- United States

- /

- Diversified Financial

- /

- NYSE:HASI

How Investors Are Reacting To HA Sustainable Infrastructure Capital (HASI) Turning a Net Loss Into Profit

Reviewed by Sasha Jovanovic

- HA Sustainable Infrastructure Capital, Inc. recently reported third quarter 2025 earnings, posting revenue of US$103.06 million versus US$81.97 million a year earlier, and moving from a net loss last year to a net income of US$83.26 million.

- This turnaround from a net loss to net profit highlights improving operational performance and appears to reflect stronger execution or improved market conditions for the company.

- With operating results showing significant year-over-year improvement in profitability, we'll explore how this earnings rebound could influence the company's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is HA Sustainable Infrastructure Capital's Investment Narrative?

For anyone considering HA Sustainable Infrastructure Capital, the big picture rests on confidence in the business’s capacity to deliver both growth and stable income as a sustainable infrastructure financier. The sharp swing to US$83.26 million in net income this quarter, after a year-ago loss, could reinforce a bullish narrative around better execution and possibly more supportive market demand. For the short term, the latest results may boost confidence in HASI’s ability to recover from patchy revenue and earnings earlier this year, nudging upcoming dividend sustainability and debt coverage into sharper focus. However, the company still faces some persistent risks: cash flows are not yet enough to fully cover dividends or debt obligations; and the rebound may not guarantee continued profit momentum unless underlying sector conditions keep improving. The recent performance could shift near-term risks and catalysts, but careful monitoring is still warranted.

By contrast, the challenge of covering dividends remains a crucial factor to watch.

Exploring Other Perspectives

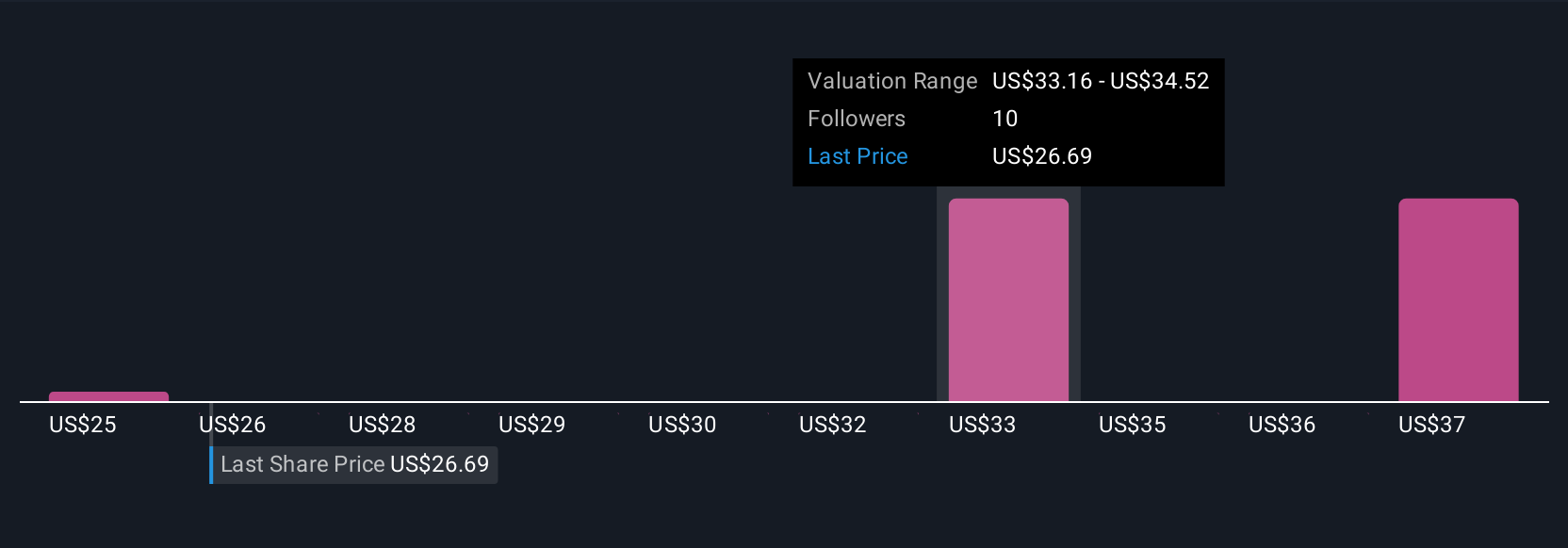

Explore 5 other fair value estimates on HA Sustainable Infrastructure Capital - why the stock might be worth 15% less than the current price!

Build Your Own HA Sustainable Infrastructure Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HA Sustainable Infrastructure Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HA Sustainable Infrastructure Capital's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HA Sustainable Infrastructure Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HASI

HA Sustainable Infrastructure Capital

Through its subsidiaries, engages in the investment in energy efficiency, renewable energy, and sustainable infrastructure markets in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives