- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Record Stock Buyback and Rising Payment Volumes Might Change the Case for Investing in Shift4 Payments (FOUR)

Reviewed by Sasha Jovanovic

- Shift4 Payments announced its third-quarter 2025 results, reporting US$1.18 billion in revenue and a $1 billion stock buyback program as its largest to date, with payment volumes and gross revenue rising year over year and beating analyst expectations.

- An interesting development is the company’s robust growth in end-to-end payment volume and the increased focus on returning capital to shareholders despite adjusted net income declining year over year.

- We'll examine how the company's record buyback program and payment volume growth may influence its long-term investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 34 companies in the world exploring or producing it. Find the list for free.

Shift4 Payments Investment Narrative Recap

To be a shareholder of Shift4 Payments, you need to believe in the company’s ability to drive strong growth in digital payment volumes across diverse verticals while successfully scaling internationally through acquisitions like Global Blue and Smartpay. The new Q3 results, featuring a record US$1.18 billion in revenue and robust payment volume gains, reinforce the importance of ongoing transaction growth as a short-term catalyst; however, the report’s continued year-over-year net income decline keeps execution risks, especially with complex integrations and higher debt, front and center. The positive revenue momentum does not materially change the top risk, which remains successful integration of acquired businesses and managing leverage, as a misstep could impact future earnings quality.

Among recent announcements, Shift4’s new US$1 billion stock buyback program stands out as most relevant to the earnings update. The buyback signals the company's intent to return capital to shareholders and may offer support to the share price, but it arrives as net income and profit margins remain under pressure, keeping the execution of core business initiatives and assimilation of acquisitions crucial for sustaining momentum. Investors will want to monitor how management balances capital allocation with growth and integration demands in the coming quarters to assess whether the business can build on current catalysts.

In contrast, it is important to remember that even as volumes and revenues rise, growing financial leverage and the ongoing challenges of integrating major acquisitions are factors investors should be aware of...

Read the full narrative on Shift4 Payments (it's free!)

Shift4 Payments' outlook anticipates $7.0 billion in revenue and $613.9 million in earnings by 2028. This is based on a 24.8% annual revenue growth rate and an increase in earnings of $406 million from the current $207.7 million.

Uncover how Shift4 Payments' forecasts yield a $105.62 fair value, a 58% upside to its current price.

Exploring Other Perspectives

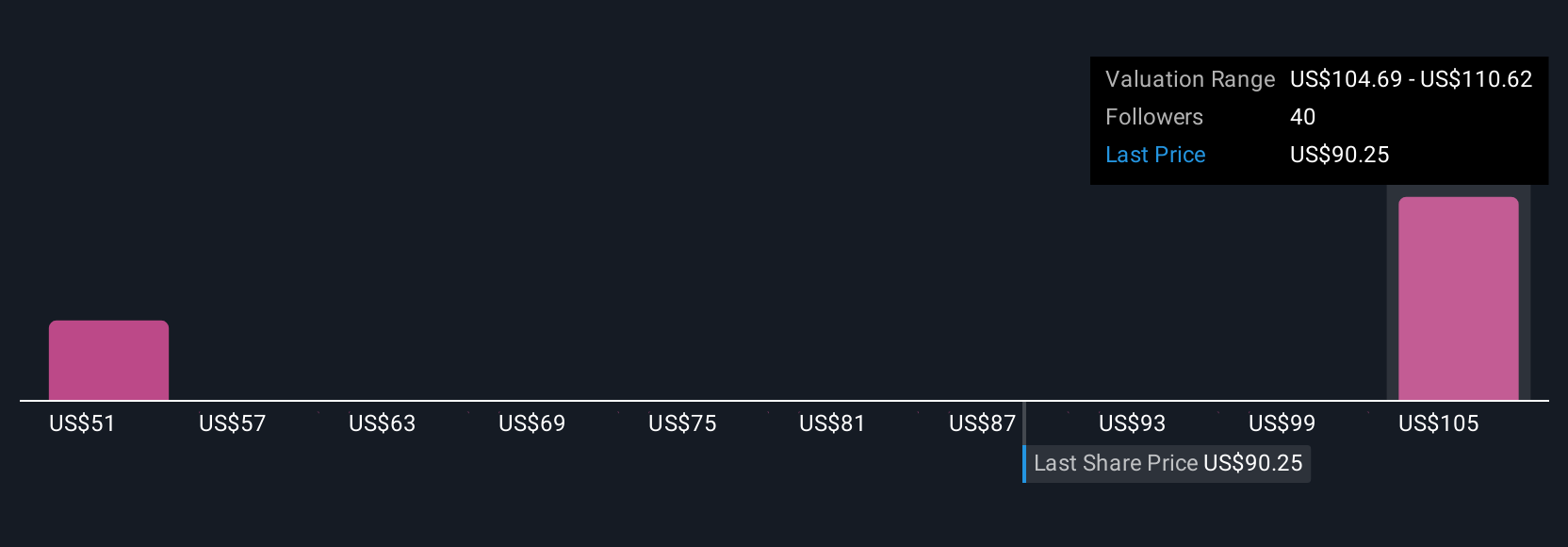

Five fair value estimates from the Simply Wall St Community span US$45.84 to US$105.99, reflecting a wide spectrum of market views. Transaction growth momentum remains a primary catalyst, but differing outlooks show investors weigh risks and opportunities uniquely, consider exploring multiple viewpoints for a balanced perspective.

Explore 5 other fair value estimates on Shift4 Payments - why the stock might be worth as much as 59% more than the current price!

Build Your Own Shift4 Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shift4 Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shift4 Payments' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives