- United States

- /

- Capital Markets

- /

- NYSE:MAIN

Assessing Main Street Capital After 21.6% Return and New Portfolio Additions

Reviewed by Bailey Pemberton

- Thinking about whether Main Street Capital is trading at a fair price? You're not alone. Questions about whether the stock is a value play or getting ahead of itself are top of mind for many investors right now.

- In the past year, Main Street Capital's stock delivered a 21.6% return, even though short-term moves have been mixed, with a 3.1% rise in the last week but a -3.1% dip over the past month.

- These moves come as market sentiment shifts after recent announcements about Main Street Capital's capital investments and strategic portfolio additions. Many investors are seeing these developments as signals of resilience and potential growth, fueling both optimism and debate over the company's prospects.

- On valuation, the company scores a 2 out of 6 on our valuation checks. We will break down how this compares to common valuation methods in just a moment, and later on, we will reveal an even better way to think about Main Street Capital's value.

Main Street Capital scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Main Street Capital Excess Returns Analysis

The Excess Returns model evaluates Main Street Capital by analyzing how much profit it generates above the cost of its equity. Rather than focusing solely on earnings or cash flow, this approach highlights whether the company’s management is creating meaningful value for shareholders compared to simply investing in safe assets.

According to analyst forecasts, Main Street Capital is expected to achieve an average Return on Equity of 12.13%. The company’s stable EPS is estimated at $4.07 per share, supported by a stable book value of $33.56 per share. The cost of equity is $3.11 per share, resulting in a healthy excess return of $0.96 per share. These projections are based on weighted future Return on Equity and Book Value estimates from multiple analysts, which adds credibility to the underlying numbers.

This analysis produces an intrinsic value of $49.58 per share using the Excess Returns methodology. Since Main Street Capital is currently trading about 18.4% above this estimated value, the stock appears overvalued by this measure.

Result: OVERVALUED

Our Excess Returns analysis suggests Main Street Capital may be overvalued by 18.4%. Discover 869 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Main Street Capital Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular method for valuing profitable companies like Main Street Capital because it translates share price into a multiple of current earnings. This approach is especially useful when a company has stable profits, as it reflects how much investors are willing to pay for each dollar of earnings today.

What constitutes a “normal” or “fair” PE ratio depends on a company’s growth prospects and risk profile. Companies with bright growth prospects or less risk usually command higher PE ratios, while mature or riskier firms tend to trade at lower multiples. The idea is that investors pay up for future growth and stability.

Currently, Main Street Capital trades at a PE ratio of 9.8x. For context, the average across peers is 15.8x, and the broader Capital Markets industry stands even higher, at 24.1x. At first glance, this makes Main Street Capital seem notably cheaper than competitors in the sector.

However, Simply Wall St uses a proprietary measure called the “Fair Ratio.” Unlike raw comparisons to peers or industry averages, the Fair Ratio adjusts for Main Street Capital’s specific factors, including its profit margins, anticipated earnings growth, market cap, competitive risks, and more. This tailored metric aims to reveal what multiple investors should expect for this company based on its unique profile, rather than broad sector averages.

Comparing Main Street Capital’s current PE of 9.8x to the Fair Ratio can offer a much clearer signal about valuation. Since the Fair Ratio is not specified here, we cannot definitively conclude, but if the absolute difference was less than 0.10, it would suggest the stock is valued about right relative to its fundamentals and risk profile. In this context, with a PE far below the peer and industry averages, and absent a Fair Ratio close to its current multiple, Main Street Capital likely appears undervalued based on PE.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1395 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Main Street Capital Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, personalized story you create to connect your expectations for a company, such as its future revenue, earnings, and profit margins, to a financial forecast and, ultimately, a fair value for the stock. Narratives go beyond the numbers by letting you record your perspective on the factors that will drive Main Street Capital’s future, so your assumptions are always tied to a clear investment thesis.

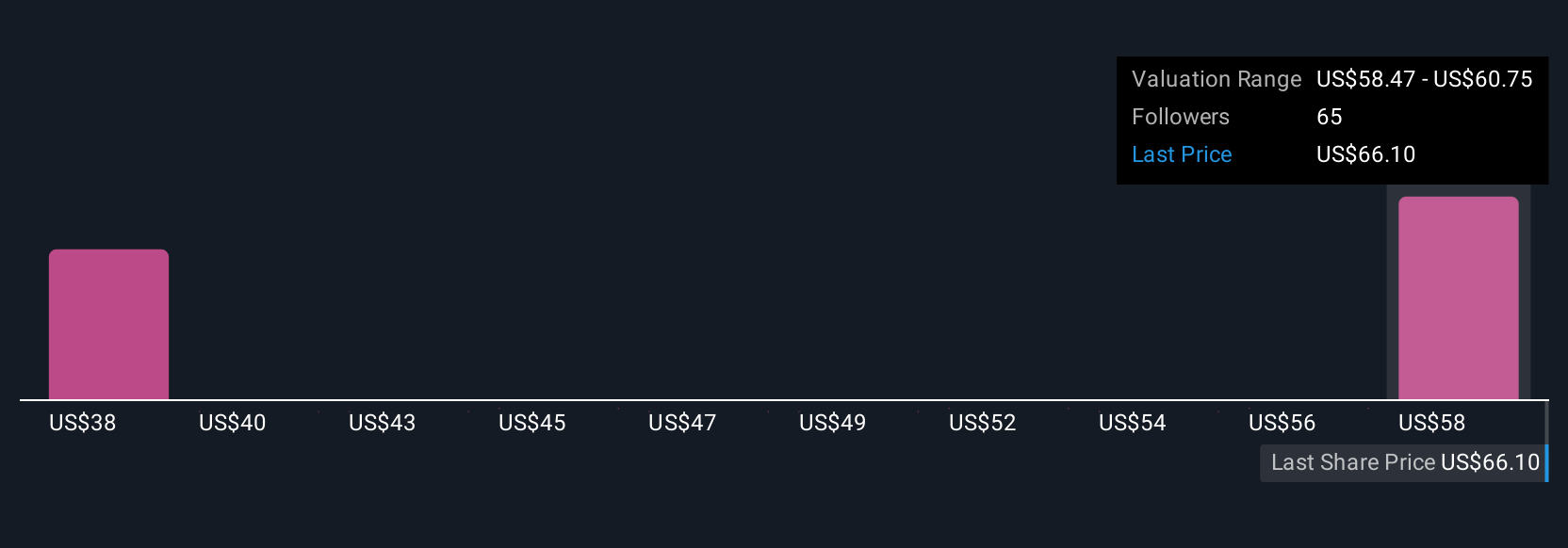

Available to millions of users on Simply Wall St’s Community page, Narratives make it easy to decide when to buy or sell by dynamically comparing your Fair Value with the current Price as new information, like earnings or news, comes in. Since every investor sees the company differently, two people could draw opposite conclusions. One Narrative might forecast robust growth and assign a Fair Value as high as $62, while another taking a more cautious stance sets it as low as $45. This clearly shows how your unique outlook shapes your investment decision.

Do you think there's more to the story for Main Street Capital? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAIN

Main Street Capital

A business development company and a small business investment company specializing in direct and indirect investments.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives