Stock Analysis

- United States

- /

- Diversified Financial

- /

- NYSE:MA

The Price Is Right For Mastercard Incorporated (NYSE:MA)

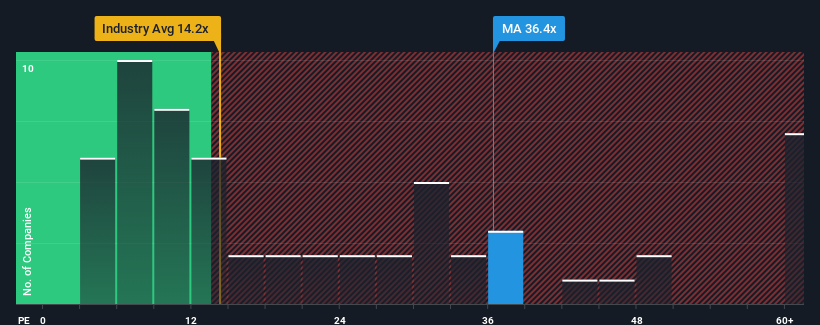

With a price-to-earnings (or "P/E") ratio of 36.4x Mastercard Incorporated (NYSE:MA) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Mastercard as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Mastercard

Does Growth Match The High P/E?

Mastercard's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. Pleasingly, EPS has also lifted 74% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 17% each year during the coming three years according to the analysts following the company. With the market only predicted to deliver 13% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Mastercard's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Mastercard maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Mastercard is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Mastercard. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Mastercard is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MA

Mastercard

Mastercard Incorporated, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Proven track record with moderate growth potential.