares closing recently at $42.09, some investors are feeling bullish, while others are wondering if the momentum can last. Over the past seven days, the stock gained 2.1%, but the 30-day surge of 20.4% is what really has people talking. On a year-to-date basis, Miami International Holdings is up an impressive 36.9%. These kinds of moves often catch the eye of those looking for growth stories or seeking stocks where the perceived risk is shifting, sometimes driven by broader market trends or sector optimism. It is worth noting that while the stock has posted short-term gains, our valuation model gives it a score of 2 out of 6, suggesting it is undervalued by only a couple of standard checks, not across the board.

Before you make your next move, let us dive into the key ways analysts judge whether a company is truly undervalued, and hint at a smarter, more holistic way to look at value by the end of the article.

Miami International Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

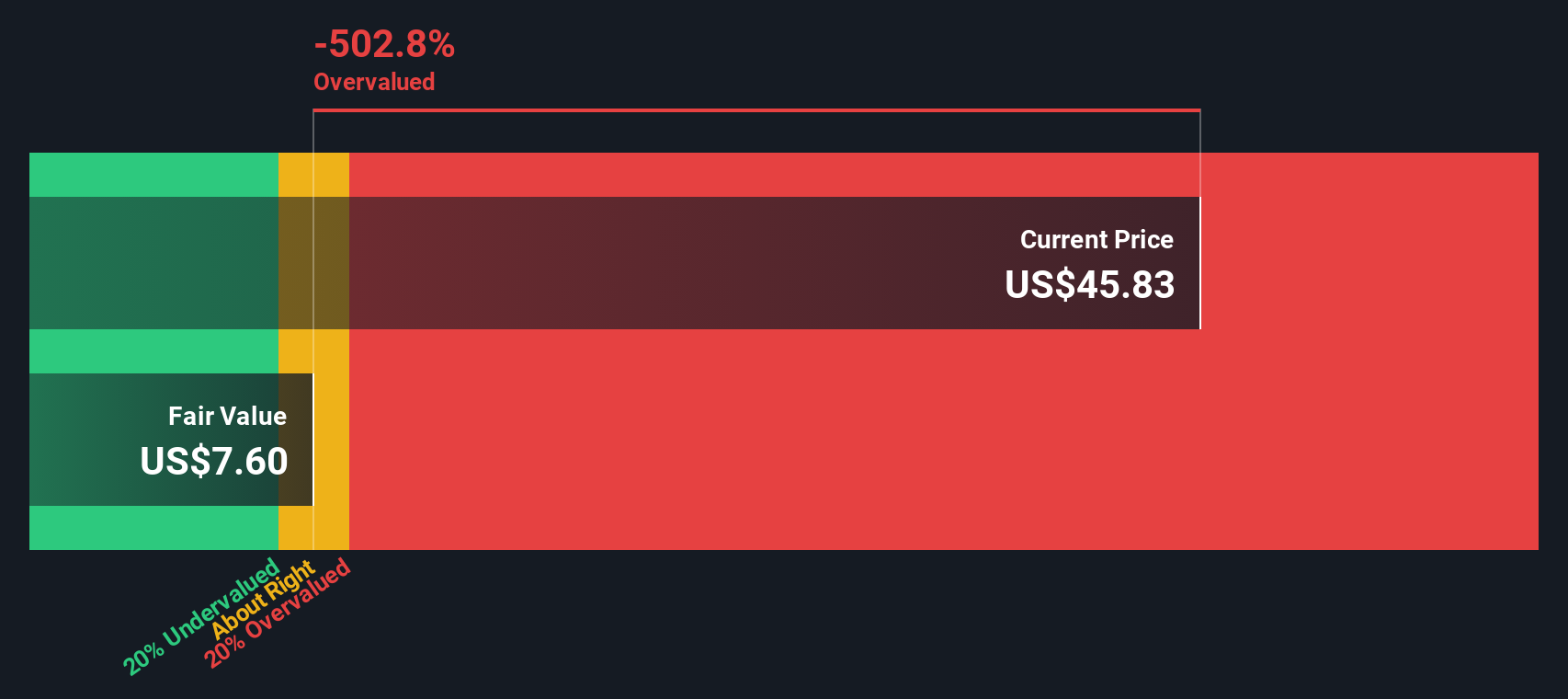

Approach 1: Miami International Holdings Excess Returns Analysis

The Excess Returns model evaluates a company's intrinsic value by focusing on how effectively it generates returns above its cost of equity. This approach emphasizes the efficiency of reinvesting profits and sustaining strong Return on Equity (ROE) over time.

For Miami International Holdings, the key figures stand out:

- Book Value: $6.57 per share

- Stable EPS: $0.42 per share

(Source: Median Return on Equity from the past 5 years.) - Cost of Equity: $0.12 per share

- Excess Return: $0.31 per share

- Average Return on Equity: 29.62%

- Stable Book Value: $1.43 per share

(Source: Median Book Value from the past 5 years.)

Using these metrics, the Excess Returns model suggests that Miami International Holdings currently appears dramatically overvalued. The model’s intrinsic value estimate for the stock is much lower than its recent share price of $42.09, which results in an implied overvaluation of 467.6%.

Result: OVERVALUED

Our Excess Returns analysis suggests Miami International Holdings may be overvalued by 467.6%. Find undervalued stocks or create your own screener to find better value opportunities.

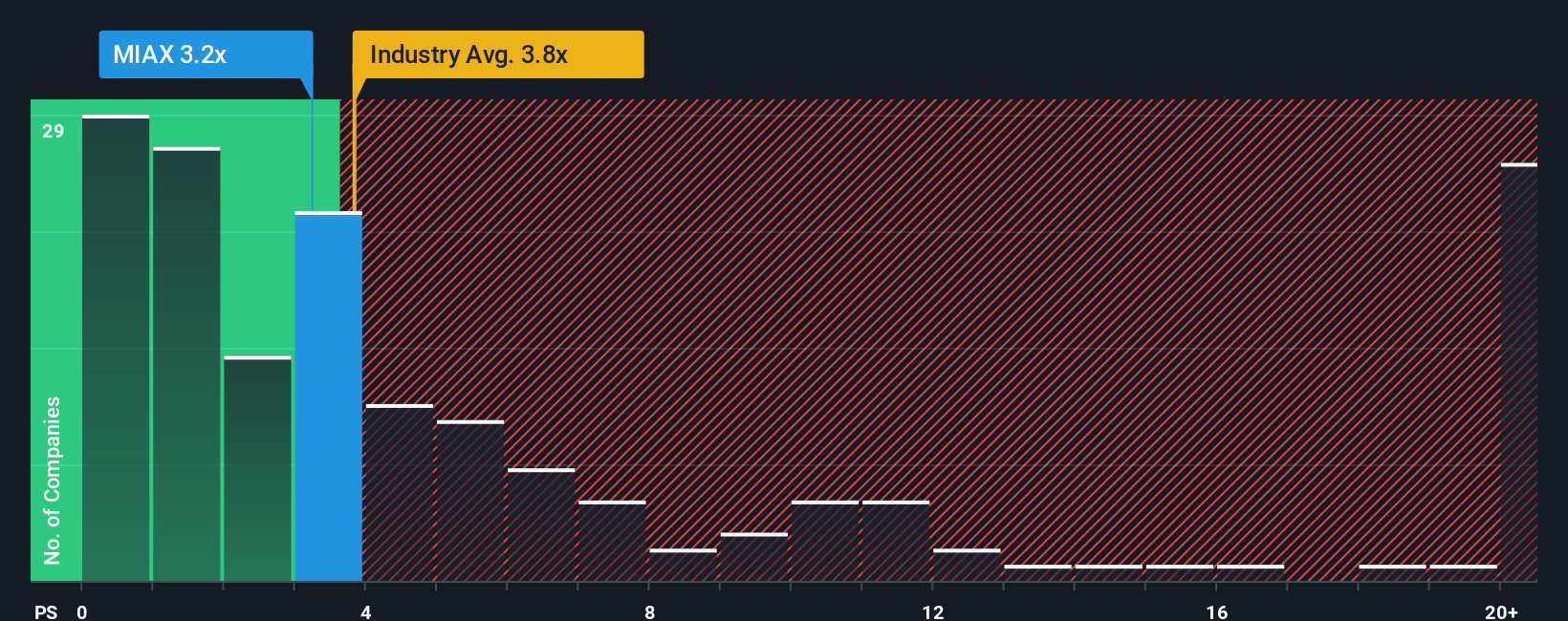

Approach 2: Miami International Holdings Price vs Sales

For companies like Miami International Holdings with a focus on growth and profitability, the Price-to-Sales (P/S) ratio is a valuable valuation tool. Unlike earnings, which can be volatile due to one-off items, sales figures provide a clear picture of the company’s ability to generate revenue from its core business.

Growth expectations and company-specific risks play a big part in shaping what investors consider normal or fair for a P/S ratio. If the company is expected to grow rapidly or is perceived as low risk, investors are often willing to pay a higher multiple. Conversely, slower growth or above-average risks could suppress the ratio.

Currently, Miami International Holdings trades at a P/S ratio of 2.89x. This is notably lower than the peer average of 9.40x and also sits below the broader Capital Markets industry average of 4.06x. While these benchmarks provide helpful context, they do not account for differences in growth rates, profit margins or risk profiles between companies.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. Rather than just comparing to industry or peer averages, this metric considers a company’s growth prospects, profitability, risks, industry and size to arrive at a more tailored view of value. This makes it a smarter benchmark for investors seeking a holistic perspective on whether a stock is cheap or expensive.

Comparing Miami International Holdings’ actual P/S ratio to its Fair Ratio provides a more durable verdict. However, based on the available data, the company’s current P/S of 2.89x is below both peer and industry benchmarks, suggesting shares could be undervalued on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Miami International Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, user-driven story about a company that connects your view of fair value and future performance to real data like estimated revenue, earnings, and profit margins. Rather than just crunching numbers, Narratives help you tie together Miami International Holdings’ past, present, and future by turning your investment perspective into a financial forecast and arriving at your own fair value for the stock.

This approach is especially user-friendly and easily accessible on Simply Wall St’s Community page, where millions of investors share and update their Narratives. With Narratives, you can directly compare your Fair Value estimate to the current share price and quickly decide when buying or selling makes sense for you. In addition, Narratives are kept up to date and react automatically when new information such as news or earnings is released.

For example, some Miami International Holdings investors may believe rapid industry growth justifies higher future earnings and a higher fair value. Others forecast slower expansion and lower valuations, highlighting how Narratives reflect real, diverse viewpoints.

Do you think there's more to the story for Miami International Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MIAX

Miami International Holdings

Through its subsidiaries, operates various markets across options, futures, and cash equities.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives