- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

A Fresh Look at Shift4 Payments (FOUR) Valuation Following Strong Q3 Results and Major Buyback Announcement

Reviewed by Simply Wall St

Shift4 Payments (FOUR) delivered third-quarter results that caught the market’s attention, topping expectations on both gross revenue and payment volumes. The company also revealed a major stock buyback program, which has added another layer of interest for investors.

See our latest analysis for Shift4 Payments.

Despite reporting strong revenue growth and announcing its biggest-ever buyback, Shift4 Payments has seen its share price remain under pressure, with a year-to-date return of -38.94%. However, the three-year total shareholder return stands at a solid 39.85%, indicating that long-term investors have fared much better as the company continues growing and navigating industry challenges.

If this kind of turnaround story piques your interest, now is a great time to broaden your investing perspective and discover fast growing stocks with high insider ownership

Given these mixed signals, such as strong earnings beats and a bullish growth outlook, yet an underperforming stock price, are investors looking at an undervalued opportunity, or is the market already pricing in future gains?

Most Popular Narrative: 37.4% Undervalued

According to the most widely followed narrative, Shift4 Payments’ estimated fair value stands well above its latest closing price of $66.15. This points to a significant gap between current trading levels and perceived future worth.

The broad adoption and integration of value-added services (such as unified software and POS solutions like SkyTab) is driving higher merchant adoption internationally and domestically. This supports an increase in net spreads and boosts recurring, higher-margin revenue streams. The cross-sell opportunity across the combined customer bases of newly acquired companies (for example, bringing Shift4's payment products into Global Blue's luxury retail clients or introducing Global Blue's DCC product to Shift4 hotels and restaurants) creates a substantial embedded pipeline for incremental revenue and sustained organic growth over multiple years.

Want to understand what’s fueling the bullish outlook? The narrative’s assumptions rely on a mix of bold expansion moves, high-margin services, and financial targets that are more ambitious than the sector norm. Which aggressive forecasts are lifting that fair value so much higher than today’s price? Peek inside to uncover the specific figures and rationale driving this conviction.

Result: Fair Value of $105.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration missteps from rapid expansion or setbacks related to rising debt could challenge Shift4’s growth story and put pressure on future valuation.

Find out about the key risks to this Shift4 Payments narrative.

Another View: What Do Multiples Suggest?

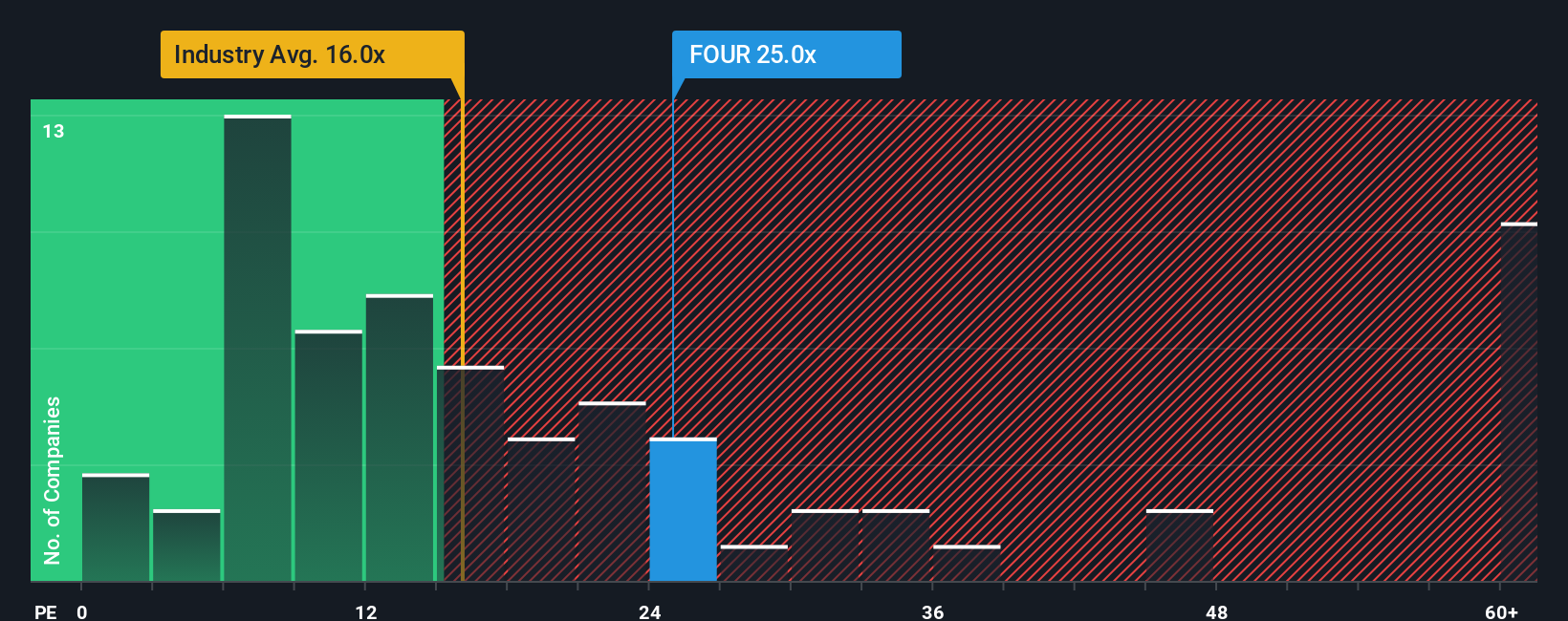

Looking at valuation through the lens of price-to-earnings, Shift4 trades at 27.1 times earnings. This is higher than both the industry average of 13.1x and the fair ratio of 26.9x, but lower than peer averages at 37.1x. This signals some relative expensiveness to the sector, but not to its closest peers. Is the market overlooking growth, or pricing in more risk than the DCF model assumes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shift4 Payments Narrative

If these perspectives don't quite align with your own analysis, you can dig into the numbers yourself and craft a personal outlook in just a few minutes, all at your own pace. Do it your way

A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your search to just one opportunity. Give yourself an edge with screener-powered insights that connect you to tomorrow's winners before the crowd arrives.

- Access steady income streams and spot high-yield shares among these 16 dividend stocks with yields > 3% with proven records above the 3% mark.

- Tap into sector-wide transformation by targeting market leaders among these 32 healthcare AI stocks thriving at the intersection of medicine and AI innovation.

- Seize early-stage growth and uncover breakthrough opportunities in these 3592 penny stocks with strong financials set for outsized returns as their stories unfold.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives