- United States

- /

- Capital Markets

- /

- NYSE:GAM

General American Investors Company (GAM): Revisiting Valuation After Special Capital Gains Distribution and Increased Dividend

Reviewed by Simply Wall St

General American Investors Company (GAM) has just announced a special distribution from net long-term capital gains, together with an increase to its annual dividend. This move underscores steady investment returns and a commitment to rewarding shareholders.

See our latest analysis for General American Investors Company.

General American Investors Company's decision to boost its annual dividend and issue a special capital gains payout seems to have caught investor attention, with the share price climbing over 25% so far this year. Long-term holders have benefited even more, enjoying a total shareholder return of nearly 28% over the past twelve months and an impressive 138% over five years. This highlights momentum that is building as the company rewards shareholders and signals confidence in its investment portfolio.

If you’re wondering what other companies are showing strong results and catching insider attention, now’s a great opportunity to discover fast growing stocks with high insider ownership

With shares surging and a sizable discount to intrinsic value still indicated, the question for investors now is whether General American Investors Company offers genuine upside or if the market has already priced in its future growth.

Price-to-Earnings of 7.8x: Is it justified?

General American Investors Company currently trades at a price-to-earnings (P/E) ratio of 7.8x, which stands out compared to both its direct peers and the broader US Capital Markets sector. The last close was $63.77, and this low multiple indicates the market views the company as undervalued relative to its earnings.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of a company’s earnings. In the investment management space, where earnings can be cyclical or volatile, a lower P/E might signal market skepticism about sustainability, but it also marks potential for rerating if profits remain solid.

In this case, the market’s current pricing appears to underestimate GAM’s earning capacity, particularly when compared to the sector’s average P/E of 24x and its peer average of 29.2x. These multiples set a high bar and suggest that if GAM can deliver consistent profits, significant upside may exist as the market adjusts its valuation of the stock.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 7.8x (UNDERVALUED)

However, risks remain, including potential earnings volatility and broader market sentiment shifts. These factors could impact both the company’s valuation and its near-term returns.

Find out about the key risks to this General American Investors Company narrative.

Another View: Discounted Cash Flow Signals Even Deeper Value

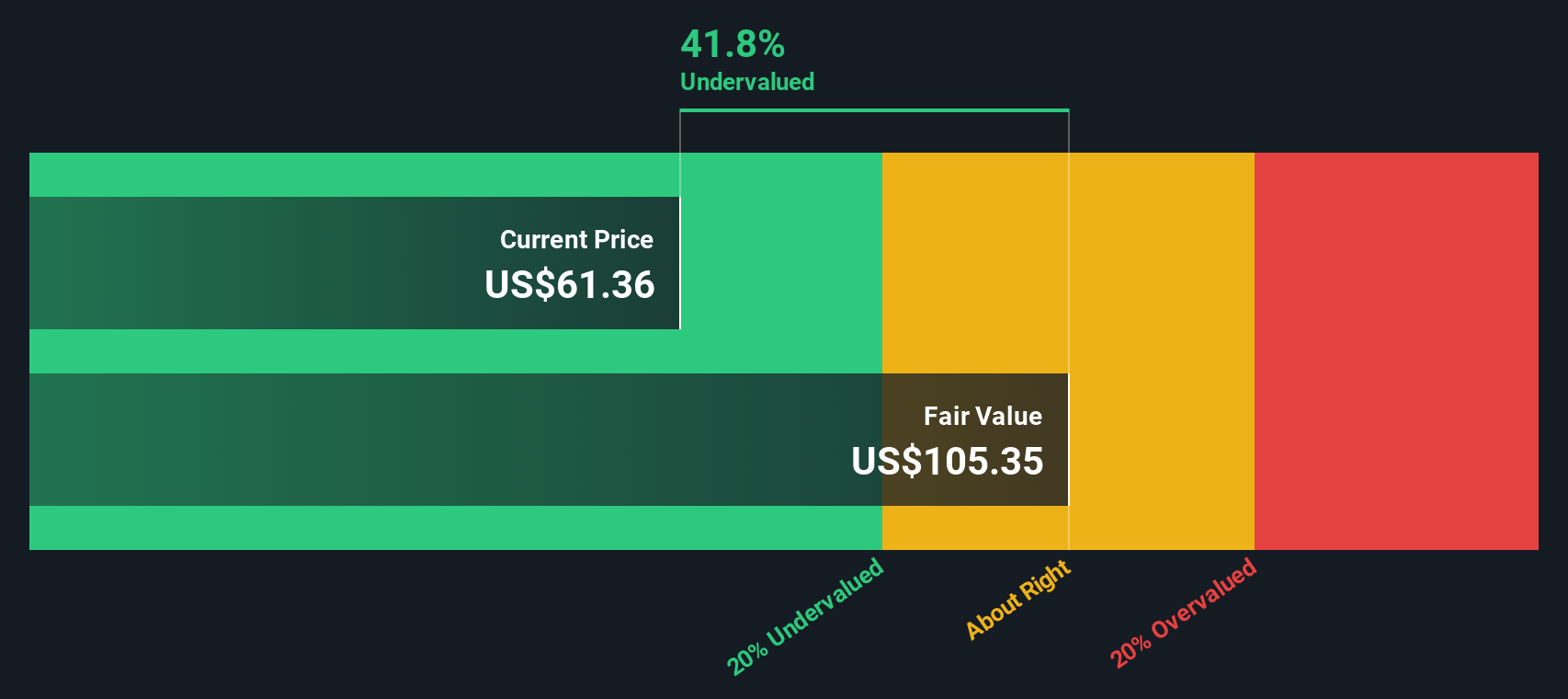

While the current low price-to-earnings ratio suggests potential undervaluation, our DCF model provides another layer of insight. According to this approach, General American Investors Company trades at a significant 39.5% discount to its intrinsic value, which points to even more upside. Could this indicate the market is missing something bigger?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out General American Investors Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own General American Investors Company Narrative

If you have a different perspective or favor your own analysis, you can assemble a personalized view in just a few minutes. Do it your way

A great starting point for your General American Investors Company research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let opportunity pass by while others find tomorrow's winners. Increase your chances of market success with fresh stock ideas matched to your goals.

- Unlock the potential of high-yield investing by scanning these 15 dividend stocks with yields > 3% for companies providing reliable income streams over 3%.

- Spot emerging leaders when you explore these 25 AI penny stocks that are pushing the boundaries in artificial intelligence and shaping industry transformation.

- Strengthen your portfolio by focusing on real value through these 855 undervalued stocks based on cash flows, which highlights stocks trading at attractive prices based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAM

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives